Unabated inflows by foreign institutional investors coupled with liquidity measures taken by the government and central bank have pulled the benchmark equity indices BSE Sensex and NSE Nifty to their all-time high levels despite the ongoing uncertainty over Covid-19 pandemic.

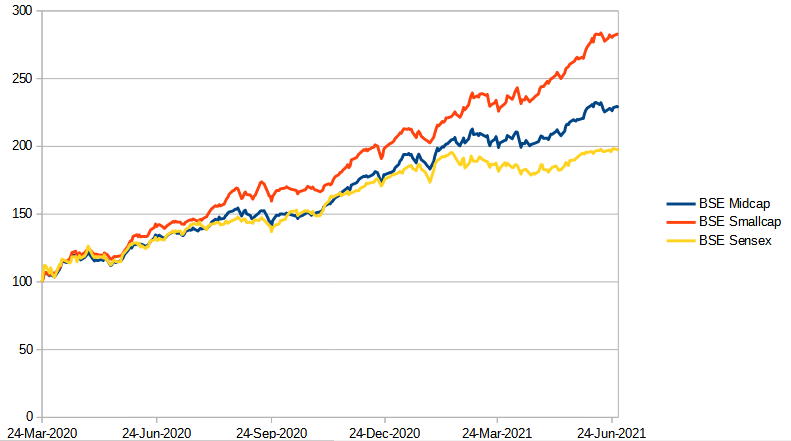

The 30-share pack Sensex has gained 97% to 52,549-mark from the closing low of 26,674, hit in March 2020. Likewise, the BSE Midcap and Smallcap indices have gained 130% and 183%, respectively, during the same period.

Following the ongoing rally in the equity markets, millions of investors have opened their Demat accounts and there must be many success stories. However, some investors must have burnt their fingers or capped their gains despite the ongoing rally in the market. Here are some mistakes one should avoid while investing in bull market:

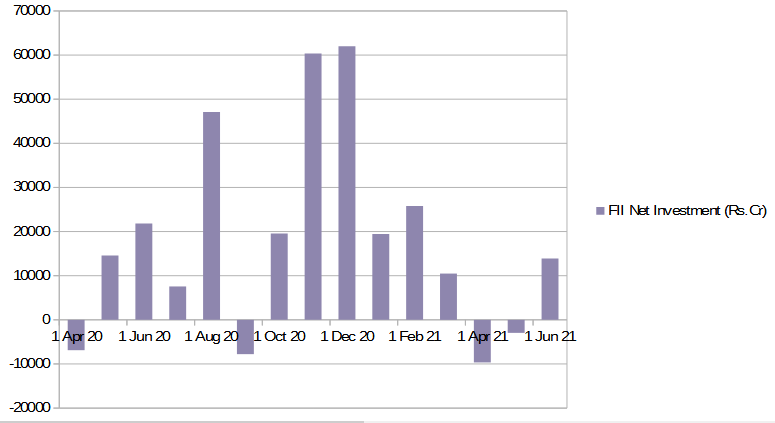

Most of the retail investors prefer to book profit when they come to know that the equity market is hovering at its record high levels. At present, the Indian equity market has been hitting new highs due to heavy liquidity in the market. Foreign portfolio investors have poured more than Rs 2.75 lakh crore since April last year. Analysts believe that low interest rates coupled with sharp fall in Covid-19 cases and easing of lockdown restriction in some parts amid a pick-up in vaccination will further support the domestic equity market. There are hopes that the Indian economy can witness sharp recovery due to normal monsoon and supportive monetary policy.

Low interest rates are one of the reasons that investors are preferring equities over fixed deposits. Considering the present market condition, there is no chance that deposit rates will go up in the near term. Therefore, chances are high that liquidity will remain robust in the market and indices will move higher. Therefore, selling your stocks early without knowing the present situation is not a good idea.

Penny stocks usually attract small investors in a bull market. Investors should understand that they are small due to some reason. Chasing little-known stocks or stocks without fundamentals can affect you portfolio even in the bull market. There are at least 21 stocks which have eroded up to 50% of investors wealth since March 24, 2020. Some of the stocks in the list included Path Infinity (down 84%), Ashari Agencies (down 80%), Jump Network (down 80%), Ozone World (down 78%) and Svaraj Trading and Agencies (down 74%).

If a stock wipes out that much of wealth when markets are trading at all-time highs, this indicates that there is something wrong with that stock. Therefore, it is advisable that retail investors should consult their financial advisors or market analysts while taking positions in penny stocks.

Sometimes small investors enter the market after bulls played most of their part. As a result, retailers poured huge amounts of money in one go to cover up their lost time. This is one of the biggest mistakes they make. Analysts believe that using your corpus in one go can erode wealth in case of any sharp downturn in the market. Therefore, one should always invest as per your goals rather than depending on the performance of Sensex and Nifty.

In a bull market, you may get a lot of stock advice on social media websites or from your friends. However, by the time the stock pick reaches you, you might have missed the bus. Sometimes they are operator driven stocks which may wipe out your wealth. It is advisable to invest in the market through mutual funds in a systematic manner if you are not able to understand the market.

Sometimes conservative investors prefers to sit on cash at the time when indices hit their all-time high levels. As a result, they started missing opportunities and lose some money as cash in the hand delivers no return. It is advisable to start systematic investment plan and stay invested in bull and bear market. This will help you to average your cost. If you are holding cash for the day when the market will crash over 20%, it means you may have to wait till the market witness substantial rise from the present levels.

It is not advisable to look at the levels of the benchmark equity indices Sensex and Nifty on a regular basis. Sometimes buying a stock on the basis of price can put you in trouble. Investors should use analytical tools, read balance sheets, financial ratios and annual reports before taking any decision. Without the use of analytical tools, an absolute number can put you in trouble. A stock trading at Rs 500 can be cheaper than it was trading at Rs 250. Therefore, investors should always see the value in what you buy. It is advisable not to look at only a single metric of valuation to make your buy or sell decision.

Published on: Aug 31, 2021, 1:16 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates