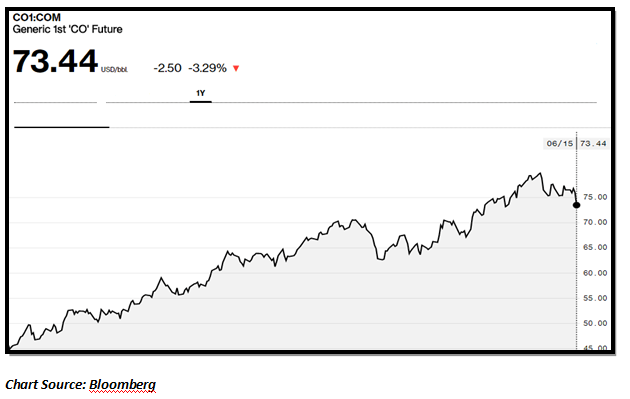

Over the last few months a very key set of macros are playing out in India. On the one hand, crude prices are going up sharply and in fact have gotten close to the $80/bbl mark. On the other hand, the Indian rupee is gradually weakening. While the rupee is still off the 2013 lows of 68.80, it is quite close to that range. Obviously, both these factors are having an impact on domestic inflation, interest rates and also on the nature of portfolio flows into India. First, let us look at why oil is up and rupee is down? Secondly, let us look at what could be a portfolio strategy in these circumstances?

As can be seen from the above chart, in the last 1 year, Brent crude has moved up from $45/bbl to $80/bbl, before settling around the $73.44 mark last week. The sharp rise in oil prices was largely driven by supply cuts imposed by Russia and the OPEC, which jointly cut 1.8 million barrels of supply per day. This had its impact on demand supply equation sending oil prices higher. Also, an economic revival is visible across the globe including the US, Europe and Japan. That is also driving demand for oil and keeping oil prices higher. Although oil may face resistance at $80/bbl, overall prices are likely to remain elevated.

There are a lot of factors for the weakness of the rupee including weak oil prices. Firstly, higher oil prices has led to the trade deficit widening to $15 billion in the month of May 2018 as India relies on imports for nearly 75% of its oil requirement. Secondly, the US Fed has been consistently hiking rates and that is making the dollar stronger. This dollar strength is, in turn, weakening the rupee. Thirdly, the weak rupee is making global portfolio managers jittery about investing in India and that has led to consistent outflows. Also, higher rates in the US means that US debt paper is a lot more attractive now. All these factors are weakening the rupee as can be seen from the chart below…

The rupee has weakened from around 63/$ to a low of 68/$. It is this combination of higher oil prices and weaker rupee that poses a challenge to investors. What should the investor’s portfolio strategy be in these circumstances?

Here is a Three-point framework for you to craft an investment strategy in these circumstances.

Strategically, it is better to stay away from cyclicals as they are more vulnerable to higher oil prices and weaker rupee. However, the higher growth that a weaker rupee will engender is likely to more than make up for the shortfall.

Published on: Jul 7, 2018, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates