Value investing thrives on the principle of identifying undervalued stocks, those trading below their intrinsic worth. By leveraging this perceived market inefficiency, investors aim to reap the benefits when the stock price eventually reflects the company’s true value. This long-term approach involves meticulous research and analysis to uncover hidden gems with the potential for significant growth. This article explores how retail investors can incorporate value investing into their portfolios through both active and passive mutual funds.

Certain mutual funds specialize in investing in value stocks, known as value or contra funds. Contra funds, short for ‘contrarian,’ aim to invest in companies that go against the prevailing market sentiment. While not strictly value stocks, they generally fall within the same realm.

Value funds focus on investing in stocks considered undervalued based on fundamental characteristics. These are open-ended equity schemes following a value investment strategy. They invest in shares of companies trading at discounted prices, often due to temporary factors. However, these stocks are believed to have the potential for high returns over the long term.

It’s important to distinguish between value funds and contra funds. Contra funds target stocks temporarily out of favour, while value funds concentrate on stocks trading below their intrinsic value. The table below highlights some of the top-performing value funds.

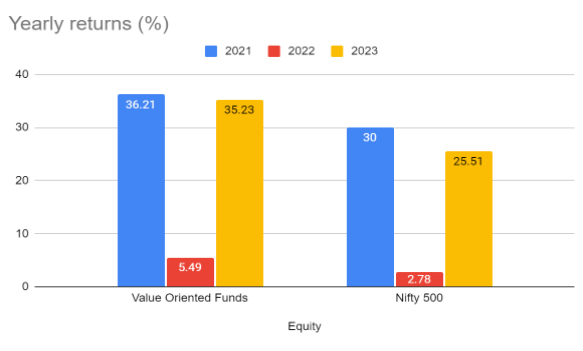

When comparing the past three-year returns of value funds with the Nifty 500 index, value funds have outperformed the Index.

Here are some notable value funds and their performance metrics over the past few years

| Scheme Name | Plan | 1Y | 2Y | 3Y | 5Y | 10Y |

| Aditya Birla Sun Life Pure Value Fund – Regular Plan – Growth | Regular | 55% | 26% | 24% | 20% | 20% |

| HSBC Value Fund – Growth | Regular | 49% | 26% | 25% | 23% | 22% |

| JM Value Fund – Growth | Regular | 59% | 31% | 26% | 25% | 22% |

| Nippon India Value Fund – Growth | Regular | 52% | 25% | 25% | 23% | 20% |

| Templeton India Value Fund – Growth | Regular | 41% | 25% | 25% | 22% | 18% |

| Bandhan Sterling Value Fund – Direct Plan – Growth | Direct Plan | 42% | 23% | 29% | 25% | 21% |

| UTI Value Fund – Direct Plan – Growth | Direct Plan | 31% | 17% | 17% | 20% | 16% |

However, active value/contra funds face a challenge due to their diverse investing styles, which depend on the metrics they use to evaluate value. For example, one fund may focus on traditional parameters like P/E, P/B, and dividend yield, while another may prioritize stocks showing potential business growth despite high P/E ratios and emphasize the quality of earnings.

As a result, some investors using active funds may not be entirely satisfied with the stocks chosen by the fund manager. For those who prefer a more hands-off approach and want to avoid relying on the fund manager’s discretion, passive funds may offer a better alternative.

Investing in value stocks through index funds offers a straightforward approach. A well-known value index, the Nifty 50 Value 20 Index, consists of 20 value stocks selected from the Nifty 50 group based on specific financial metrics like return on capital employed (ROCE), price-to-earnings ratio (P/E), price-to-book-value ratio (P/B), and dividend yield. These stocks are chosen for having lower P/E and P/B ratios and higher ROCE and dividend yield compared to others in the Nifty 50 group.

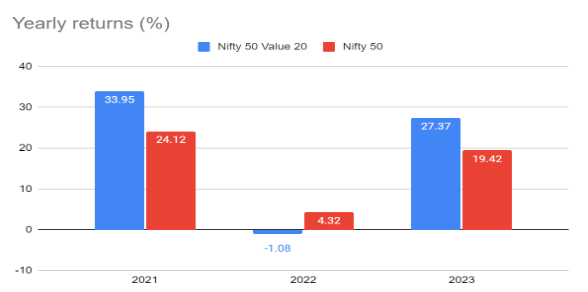

Over time, the Nifty 50 Value 20 Index has outperformed its parent Nifty 50 index, making it a viable option for long-term investors interested in value investing.

Another available index for value-based investing is the Nifty 500 Value 50 Index, which selects 50 value stocks from the broader Nifty 500 Index. This index is more diversified than the Value 20 Index but follows a similar methodology, focusing on value stocks based on the price-to-sales ratio instead of ROCE. However, as of now, there is only one index fund based on this index, limiting options for investors.

Here are the option for investing in index funds using value startegy

| Index Funds | Returns since Inception | Inception |

| Nippon India Nifty 50 Value 20 Index Fund-Reg(G) | 20.22 | Feb 19, 2021 |

| ICICI Pru Nifty50 Value 20 ETF | 18.75 | Jun 17, 2016 |

| HDFC Nifty50 Value 20 ETF | 30.54% | Sep 23, 2022 |

| Kotak Nifty 50 Value 20 ETF | 17.88 | Dec 02, 2015 |

| UTI Nifty 500 Value 50 Index Fund-Reg(G) | 72% | May 10, 2023 |

In conclusion, value investing offers retail investors the opportunity to potentially reap substantial returns by identifying undervalued stocks. While active value and contra funds provide a hands-on approach, their diverse investing styles may not always align with investors’ preferences. On the other hand, index funds offer a more straightforward option for incorporating value investing into portfolios, with indices like the Nifty 50 Value 20 and Nifty 500 Value 50 providing diversified exposure to value stocks. Whether investors choose active or passive strategies, diligent research and a long-term perspective are crucial for success in value investing. While value investing can potentially lead to wealth accumulation, it’s essential to remember that no investment strategy guarantees riches.

Dreaming of financial freedom? Use our Online SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Feb 16, 2024, 5:07 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates