Motilal Oswal Mutual Fund is launching a new fund, the Motilal Oswal Quant Fund. This fund aims to grow your investment over the medium to long term by picking stocks and similar investments using a computer-driven system (quantitative investment framework). It is an open-ended fund, so you can buy and sell units whenever you want. While it is not restricted to a specific sector, it does follow a thematic approach based on the quantitative model. The fund just launched today, June 3rd, 2024, and the offer closes on June 5th. There’s no upfront fee to invest (entry load), but if you sell your units within 15 days of buying them, you’ll pay a 1% exit load. Otherwise, you can redeem them without penalty. The minimum investment is Rs 500 and you can add more.

The investment objective of the Motilal Oswal Quant Fund is to generate medium to long-term capital appreciation by investing in equity and equity-related instruments selected based on a proprietary quantitative investment framework. However, there can be no assurance that the investment objective of the scheme will be realized.

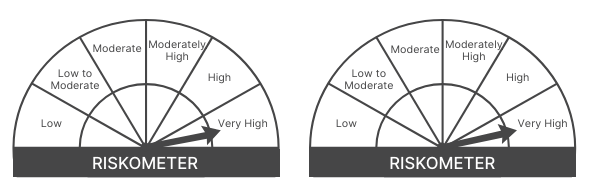

This NFO of Motilal Oswal Quant Fund is suitable for investors who are seeking to generate medium to long-term capital appreciation and investments in equity and equity-related instruments selected based on a proprietary quantitative investment framework

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equity and Equity related instruments | Very High | 80 | 100 |

| Units of Liquid fund and Money Market instruments (including cash and cash equivalents) | Low | 0 | 20 |

The performance of the Motilal Oswal Quant Fund is benchmarked against Nifty 200 Index TR.

Ajay Khandelwal, aged 44, holds a CFA Level 3 certification, a PGDM-MBA from TAPMI, Manipal, and a B.E. in Electrical Engineering from MITS, Gwalior. With 13 years of experience in fund management and research, Ajay has notably contributed to the field. Before his current role at Motilal Oswal Asset Management Company Limited, he managed the Small Cap Fund at Canara Robeco Asset Management Company Limited, showcasing his expertise in handling small-cap investments.

Rakesh Shetty, aged 42, has a Bachelor’s degree in Commerce and brings over 14 years of comprehensive experience in equity and debt trading, ETF management, and corporate treasury. Before joining Motilal Oswal Asset Management Company Limited, he worked with a capital market business firm where he managed equity and debt ETFs, developed customized indices, and participated in product development, demonstrating his broad expertise in financial markets.

| Scheme Name | Launch Date | AUM (Crore) | TER (%) |

Returns (%) |

Since Launch Rtn. (%) | |||

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

| quant Quantamental Fund | 20-04-2021 | 2,173.52 | 2 | 64.77 | 31.28 | – | – | 32.44 |

| 360 One Quant Fund | 29-11-2021 | 175.14 | 1.83 | 57.83 | – | – | – | 26.55 |

| Nippon India Quant Fund | 02-02-2005 | 63 | 0.98 | 42.24 | 21.41 | 19.39 | 13.91 | 10.05 |

| Axis Quant Fund | 30-06-2021 | 1,062.73 | 2.18 | 32.79 | – | – | – | 15.83 |

| ICICI Pru Quant Fund | 07-12-2020 | 76.8 | 1.23 | 32.69 | 16.44 | – | – | 22.25 |

| Tata Quant Fund | 22-01-2020 | 57.67 | 2.38 | 24.09 | 10.45 | – | – | 8.07 |

| DSP Quant Fund | 10-06-2019 | 1,179.23 | 1.26 | 17.4 | 9.65 | – | – | 14.11 |

| Kotak Quant Fund | 02-08-2023 | 683.5 | 1.26 | – | – | – | – | 44.06 |

| Category Average | – | – | – | 38.83 | 17.85 | 19.39 | 13.91 | 21.67 |

| NIFTY 500 TRI | – | – | – | 35.17 | 18.1 | 17.85 | 15.07 | 12.63 |

Data as of May 31, 2024

Elevate your savings strategy with our easy-to-use Angel One SIP Calculator. See the impact of consistent investing. Your future self will thank you. Start planning today!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jun 3, 2024, 1:57 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates