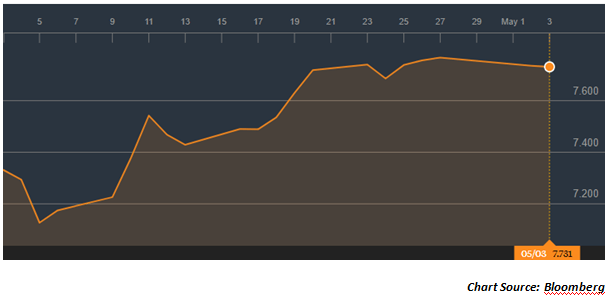

Bond yields, in India and across the world, have been rising sharply in the last few months. In fact, when the monetary policy was announced by the RBI on 3rd April 2018, the bond yields had touched a low of 7.12% have since then rallied by more than 60 basis points to the 7.73% levels. Why are the Bond Yields moving up and what do they imply for Indian markets?

Bond yields started moving up in July last year but they did display a fall in yields after the monetary policy painted a rather dovish picture. However, the MPC minutes were quite emphatic about the risk of inflation. Inflation in 2018 is likely to be higher for 2 reasons. Firstly, the food prices of Kharif crops are likely to be higher after the Budget 2018 had promised a 150% assured MSP on cost of production. Secondly, oil prices are consistently trending higher and at $74/bbl, the risk of a higher imported inflation is quite high. When inflation is high, bond yields are likely to trend higher. The US Fed has adopted a hawkish tone and it means that the RBI could also be compelled to raise repo rates. Above all, the higher fiscal deficit outlook for the year also raises questions over bond yields. The bond yields are moving up in response to these triggers. But what exactly do they mean for equity markets and why?

This is the first impact of rising bond yields on equities. This works in two ways; one is fairly simple and the other is slightly more complicated. Firstly, when bond yields rise, the yield on the bonds become more than the equity yield. In India, equities were attractive for the last 3 years because bond yields were headed down. But with bond yields headed higher since July last year, investors and asset allocators may find debt relatively more attractive compared to equity in risk adjusted terms. Secondly, there is a more complex explanation as to why higher yields are negative for equities. For example, when rates go up, the cost of debt goes up and the cost of capital goes up. This cost of capital is used to discount future cash flows to arrive at the valuation of companies. That means higher cost of capital will depress valuation of equities. That will be evident in the markets.

This is more related to flows. When do foreign portfolio investors (FPIs) find it attractive to invest in India? Indian bond yields on 10-year benchmark are nearly 400-500 basis points higher than the US yields. The higher the yield spread, the more attractive Indian debt becomes for foreign bond investors. But, how does that impact equities. When FPIs pull out money from debt, it negatively impacts the INR as we saw in 2013 in a big way and in a much smaller way in 2016 and again in 2018. A weak rupee will mean that equity returns will be lower in dollar terms and that is something FPIs are not comfortable with. They may not really see any point in holding on to Indian assets when the INR is weakening and that could lead to a sell-off in equities too. That is something the equity markets need to be cautious about.

Recently, a blue chip company borrowed short term debt at a rate that was 100 basis points higher than the previous year bond yields move up, other private bond yields will move up even more to adjust for the risk differential. That means; mid-sized companies will find it increasingly difficult to raise fresh debt at competitive yields. As working capital costs go up, the entire cycle may turn negative or these mid-cap companies and even for less capitalized large cap companies. This increases the risk of bankruptcy for a lot of vulnerable Indian companies.

This is a unique problem for companies that have borrowed from the Dollar market. When the INR weakens, the liability in dollar terms goes up sharply. As long as the rupee is strong and the dollar is weak, these companies with dollar borrowings have nothing much to worry about. The real problem arises when the dollar gets stronger and the rupee gets weaker. Most borrowers are ill-equipped to handle a sharp depreciation. This again increases the default risk for these companies.

There is a positive side to this argument. It was observed by Russell Research that in the long run, higher yields are positive for equities as they imply higher inflation caused by higher growth. That could be the icing on the cake for Indian equities, if this prophecy was to come true!

Published on: May 3, 2018, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates