The Long Iron Condor stands as an intermediate strategy well-suited for capitalizing on rangebound stocks. Serving as a variation of the Long Iron Butterfly, it cleverly combines a Bull Put Spread and a Bear Call Spread. Notably, it crafts its distinctive condor shape by positioning the higher strike put below the lower strike call.

This strategic amalgamation of two income-generating tactics positions the Long Iron Condor as an income strategy. Traders often adopt a stepwise approach, initially executing a Bull Put Spread just beneath support levels. Subsequently, as the stock rebounds from resistance, they layer on a Bear Call Spread, thus constructing the Long Iron Condor.

The ideal scenario unfolds when the stock remains confined between the two middle strikes. Maximum profit is realized when options expire within this range, rendering them worthless and allowing the trader to retain the combined net credit. This combined credit expands the breakeven zone, as each component – the Bull Put and Bear Call elements – reinforces the other.

Trading a Long Iron Condor involves four steps. First, you buy a put option with a lower strike price. Second, you sell another put option with a middle strike price lower than the first. Then, you sell a call option with a middle strike price higher than the second put option. Finally, you buy a call option with a higher strike price than the call option you sold. All these options should have the same expiration date.

It’s important to use both put and call options for this strategy. Essentially, it combines two other strategies: the Bull Put Spread and the Bear Call Spread. Make sure the strike price of the put option you sell is lower than the strike price of the call option you sell. Also, ensure there’s an equal distance between each strike price, and the stock price usually falls between the two middle strikes.

When entering this trade, look for a market trend that moves within a range, without a clear upward or downward direction. Identify levels where the stock tends to find support or resistance.

When it’s time to exit the trade, stick to your Trading Plan. Remember, the Long Iron Condor involves several moving parts, so you can unwind the position bit by bit. You might want to consider closing the position just before the options expire.

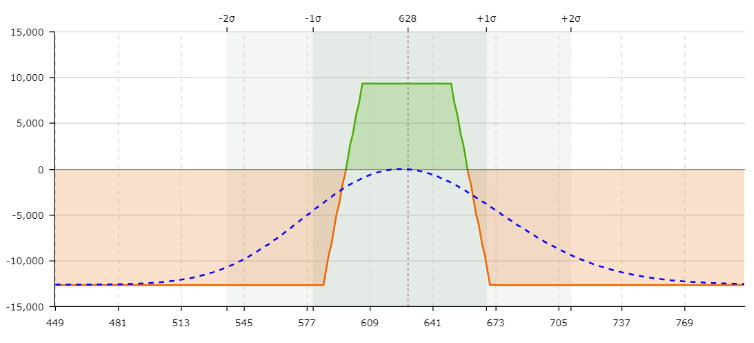

HDFC Life Insurance Company share price is trading at Rs 628 on April 3, 2024.

| Action | Option | Expiry Date | Strike Price | Premium (Rs) |

| Buy | Put | 25-Apr-24 | 585 | 3.9 |

| Sell | Put | 25-Apr-24 | 605 | 7.9 |

| Sell | Call | 25-Apr-24 | 650 | 8.9 |

| Buy | Call | 25-Apr-24 | 670 | 4.4 |

| Probability of Profit | Max. Profit (Rs) | Max. Loss (Rs) | Max. RR Ratio | Break-evens |

| 51.09% | Rs +9,350 (13.25%) | Rs -12,650 (-17.93%) | 01:00.7 | 597 – 658 |

To minimize the losses, we can liquidate the positions just before the breach of break-evens. Mostly between Rs 595 to Rs 605 and Rs 650 to Rs 660.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Apr 3, 2024, 3:38 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates