Silver is the most popular white metal, and Indians love to invest in precious metals like silver. So, it becomes big news whenever there is a significant change in the price of silver. However, in the last four months, the cost of silver witnessed a 20-22 percent decline in the global market. If you are wondering ‘why is silver falling’, read till the end.

Precious metal as an asset class is considered a low-risk investment, especially when the market is volatile. Often investors perk their money in gold and silver to protect their wealth from value erosion. Now why is the value of silver falling? This blog investigates the reasons.

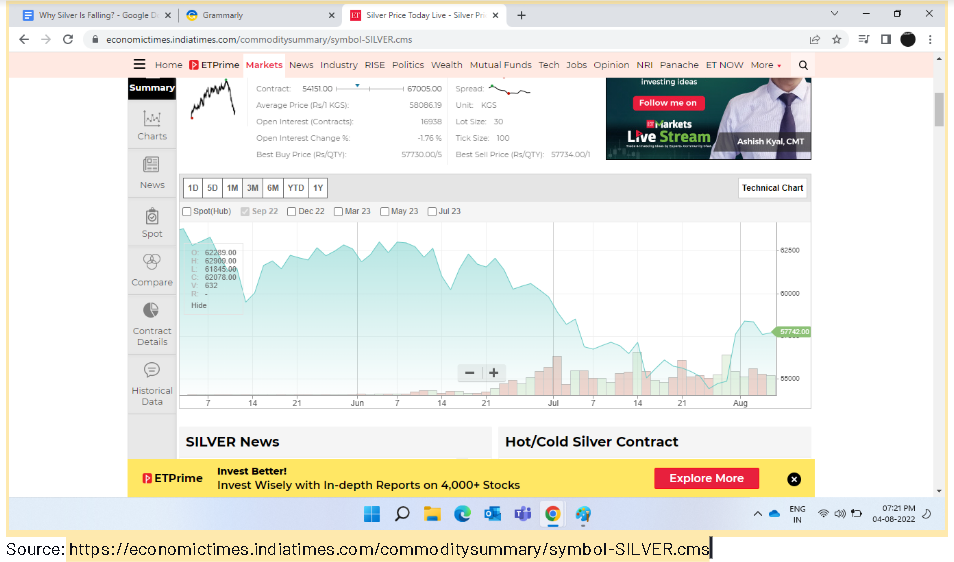

Since March 2022, silver prices have dipped from Rs 72,000 to Rs 55,000. It crossed the critical USD20 threshold in the US market to fall 28 percent, while other precious metals have rallied by 36% since February 2021.

Rising interest: The rising inflation rates are a reason that investors are losing interest in silver investment. The US Federal Reserve and The Central Bank have increased the interest rates to curb inflation. It assisted in escalating the Dollar, which usually moves in the opposite direction of silver, meaning when the dollar rate rises, the price of silver metal falls.

The US dollar is currently at twenty year high. It is due to the fear of recession hitting the US economy. There is a massive inflow of funds in the US economy to prevent it from slipping into a recession, which helped strengthen the US dollar.

Also read – Impact of US Dollar on Indian Economy

The rising interest rates have drawn investors away from silver toward government bonds.

Economic contraction: Unlike gold, silver is both precious metal and industrial metal, meaning its price is impacted by changes in industry demand.

Gold prices often rise during recession and stagflation. But silver needs a flourishing economy for a price boost.

Silver metal has a huge demand in green energy and EV adoption. It is a primary component in producing photovoltaic units for solar panels. Besides, silver is widely used in photography, electronics, water purification, dentistry, home appliances, medicine, textile, and several other sectors. The slow industrial demand is another reason for the silver price to fall.

Outflow from silver ETFs: During 2020 and 2021, investors were bullish on silver ETFs and invested heavily in silver-backed investment securities. In 2022, there is a steady outflow from silver ETFs, causing the asset’s price to slip. Considering the current situation, one can anticipate further downside in silver price in the short-run.

Demand disparity: According to a report by the London Bullion Market Association (LBMA), the silver supply recovered more rapidly, but the demand for silver declined primarily from important importers like India and China during the pandemic.

You can invest in silver at a lower price when the silver rate falls. If you look at the trading chart, silver is currently at the oversold threshold, indicating demand revival. Silver gained during the last trading sessions in the US market and moved above the critical USD 20 mark. When silver can be volatile, it is also a safe-haven asset that can protect your portfolio during uncertainty.

Check out the following trading chart of silver.

One way to take exposure to the precious asset is Silver Mini.

Among all the four silver contracts available in MCX, Silver Mini is one of the most traded ones, meaning liquidity will not be a problem for you.

Find more exciting investment news and informative videos on Angel One’s website. Open a free Angel One Demat Account and invest in a broad asset class.

Published on: Aug 11, 2022, 2:38 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates