As we navigate the financial terrain, the appeal of small-cap funds calls for the potential for significant growth. This journey unfolds as we examine the outcome of a Rs. 5,00,000 investment in India’s leading small-cap fund a decade ago.

In the realm of small-cap funds, one stands out with unwavering consistency – Kotak Small Cap Fund. Renowned for its stellar performance, this fund has earned its place as India’s no 1 small-cap investment choice.

Launched on 01/01/2013, Kotak Small Cap Fund Direct-Growth has amassed an impressive Rs 12,163 Crores in assets under management (AUM) as of 30/09/2023. Despite its medium size, the fund boasts an enviable expense ratio of just 0.44%, outshining its peers.

With a remarkable 26.10% return over the past year and an impressive average annual return of 20.59% since inception, Kotak Small Cap Fund has proven its prowess. Investors have witnessed their investments double every three years, a testament to the fund’s wealth-building potential.

The fund strategically allocates its assets across the Materials, Capital Goods, Consumer Discretionary, Chemicals, Metals & Mining sectors. Notably, it maintains a conservative stance in Materials and Capital Goods compared to its counterparts in the category.

Kotak Small Cap Fund’s ability to deliver consistent returns aligns with the best in its category. While demonstrating resilience in controlling losses during market downturns, its performance remains steadfast, offering investors a reliable small-cap investment avenue.

The fund’s top 5 holdings include Cyient Limited, Carborundum Universal Ltd., Ratnamani Metals & Tubes Ltd., Century Plyboards (India) Ltd., and Blue Star Ltd. These robust holdings contribute to the fund’s success and underline its strategic investment approach.

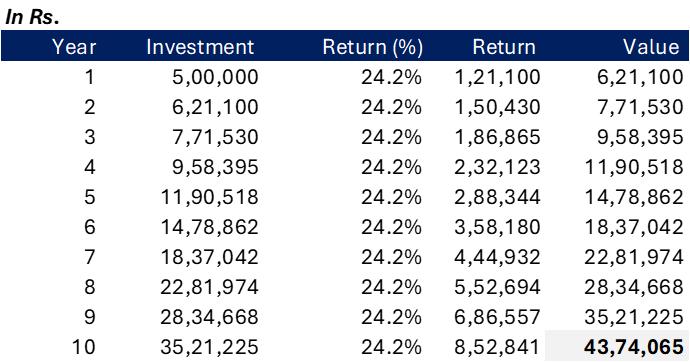

Let’s explore the potential wealth that could have been generated had we invested Rs 5,00,000 in Kotak Small Cap Fund a decade ago. Brace yourself for the magic of compounding, with an impressive annual growth rate of 24.22%.

Your initial investment of Rs 5,00,000 has grown significantly, reaching an impressive Rs 40,00,000 over 10 years.

This remarkable 8x increase highlights the potential inherent in concentrated investments in small-cap companies. Your pre-tax profit, a substantial Rs 38,00,000 in absolute terms, underscores the rewarding outcomes of strategic investment choices.

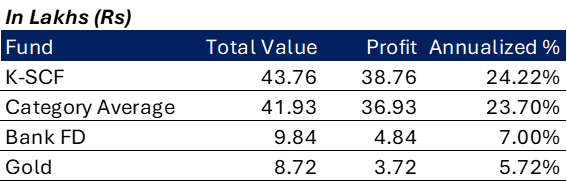

Comparing Kotak’s Small Cup Fund to other investment vehicles

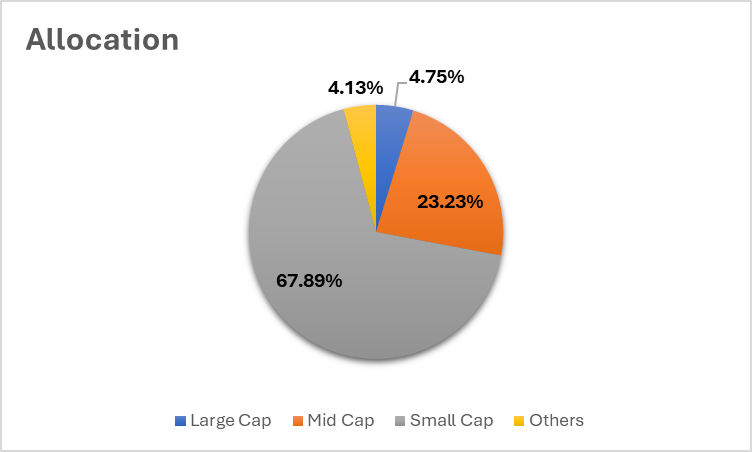

Asset Allocation of the Fund

As we peel back the layers of time and financial data, the journey of Rs. 5,00,000 in India’s #1 small-cap fund unveils not just a numeric growth but a narrative of resilience, strategic decisions, and market dynamics. As we navigate the next decade, armed with the wisdom of the past, the small-cap fund continues to stand as a testament to the potential for growth and wealth creation in the dynamic landscape of Indian markets.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 20, 2023, 6:24 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates