Paytm, known as One 97 Communications Ltd, recently reported a significant net loss of ₹840 crore for the quarter. This marks a considerable increase from the ₹550 crore loss in the previous quarter and the ₹338 crore loss in the same quarter last year. Despite the widened net loss, Paytm’s share price saw an unexpected rise of up to 6% in intraday trades post the results.

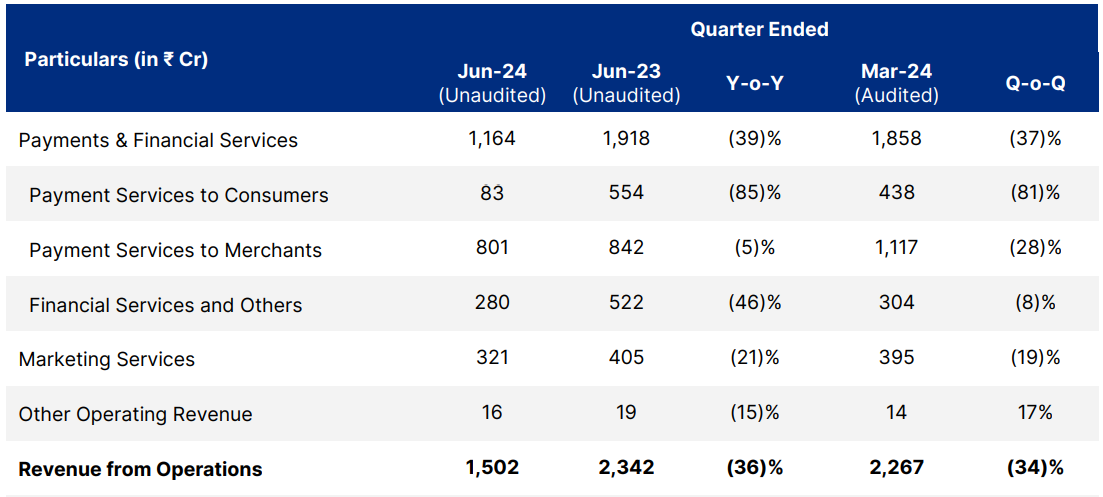

The company’s revenues from operations took a hit, dropping to ₹1,502 crore, which is a 36% year-on-year decline from ₹2,342 crore in June 2023. Sequentially, this marks a 34% decrease from ₹2,267 crore in the previous quarter. The dip in revenues is primarily attributed to a downturn in Payments & Financial Services, which saw a decline of 37% sequentially and 39% year-on-year, landing at ₹1,164 crore.

(source: company presentation)

The company’s operational performance also took a hit. Adjusted for ESOP costs, the Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA) loss stood at ₹545 crore during the quarter. This is a stark contrast to the positive EBITDA of ₹84 crore in the same quarter last year and ₹102 crore in the previous quarter.

Paytm’s payment processing charges declined significantly to ₹517 crore, a 28% QoQ drop and a 33% year-on-year decrease.

The Gross Merchandise Value (GMV) also saw a decline, coming in at ₹4.26 lakh crore, compared to ₹4.69 lakh crore in the previous quarter. GMV represents the rupee value of total payments made to merchants through transactions on the Paytm app, using Paytm Payment Instruments, or through its payment solutions, excluding any consumer-to-consumer payment services.

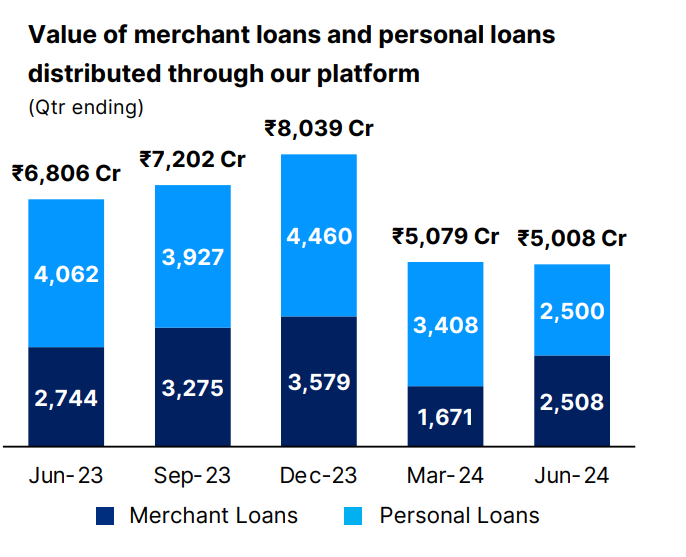

(source: company presentation)

Despite the challenges, Paytm remains optimistic about its future. The company noted that the revenue and profitability impact was in line with their guidance. They also highlighted that their payment operating metrics are rebounding to January 2024 levels.

Paytm is focusing on cost reduction, with employee costs declining by 9% sequentially. Going forward, the company expects revenue and profitability to improve, driven by growth in operating parameters such as GMV, an expanding merchant base, recovery in the loan distribution business, and continued cost optimization efforts.

As of 2:55 pm, Paytm shares are trading at Rs 462 (+3.75%) a piece on NSE.

While Paytm’s latest financial results paint a picture of significant challenges, the company’s strategic focus on cost optimization and operating metric improvement offers a glimmer of hope for the future. As they navigate through this turbulent phase, all eyes will be on their next steps and how they leverage their strengths to bounce back.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jul 19, 2024, 6:13 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates