In an unexpected twist that caught the eyes of investors and market watchers worldwide, the Japanese yen took a significant dive, reaching levels not seen since the financial crises of previous decades. This intriguing movement in currency valuation comes at a time when the Bank of Japan (BOJ) appears to be charting a new course for its monetary policy, steering away from the long-standing negative-interest-rate landscape. Let’s unravel this economic enigma and explore what it means for Japan and the global market.

The BOJ recently took a step that could redefine Japan’s economic stance, ending the unique negative-interest-rate policy it held onto even as the world around it moved in different directions. This landmark decision came with a caveat, though; despite the shift, the BOJ signaled a commitment to maintaining a relaxed financial environment. This move was perceived as somewhat conservative, especially after a notable increase in interest rates—the first since 2007—and the abandonment of the yield-curve control regime.

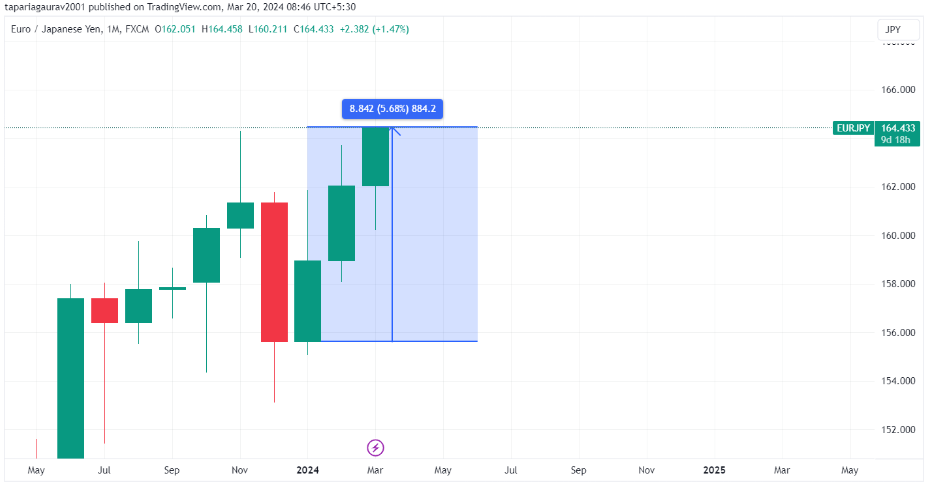

Following these decisions, the yen experienced a significant downturn. It plummeted to a low against the euro, a level it hadn’t touched since 2008, and it’s on a similar trajectory against the dollar, edging close to a nadir last seen in 1990.

This depreciation extends the yen’s decline to about 6% for the year, positioning it as the least performing currency among the Group-of-10 economies.

The yen’s fall is largely attributed to expectations that Japan will continue to face a substantial yield gap compared to other developed nations, especially the United States. This speculation gained momentum as BOJ Governor Kazuo Ueda emphasized the continuation of lenient financial conditions, despite tightening the monetary reins for the first time in over a decade.

Interestingly, the markets had already been buzzing with expectations of a policy shift from the BOJ, especially in light of successful wage negotiations by Japan’s largest union group, which outpaced forecasts. This anticipation set the stage for the yen’s current trajectory, sparking concerns about potential interventions by the BOJ to curb further devaluation.

The BOJ’s recent maneuvers mark a pivotal moment in Japan’s economic policy, navigating between fostering growth and stabilizing its currency. The yen’s performance is not just a reflection of domestic policy changes but also of global economic dynamics and investor sentiment. As Japan treads this delicate balance, the international community watches closely, gauging the impact of these shifts on global trade, investment, and economic stability.

The journey of the yen through these turbulent waters is more than a financial saga; it’s a testament to the intricate dance between national monetary policies and the global economic order. As we continue to witness the unfolding of this narrative, one thing remains clear: the path ahead is fraught with challenges and opportunities, demanding careful navigation and keen insight into the ever-evolving economic landscape.

The Japanese yen’s recent downturn is a fascinating case study of the effects of monetary policy adjustments on currency valuation. As Japan moves forward with its accommodative yet cautious approach, the world will be watching how these decisions play out on the global stage.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Mar 20, 2024, 1:09 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates