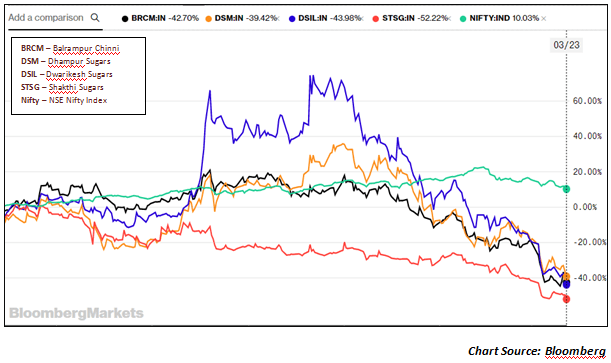

If you have even been a casual observer of markets, the one thing you would have noticed is the stark underperformance of sugar stocks on the NSE. What is rather surprising is that over the last 3-4 years these sugar stocks have been rank outperformers. In the last 6 months the situation changed for the worse as a glut of supply took its toll on the stock prices of sugar stocks. During the last 1 year, even as the Nifty has given a 10% positive returns, sugar stocks have seen deep cuts. Check the chart below…

As can be seen from the above chart, most of the sugar companies in India have fallen by 40-50% in the last 1 year. The stock market is considered to be the best barometer of the prospects of any industry. That brings to the fundamental question; why have sugar stocks underperformed and why sugar industry could be a worry.

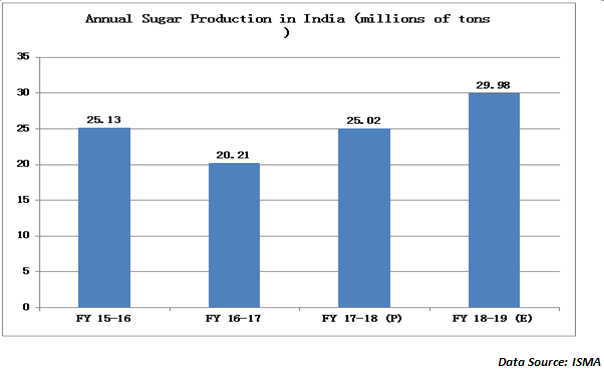

Sugar output is a function of better production and also more productive methods of sugarcane farming. Famers are assured the best annual price hike on sugar compared to other Kharif crops and that has added to the woes of the sugar manufacturers. Consider the sugar production chart below…

While Brazil continues to be the largest producer of sugar in the world with nearly 25% market share in sugar production. India is the second largest producer of sugar. What is interesting is that the sugar production in India has increased by 20% in 2017-18 (Oct-Sep) and is projected to rise by another 20% in the fiscal year 2018-19 (Oct-Sep). In India the Sugar production cycle commences in October and ends in September next year. With Indian per capita consumption of sugar at just about 10 kg (much lower than the global average of 20 kg), there is only so much capacity that Indian sugar demand can absorb. If India produces 30 million tonnes in 2018-19 then India may have a surplus stock of nearly 5 million tonnes. Secondly, the government has just withdrawn export duties to encourage the export of sugar. But the challenge is the cost! Both in terms of sugarcane production and in terms of actual sugar production, our costs are much higher than other major producers like Brazil and Thailand. This will make Indian sugar almost uncompetitive in global sugar markets.

As one of the most eloquent representatives of the sugar industry, Mr. M Manickam of Shakthi Sugars put it, “The Fair Remunerative Price Policy for farmers is resulting in a sharp rise in sugarcane production by farmers but it will create a situation where there will be no buyers for the sugar. Two of the largest producer states of Maharashtra and Uttar Pradesh have announced higher prices for sugarcane but this has only resulted in overproduction. Currently the cane price of Rs.2550 per tonne is leading to unprecedented to acreage. It is this acreage that is leading to a glut in production. According to Manickam, in the Budget 2018, Jaitley had announced an assured MRP at 150% of the cost of production for Kharif crops. But in the case of sugarcane, the actual price is 25% more than this assured price too. It is hardly surprising that the sugar mills are currently having nearly Rs.14,000 crore of dues to sugarcane farmers and that situation is likely to continue with the current glut situation.

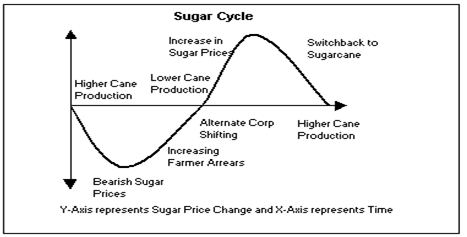

The above sugar chart captures the typical cycles that sugar moves in India. In this entire story, the sugar manufacturers are caught in a one-way street. They really do not have too many exits from here. Currently, sugar mills have a cost of production of Rs.34/kg at a time when the market price is Rs.30/kg. Instead of making loss of Rs.4 on each kg, sugar mills just prefer to create an inventory of sugar hoping that the shortage of sugar will automatically push up sugar prices helping them to offload inventories. The use of sugar for other purposes like alternate fuels is also not a very viable proposition. The government has taken the initiative to impose heavy import duties on sugar but that will hardly help because the entire problem is with domestic production. There is only one good thing that may emerge from the fall in sugar prices in India. The market price will at least become competitive in the global markets and enable a push to exports. That will also mean that, either ways, the domestic sugar producers will continue to face a tough time.

The good news for the Indian sugar companies may be that in terms of leverage they are much better off today than they were 5 years ago. That will give them greater staying power in this situation. The real challenge is not just managing the domestic supply but also the global glut in sugar. It looks like the sugar stocks may be in for a prolonged lull from here on!

Published on: Apr 9, 2018, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates