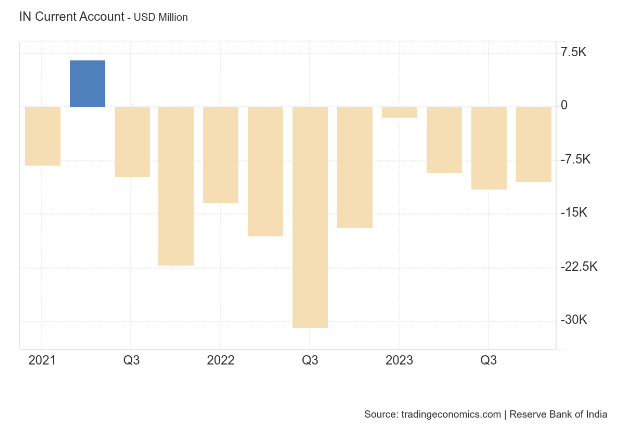

India’s economic landscape saw a notable shift in the third quarter of the fiscal year 2023-24, with the current account deficit (CAD) narrowing to $10.5 billion, a positive development compared to the preceding quarter. The Reserve Bank of India’s (RBI) data release on March 26, 2024, shed light on this significant change.

In the July-September 2023 period, the CAD was recorded at $11.4 billion, or 1.3% of GDP, showcasing a slight improvement from the previous quarter’s figures. However, the more substantial improvement was observed in the October-December 2023 period, where the deficit stood at $10.5 billion, translating to 1.2% of India’s GDP. This marked a notable decline from the CAD of $16.8 billion (2.0% of GDP) in the same quarter of the previous year.

The revised CAD figures for Q2 FY24 highlight an upward revision from 1.0% to 1.3% of GDP, primarily due to an adjustment in customs data on merchandise imports. Despite this revision, the overall trend indicates a positive trajectory, largely driven by the growth in services exports. Services exports, including software, business, and travel services, grew by 5.2% year-on-year, contributing significantly to the narrowing of the CAD.

The moderation in India’s CAD is a positive sign for the economy, reflecting a more balanced trade scenario. The lower CAD in the April-December period of FY24, compared to the corresponding period last year, can be attributed to a decrease in the merchandise trade deficit. This trend has contributed to stabilizing India’s external balance and reducing the vulnerability of the economy to external shocks.

While the merchandise trade deficit widened slightly in February 2024, reaching $18.71 billion, there were positive indicators within this segment. Merchandise exports rose by 11.9% year-on-year to $41.40 billion, while imports also saw an increase of 12.2% to $60.11 billion. This indicates a healthy growth in trade activity, albeit with a slightly widened trade deficit.

Key indicators such as the one-month non-deliverable rupee forward and the onshore one-month forward premium remained stable, indicating confidence in the rupee’s stability. However, NSDL data revealed that foreign investors sold a net $425.3 million worth of Indian bonds on March 22, signaling a cautious approach among international investors.

Conclusion

India’s narrowing current account deficit in Q3 FY24 reflects a positive trend in the country’s external trade dynamics. The growth in services exports, coupled with a reduction in the merchandise trade deficit, has contributed to a more stable external balance. While challenges such as the widening trade deficit in February 2024 and foreign investment outflows remain, the overall trend suggests a resilient Indian economy poised for further growth.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Mar 27, 2024, 5:42 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates