A Systematic Investment Plan (SIP) is a highly organized method for building a substantial fund, tailored to meet various objectives. It not only serves as a valuable resource during unforeseen emergencies but also fosters a sense of financial security for future endeavors. SIP involves an automated process where a system-generated order is essential for authorizing the server to deduct a specified amount from your bank account and invest it in your chosen fund. It’s worth noting that while manual investment decisions can be postponed, an automated system does not allow for procrastination.

In this article, we will explore how SIPs have been instrumental in generating long-term wealth for investors over the past 10 years. Our focus will be on discussing how SIPs in certain large-cap funds have contributed to wealth creation for their investors and calculating the returns that an investor would have accrued if they had initiated an SIP of Rs 3,000 ten years ago.

Nippon India Large Cap Fund:

The Nippon India Large Cap Fund launched in 2007, has its primary investment objective focused on seeking long-term capital appreciation primarily through investments in equity and equity-related instruments of large-cap companies. Its secondary objective is to generate consistent returns by investing in debt, money market securities, REITs, and InvITs. The current fund managers are Kijal Desai, Ashutosh Bhargav, Sailesh Raj Bhan, and Akshay Sharma. As of August 2023, the expense ratio stands at 1.72%.

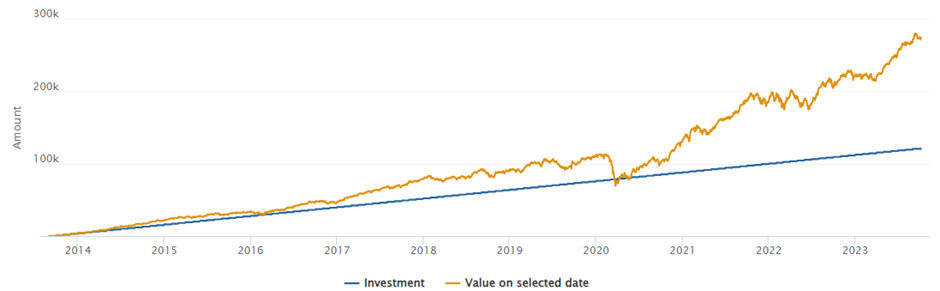

If we consider a monthly SIP of just Rs 3,000 consistently over a 10-year period in the Nippon India Large Cap Fund, which has been the best-performing fund in the last decade with an impressive absolute return of 127.77% and an annualized return of 15.45% during the same period, your investment of Rs 3.60 lakh over the decade, with a small SIP amount of Rs 1,000 per month, would have grown to a value of Rs 8.20 lakh.

ICICI Prudential Bluechip Fund

The ICICI Prudential Bluechip Fund was launched in 2008 with the primary objective of providing long-term capital appreciation to its investors. This is achieved by predominantly investing in the equity and equity-related securities of large-cap companies. The current fund managers are Anish Tawakley, Vaibhav Dusad, and Sharmila, and as of August 2023, the expense ratio stands at 1.59%.

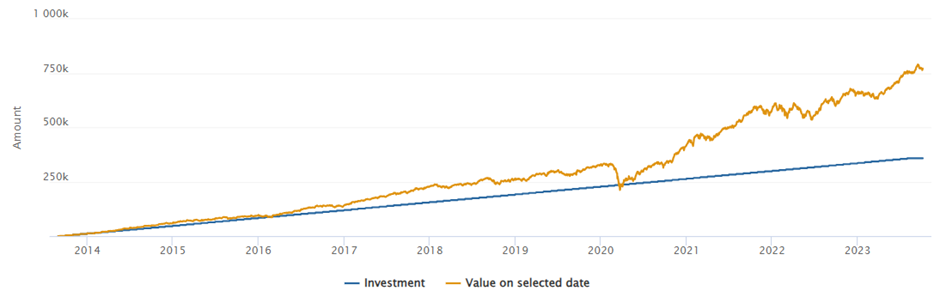

If we consider a consistent monthly SIP of just Rs 3,000 over a period of 10 years in the ICICI Prudential Bluechip Fund, which is the third-best performing fund in the last decade, it has delivered an impressive absolute return of 114.51% and an annualized return of 14.35% during the same period. This means that an investment of Rs 3.6 lakh over the decade, with a modest SIP amount of Rs 3,000 per month, would now be valued at Rs 7.72 lakh.

Mirae Asset Large Cap Fund:

The Mirae Asset Large Cap Fund launched in 2008, has set out with the goal of achieving long-term capital appreciation by predominantly investing in equities of large-cap companies, capitalizing on potential opportunities. The current fund managers are Gaurav Misra and Gaurav Khandelwal, and as of August 2023, the expense ratio stands at 1.54%.

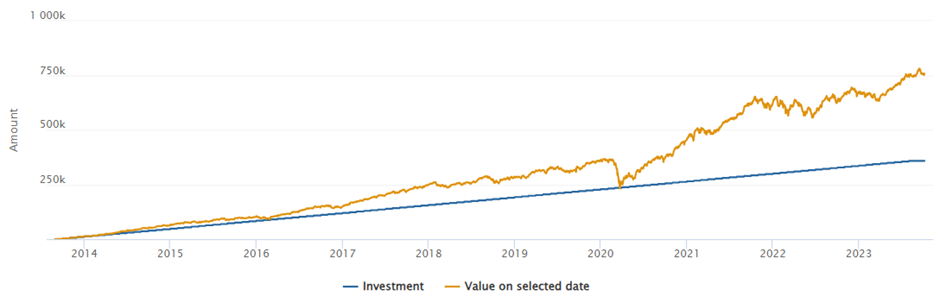

Considering a consistent monthly SIP of just Rs 3,000 over a span of 10 years in the same scheme of the Mirae Asset Large Cap Fund, which stands as the third-best performing fund in the past decade, it has delivered an impressive absolute return of 110.78% and an annualized return of 14.03% during the same period. This translates to an investment value of Rs 3.6 lakh over the decade, with a modest SIP amount of Rs 3,000 per month, now being valued at Rs 7.58 lakh.

In this article, we analysed the wealth-building potential of SIPs in large-cap funds over the long term. SIPs harness the power of compounding, emphasizing the significance of initiating them as early as possible to maximize wealth creation opportunities.

Nevertheless, the choice of a suitable fund for your SIPs is crucial. It’s important to note that as your risk profile evolves over time, it’s advisable to rebalance your portfolio accordingly. To achieve the best returns in the long term, it is good to start investing early as soon as you begin earning.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 9, 2023, 6:26 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates