Zomato, the Indian online food delivery giant, disclosed its performance for the December quarter of FY24. After the announcement, the company’s shares experienced a rally during the closing of today’s trading session.

According to the company’s statement, it reported a total revenue of Rs 3,507 crore, indicating a remarkable growth of 65% YoY from Rs 2,121 crore in the same quarter last year.

Turning attention towards the segment-wise revenue details, Zomato currently operates in four major business segments. The Indian food and delivery business reported a revenue of Rs 1,704, showcasing significant YoY growth from Rs 1,151 crore. In the Hyperpure Supplies (B2B Business) segment, revenue increased from Rs 421 crore to Rs 859. Meanwhile, the Quick Commerce business revenue stood at Rs 644 crore, compared to Rs 301 in the same quarter last year.

On the profitability front, consolidated Adjusted EBITDA was positive for the third consecutive quarter at Rs 125 crore, reflecting an improvement of Rs 390 crore compared to the same quarter last year.

Furthermore, the company reported a net profit of Rs 138 crore, a significant improvement compared to a net loss of Rs 364 crore. Furthermore, the net profit surged by 283% quarter on quarter, rising from Rs 36 crore to Rs 138 crore in the current quarter.

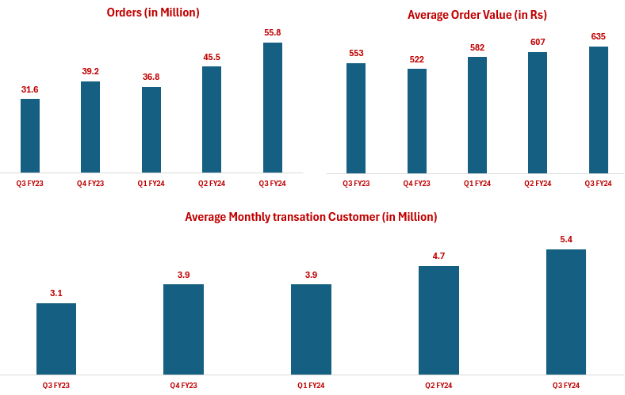

The company’s Gross Order Value (GOV) across its B2C businesses experienced a 47% YoY growth (13% QoQ), reaching Rs 12,886 crore. On an annualised basis, the company has now surpassed Rs 50,000 crore in gross order value for its B2C businesses. Specifically, food delivery GOV grew by 27% YoY (6.3% QoQ), quick commerce GOV saw a substantial growth of 103% YoY (28% QoQ) and Going-out GOV exhibited a remarkable increase of 154% YoY (26% QoQ).

The company announced its quarterly earnings during market hours, and after the announcement, its shares initiated a rally, surging approximately 5% during the closing hour. However, it ultimately settled at a 2.42% increase, closing at Rs 144 each on the BSE. Furthermore, the company’s shares are currently trading at a discount of 15% compared to the all-time high price of Rs 169 each.

In addition, the company’s current market capitalisation stands at Rs 1,12,437 crore. The stock has delivered an impressive return of around 54% in the past six months and a remarkable 165% return in the past year.

Investors should keep this stock on their radar.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Feb 8, 2024, 5:18 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates