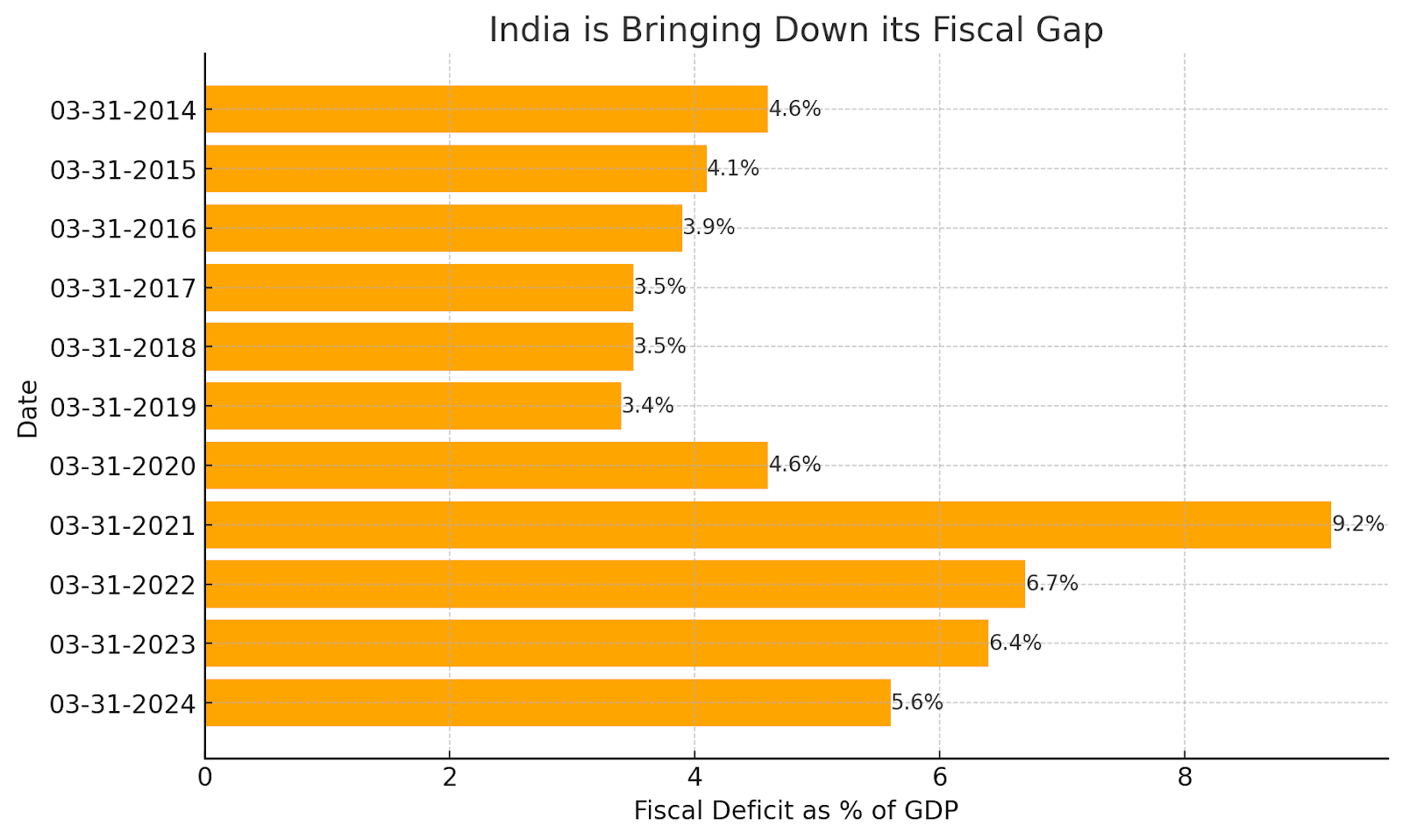

In recent years, India has demonstrated a concerted effort to manage its fiscal deficit, a crucial indicator of economic health. The fiscal deficit, which measures the shortfall between the government’s revenue and expenditure, has seen significant fluctuations, particularly influenced by the COVID-19 pandemic.

From March 2014 to March 2019, India’s fiscal deficit as a percentage of GDP consistently decreased from 4.6% to 3.4%, showcasing strong fiscal discipline. However, the pandemic caused an unprecedented spike to 9.2% by March 2021, reflecting the massive fiscal stimulus deployed to support the economy during the crisis. Since then, the government has made significant strides in reducing the deficit, with projections indicating a steady decline to 5.6% by March 2024.

With a new coalition government in place, Prime Minister Narendra Modi faces the challenge of maintaining fiscal discipline while addressing the demands of his political allies. The upcoming budget, to be presented by Finance Minister Nirmala Sitharaman, is expected to strike a delicate balance. Economists forecast a slight reduction in the deficit target from the pre-election projection of 5.1% of GDP, emphasizing fiscal responsibility while aiming to boost consumer spending and job creation, particularly in rural areas.

India’s fiscal management has been bolstered by a significant windfall from the central bank and robust tax revenue growth. The economy’s expected expansion of over 7% this fiscal year provides the government with ample resources to enhance spending without compromising deficit targets. A notable $25 billion dividend from the central bank and a 20% growth in net direct tax collections contribute to this optimistic outlook.

Despite an impressive 8.2% economic growth in the past fiscal year, private consumption growth remains subdued at 4%. To stimulate consumer spending, the government may consider reducing personal income tax rates for individuals earning between 500,000 and 1.5 million rupees. This demographic, taxed at rates between 5% and 20%, has a high propensity to spend, potentially driving economic activity.

As India heads into a series of crucial state elections, the budget is likely to reflect measures aimed at securing voter support. Increased cash handouts for farmers, enhanced funding for rural housing, and higher wages under fixed employment programs are anticipated. These measures aim to address key voter concerns, particularly in rural areas.

Infrastructure development remains a cornerstone of Modi’s economic strategy. Since the 2018-19 budget, government spending on infrastructure has more than tripled. The current fiscal year sees an 11.1% increase in capital expenditure allocation, bringing it to 3.4% of GDP. Prioritizing roads, railways, seaports, airports, and digital infrastructure aligns with the BJP’s election pledges and is expected to continue.

Addressing the pressing issue of job creation, the budget may introduce measures to bolster manufacturing and support small and medium enterprises (SMEs). Expanding production-linked incentives for labor-intensive sectors, such as toys, leather, and footwear, is on the agenda. Given that SMEs are the largest job creators in India, targeted support for this sector is crucial.

India’s fiscal journey reflects a balance between managing the deficit and fostering economic growth. As the government prepares to unveil its budget, the focus will be on maintaining fiscal credibility while addressing voter concerns and stimulating economic activity.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jul 22, 2024, 6:14 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates