Step into the mind of Warren Buffett as we unravel the intricacies of his Q3 investment manoeuvres. The Oracle of Omaha, known for his calculated dance with market dynamics, made strategic exits, surprising reductions, and even ventured into new territory.

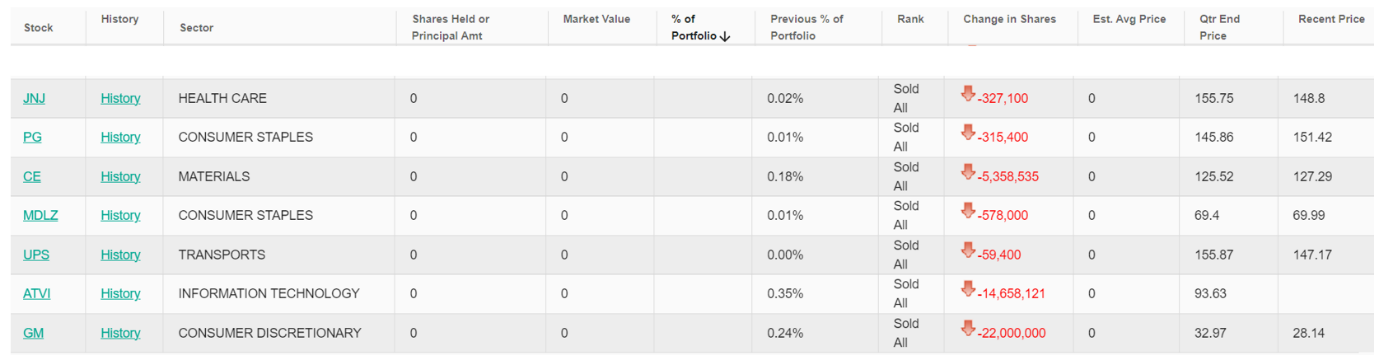

In Q3 2023, Berkshire Hathaway, led by Buffett, executed a series of noteworthy actions, including exits from seven companies and reductions in three insurance holdings. However, the spotlight shines on the strategic departure from General Motors and the surprising addition of a new player – the Atlanta Braves Holdings Inc.

Source: whale wisdom

Read: Investment lessons from Warren Buffett

Warren Buffett’s decision to exit General Motors raised eyebrows in the investment community. Several factors contributed to this strategic departure:

Insights into Updated Positions: Buffett’s portfolio adjustments go beyond exits

They offer a glimpse into his updated positions and investment philosophy. As of September 30, 2023, here are some key insights:

Conclusion: As the curtain falls on Q3 2023, Buffett’s portfolio adjustments echo a timeless melody of strategic investing. The disciplined composition is a lesson in meticulous research, steadfast long-term vision, and a focus on companies with robust fundamentals.

Investors, take note: understanding the why behind Buffett’s moves provides valuable insights for navigating the ever-evolving landscape of investments.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 20, 2023, 4:39 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates