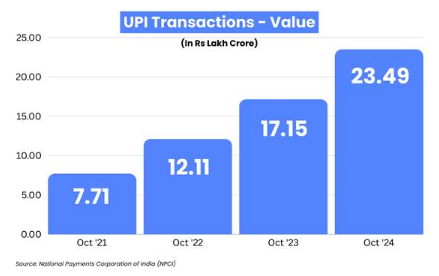

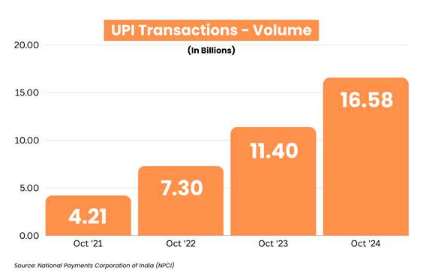

Unified Payments Interface (UPI), a flagship initiative by the National Payments Corporation of India (NPCI), has transformed India’s financial ecosystem. In October 2024, UPI processed a record-breaking 16.58 billion transactions, worth ₹23.49 lakh crore, showcasing its pivotal role in driving the country’s shift towards a cashless economy.

The growth trajectory of UPI is remarkable. Compared to October 2023, transactions have surged by 45%, rising from 11.40 billion to 16.58 billion. This substantial growth is backed by 632 banks integrated into its platform.

Such numbers not only highlight UPI’s scalability but also its deep penetration across urban and rural India. The adoption by businesses, individuals, and even small vendors showcases its universal appeal.

UPI’s success stems from its innovative features that cater to diverse users:

These features, combined with the integration of RuPay credit cards, add to UPI’s versatility, allowing payments via credit lines for enhanced liquidity.

UPI has significantly benefitted small businesses, street vendors, and migrant workers by enabling easy and secure digital transactions. Tools like voice boxes at stalls, which announce payments received via QR codes, have built trust among users transitioning from cash.

Additionally, during the pandemic, UPI’s contactless payment system gained rapid traction, accelerating India’s digital shift.

UPI’s reach extends beyond India, operating in seven countries, including the UAE, Singapore, and France. Its expansion to Europe through France is a landmark achievement, enhancing the global adoption of Indian financial technology.

Efforts led by India’s leadership, including proposals for UPI integration within BRICS nations, underscore its potential to enhance remittance flows and strengthen India’s global financial influence.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Dec 2, 2024, 2:24 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates