Shareholder lock-ins are a common feature of initial public offerings (IPOs) in India. Lock-ins prevent pre-IPO investors from selling their shares for a specified period of time, typically six months to two years. This is done to ensure that the post-IPO market is orderly and to prevent pre-IPO investors from dumping their shares on the market and driving down the price.

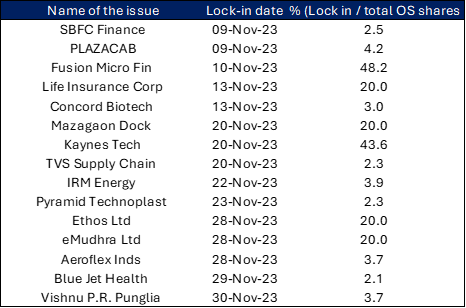

The following table shows a list of upcoming shareholder lock-ins:

Implications for investors

The lock-in expiry of a large IPO can have a significant impact on the market. If there is a large overhang of supply from pre-IPO investors, it can put downward pressure on the stock price. However, if the company has performed well since its IPO, the lock-in expiry can be a positive event, as it allows pre-IPO investors to monetize their investments.

Investors should carefully consider the implications of upcoming lock-in expires before making any investment decisions. If you are invested in a stock that is approaching a lock-in expiry, it is important to monitor the company’s performance and the overall market conditions.

Here are some specific things to look for:

The company’s performance:

If the company has performed well since its IPO, it is more likely that the lock-in expiry will be a positive event.

The overall market conditions:

If the market is strong, it is more likely that the company’s stock price will be able to absorb the increased supply from pre-IPO investors.

The size of the lock-in expiry:

The larger the lock-in expiry, the greater the potential impact on the market.

Conclusion

Shareholder lock-ins are a common feature of IPOs in India. Investors should carefully consider the implications of upcoming lock-in expiries before making any investment decisions. By monitoring the company’s performance and the overall market conditions, investors can make informed decisions about whether to hold, sell, or buy a stock before or after a lock-in expiry.

Additional considerations

In addition to the factors mentioned above, investors should also consider the following when evaluating the potential impact of a lock-in expiry:

The company’s fundamentals:

Investors should look at the company’s financial statements, business model, and competitive landscape to assess its long-term prospects.

The company’s management team:

Investors should evaluate the management team’s track record of execution and their vision for the company’s future.

The company’s valuation:

Investors should compare the company’s valuation to its peers and to the overall market.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 7, 2023, 6:33 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates