India’s banking sector has reached a significant milestone in fiscal year 2024 (FY24), with the collective net profit exceeding Rs 3 lakh crore for the first time ever. This achievement underscores a remarkable turnaround in the sector

A closer analysis reveals a notable discrepancy in the performance between private sector banks and public sector banks (PSBs) during this period. Private banks have reported a substantial surge in net profit, outperforming their PSB counterparts. In FY24, private sector banks led the charge with a combined net profit of Rs 1.78 lakh crore, surpassing the Rs 1.41 lakh crore reported by PSBs. This disparity underscores the growing influence and robust performance of private banks in India’s banking landscape.

Now, let’s delve into the financials of India’s top six banks to gain a deeper understanding of their performance. We will analyze crucial metrics such as Gross Non-Performing Assets (GNPA), Net Non-Performing Assets (NPA), Net Interest Margin (NIM), Return on Assets (ROA), and Profit After Tax (PAT) for the fourth quarter of FY24 versus the third quarter of FY23. Additionally, we’ll compare the PAT of FY24 with FY23 to discern trends and identify key drivers behind the financial performance of these banks.

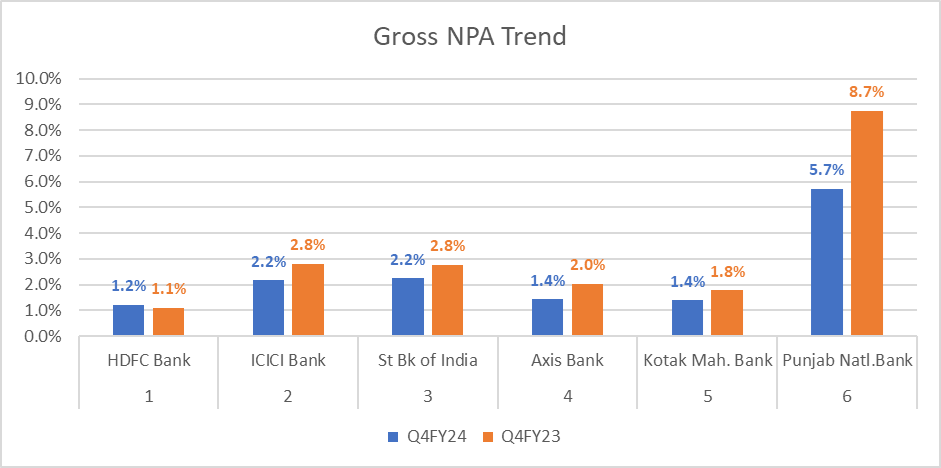

Gross NPA and NPA trend

Source- Investor presentation & Press releases of the respective banks

In Q4FY24 vs Q4FY23, Punjab National Bank was the best performer in reducing its GNPA, dropping from 8.7% to 5.7%, a significant improvement. ICICI Bank and State Bank of India also showed strong performance, with their GNPA decreasing from 2.8% to 2.2%.

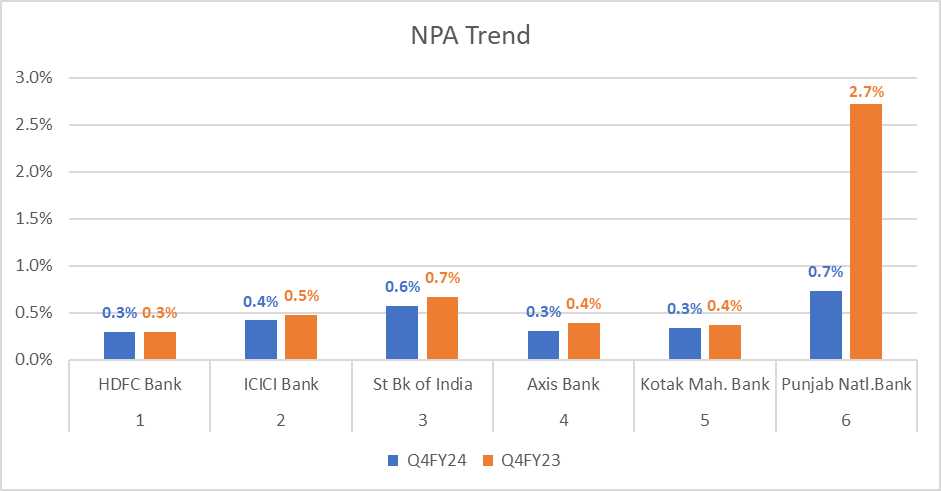

Source- Investor presentation & Press releases of the respective banks

For NPA, Punjab National Bank again led the improvement, with a reduction from 2.7% to 0.7%. State Bank of India followed, reducing its NPA from 0.7% to 0.6%, and ICICI Bank reduced its NPA from 0.5% to 0.4%.

NIM and ROA

| S.No. | Name | NIM Q4FY24 | NIM Q4FY23 | Change in bps |

| 1 | HDFC Bank | 3.4% | 4.1% | -339.96 |

| 2 | ICICI Bank | 4.4% | 4.9% | -439.95 |

| 3 | St Bk of India | 3.5% | 3.8% | -346.96 |

| 4 | Axis Bank | 4.1% | 4.2% | -405.96 |

| 5 | Kotak Mah. Bank | 5.3% | 5.2% | -527.95 |

| 6 | Punjab Natl.Bank | 3.1% | 3.2% | -309.97 |

Source- Investor presentation & Press releases of the respective banks

| S.No. | Name | ROA Q4FY24 | ROA Q4FY23 | Change in bps |

| 1 | HDFC Bank | 2.0% | 2.2% | -199.98 |

| 2 | ICICI Bank | 2.4% | 2.4% | -235.98 |

| 3 | St Bk of India | 1.4% | 1.2% | -135.99 |

| 4 | Axis Bank | 2.0% | 2.1% | -199.98 |

| 5 | Kotak Mah. Bank | 2.9% | 3.1% | -291.97 |

| 6 | Punjab Natl.Bank | 0.5% | 0.2% | -54.00 |

Source- Investor presentation & Press releases of the respective banks

During Q4FY24, the top six banks in India showed a reduction in their net interest margins (NIM) and return on assets (ROA) compared to Q4FY23. Kotak Mahindra Bank reported the highest NIM at 5.3%, though this was a decrease from 5.2%. ICICI Bank had the second highest NIM at 4.4%, decreasing from 4.9% in the previous year. Notably, Punjab National Bank had the lowest NIM at 3.1% and the lowest ROA at 0.5%. Overall, all banks witnessed a decline in both NIM and ROA.

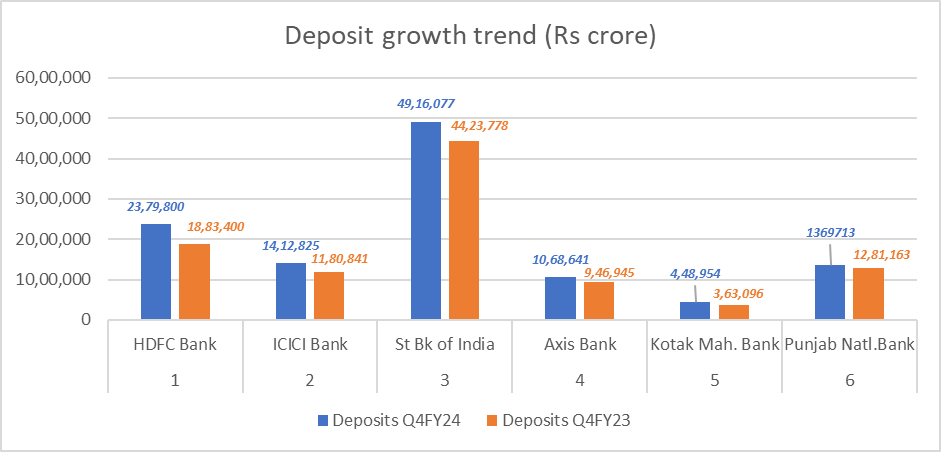

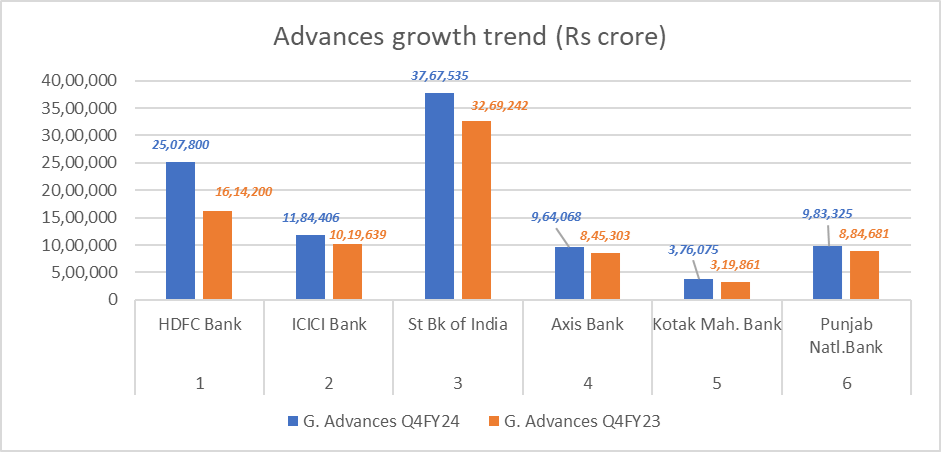

Deposits and Advances

Source- Investor presentation & Press releases of the respective banks

HDFC Bank excelled with a 26.4% increase in deposits to Rs 23,79,800 crore and a 55.4% rise in gross advances to Rs 25,07,800 crore. ICICI Bank saw deposits grow by 19.6% to Rs 14,12,825 crore and advances by 16.2% to Rs 11,84,406 crore. State Bank of India experienced an 11.1% increase in deposits to Rs 49,16,077 crore and a 15.2% rise in advances to Rs 37,67,535 crore.

Axis Bank and Kotak Mahindra Bank reported deposit growths of 12.9% to Rs 10,68,641 crore and 23.6% to Rs 4,48,954 crore, respectively, with advances growing by 14.0% to Rs 9,64,068 crore and 17.6% to Rs 3,76,075 crore. Punjab National Bank had the smallest growth, with deposits rising by 6.9% to Rs 13,69,713 crore and advances by 11.2% to Rs 9,83,325 crore. These figures highlight robust expansion across the sector, driven by increased deposits and lending activities

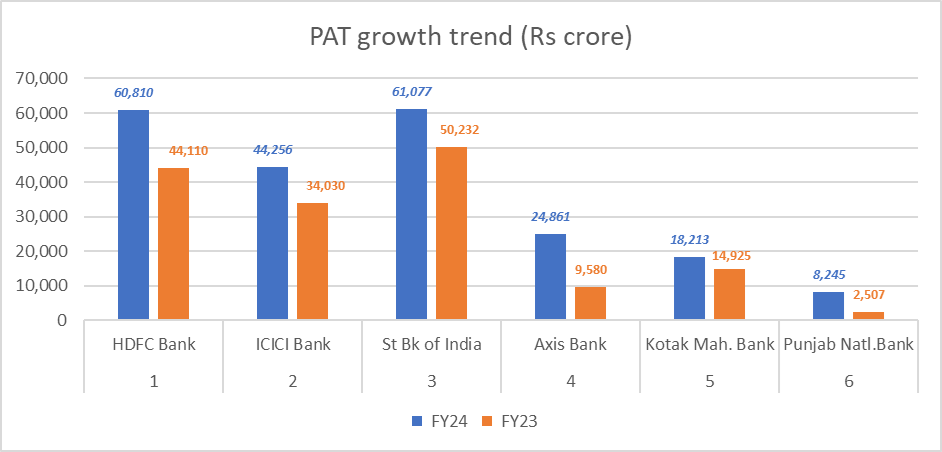

Profit after tax trend

| S.No. | Name | PAT Q4FY24 | PAT Q4FY23 | Growth in % |

| 1 | HDFC Bank | 16,510 | 12,050 | 37.0% |

| 2 | ICICI Bank | 11,672 | 9,853 | 18.5% |

| 3 | St Bk of India | 20,698 | 16,695 | 24.0% |

| 4 | Axis Bank | 7,130 | -5,728 | -224.5% |

| 5 | Kotak Mah. Bank | 5,337 | 4,556 | 17.1% |

| 6 | Punjab Natl.Bank | 3,010 | 1,159 | 159.7% |

Source- Investor presentation & Press releases of the respective banks

In Q4FY24, the top six banks in India demonstrated notable changes in Profit After Tax (PAT) compared to Q4FY23. Punjab National Bank led with a substantial 159.7% increase in PAT to Rs 3,010 crore. HDFC Bank achieved the highest absolute PAT of Rs 16,510 crore, reflecting a 37.0% growth. State Bank of India saw a 24.0% increase to Rs 20,698 crore. ICICI Bank’s PAT grew by 18.5% to Rs 11,672 crore, while Kotak Mahindra Bank had a 17.1% rise to Rs 5,337 crore. Axis Bank, showing significant recovery, posted Rs 7,130 crore, reversing its loss from the previous year.

Source- Investor presentation & Press releases of the respective banks

In fiscal year 2024 (FY24) compared to the previous fiscal year (FY23). HDFC Bank registered a 37.9% increase, ICICI Bank saw a 30.0% growth, and State Bank of India (SBI) recorded a 21.6% rise in PAT . Axis Bank exhibited the most significant growth, with its PAT surging by 159.5%. Kotak Mahindra Bank showed a 22.0% increase, while Punjab National Bank (PNB) witnessed an exceptional growth of 228.9%.

Conclusion

The top six banks demonstrated strong growth in key financial metrics for FY24, despite declines in Net Interest Margin (NIM) and Return on Assets (ROA). High credit growth boosted net interest income (NII), while effective asset quality management kept bad loans in check. The robust demand for loans, driven by retail and corporate borrowers, enabled banks to expand their loan portfolios and maintain profitability. The banking sector’s focus on credit growth and asset quality management bodes well for future stability and economic development, despite challenges such as managing high volumes of bad loans for some banks.

While the overall trend was positive, it is important to note the contrasting performance of Uco Bank and Punjab & Sind Bank, both of which saw declines in net profit. Uco Bank’s net profit fell to Rs 1,653 crore from Rs 1,862 crore in FY23, and Punjab & Sind Bank’s net profit dropped to Rs 595 crore from Rs 1,313 crore. These challenges highlight the need for continued vigilance in profitability management across the sector.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: May 28, 2024, 6:25 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates