Options are financial instruments that allow you to buy a high-value underlying asset at a relatively lower price and thus give you the potential to earn substantial profits. In this brief overview, we'll delve into the fundamentals of Options, their types, and how they function.

What are Options?

Options are a type of derivative. This means they derive their value from a different, underlying instrument. Depending on the type of option you hold, it gives you the choice to buy or sell an asset. The asset could be a stock, an index value, a commodity, a currency or even a Futures contract.

Understanding Options With Example

Let us take a look at a real-life example of an Options contract to understand it better:

On October 19, 2023, the TATAMOTORS 26-Oct-23 665 CE closed the day at ₹12.05 after gaining 72.14% on a single day! Sounds interesting, but what does this mean?

Let us understand this step by step:

- The term ‘TATAMOTORS 26-Oct-23 665 CE’ represents an Options contract on the Tata Motors Ltd. stock as the underlying asset.

- 26-Oct-23 means this option can be exercised only on October 26, 2023.

- CE stands for Call option of the European type. A call option gives you the right to buy the underlying asset on the expiry day at the agreed price. We will further explain the call and put options to you in detail in a later section.

- 665 stands for the strike price of ₹665 for the underlying Tata Motors stock.

- Therefore, if you buy this call option today, then this contract will allow you to buy the TATAMOTORS stock at ₹665 on October 26, 2023.

- In order to buy this option, you will have to pay an amount much smaller than ₹665. As of the closing of October 19, 2023, this amount was ₹12.05 per Options contract.

To make things more clearer, let’s go over Options contracts in greater detail.

Types of Options

Option contracts can be of two types only, i.e. call option or put option.

Call option

A call option gives the holder/buyer the right to buy the underlying asset at a predetermined price on a given date. The predetermined price is called the strike price, and the given date is called the expiry date. In the example above, the Tata Motors stock was the underlying asset, ₹665 was the strike price, and October 26, 2023 was the expiry date.

Buying a call option is said to be a long call strategy while selling a call option is called a short call strategy. The price the buyer of an option pays to buy the contract is called the Options premium. In the above example, ₹12.05 was the option premium.

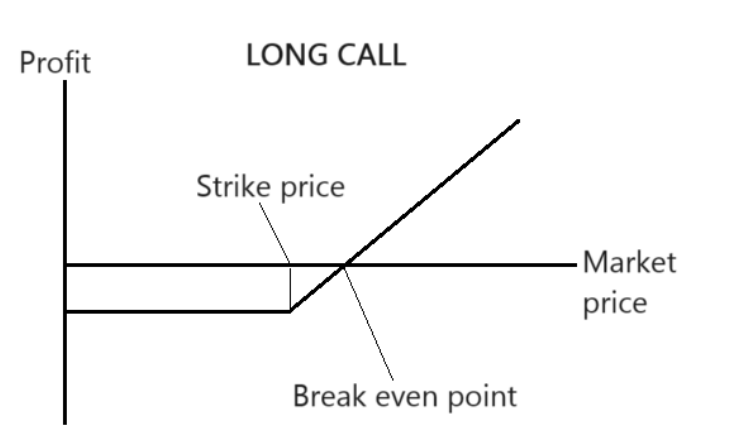

Fig.: Long call diagram

You may notice that there is a gap between the strike price and the break even point. This is because, even after the spot price or market price surpasses the strike price, the premium or the price of the option that you paid must still be subtracted from the profit. Therefore, you make a profit overall only when:

Spot price - Strike Price > Premium paid

Put Options

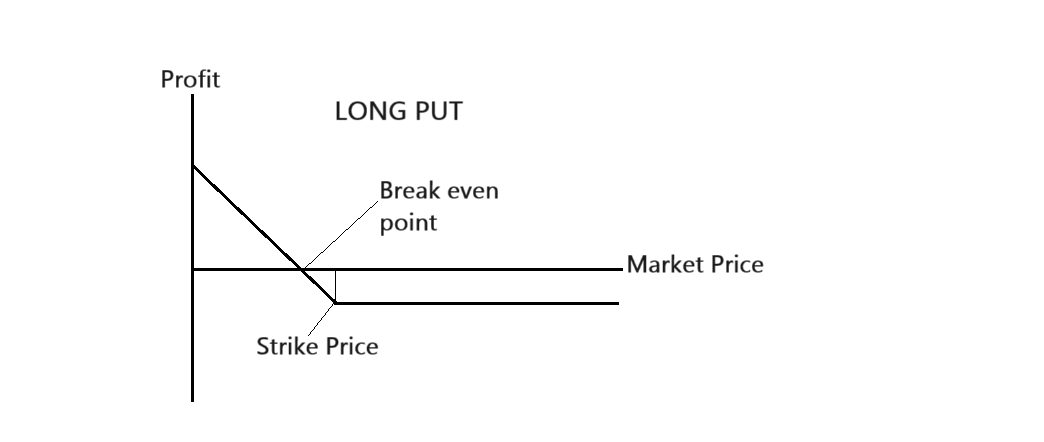

A put option, on the other hand, gives the option holder/buyer the right to sell an underlying asset to the option seller. Like call Options, put Options also have an expiry day on which they can be exercised and a premium that must be paid to buy them. Buying a put option is said to be a long put strategy, while selling a put option is called a short put strategy.

Fig.: Long put diagram

You can find out more about the call and put Options in this article.

Features of an Options Contract

Let us now dive deeper into the salient features of an Options contract:

Option Chain

An option is basically a chart that shows real-time data on the premiums, open interest, option Greeks, etc.

ITM, OTM and ATM

The profitability of the option is indicated by whether they are ITM, OTM or ATM:

- An option is said to be ITM or in the money, if exercising the option on expiry day gives the option holder profit.

- An option is said to be OTM or out of the money if exercising the option will give them a loss.

- If the profit or loss incurred from exercising the loss is low because the strike price of that option contract is nearest to the market price compared to other strike prices on the option chain, then the option is said to ATM or at the money.

No Obligation To Buy or Sell

As mentioned earlier, holding the Options contract gives you the right but not the obligation to buy/sell the underlying asset. On the expiry day, you may choose not to buy/sell at the strike price despite having the right to do so. The reason for not exercising the option is usually that the market price is more favourable than the strike price.

This is in contrast to Futures contracts where both the buyer and seller must perform their agreed role to buy and sell respectively.

Lot Size

It is often the case in the Indian derivatives market that you cannot just buy an Options contract of a single unit of the underlying asset, such as a single stock. Instead, there is a minimum number of units of option contract that you must buy.

For example, the lot size for Options on Tata Motors is 1,425, including both call and put Options. This means you have to buy at least 1,425 option contracts with one stock per contract. Therefore, at ₹12.05 per contract, the minimum investment required for this set of contracts becomes not ₹12.05 but ₹17,171.25.

Settlement of an Option

When an option reaches its expiry date, the option holder can exercise their option. If they exercise this option, then the settlement can either be a physical settlement or a cash settlement. All Options in India are settled by cash settlement, whereby you do not have to take delivery of the stock. The profit that you make is simply transferred to your account.

Options Greeks

These are a set of important ratios that help us understand the market for Options better. You can find out more about option greeks here.

American Options vs European Options

- American Options - These are Options that can be exercised at any time up to the expiration date. Select security Options available at NSE are American-style Options.

- European Options - These Options can be exercised only on the expiration date. All index Options traded at NSE are European Options.

How Do Options Work?

Let us revert to the previous example of a call option on Tata Motors stock at ₹665, expiring on October 26, 2023. If on October 26, the market price of the Tata Motors stock is ₹700, then the difference between the strike price and the market price, or spot price, is ₹35. You would probably want to exercise your option then. This is because you can exercise the call option and buy the stock at ₹665, despite the market price being ₹700. Then, you can sell the stock at ₹700 in the open market.

However, the price that you had already paid for each contract is ₹12.05. So the profit per contract for you, assuming you bought the call option, would be ₹22.95.

On the other hand, all other things remain the same, had this contract been a put option, then there would have been no point in you exercising that option. This is because having the right to sell the Tata Motors stock at ₹665 is not useful if you can sell the stock at ₹700 in the open market already.

How To Use Options in Trading?

There are two ways in which you can profit from Options trading:

- Holding Options till expiry - You can hold on to an option contract till the expiry day, and if the market price is favourable in the ways mentioned above, then you make a profit.

- Trading Options - Even before the expiry date, you can sell the option that you hold in the derivatives market. You may want to do so if the price of the contract in the market has increased since the time you bought it. For example, if you bought the option at ₹12.05 but on October 24, the price of the option has reached ₹15, then you can sell the option at ₹15 per contract and keep the difference as profit.

In order to make profits from option trading, you have to be able to predict the direction of the option and then deploy an option strategy accordingly. For example, if you expect the price of the underlying asset to go up, then a long call or a short put is useful. On the other hand, if the price is expected to go down, then a short call or a long put is preferable.

You can find out more about Options trading in this article.

However, it is not necessary that everyone enter into an Options contract for profit only. Sometimes, you may want to use an Options contract just to hedge your position. For example, assume you have the right to sell a stock that you bought at ₹100 at a strike price of ₹99 under the contract. Therefore, it ensures that your losses will not go above ₹1 per share.

There are a number of Options strategies, such as straddle, strangle, etc., that you can deploy by buying and selling multiple Options at once. You can find some of these strategies here. You can also use Options strategies to reduce risk in trading.

Understanding Options Pricing

To understand Options pricing, you must understand the concepts of intrinsic value and time value of Options.

The difference between the strike price, as mentioned in the option, and the actual market price of the underlying asset is known as the intrinsic value of the option. In the above example of a call option, if the market price is ₹700, then the intrinsic value of the call option at ₹665 strike price would be ₹35.

However, the actual option price is not the same as the intrinsic value. This is because of the time value of the option. The time value of the option affects the premium of the option based on the likelihood of the option becoming in-the-money. This is something that changes with time and is hence called the time value of the option.

You can read about intrinsic value and time value in greater detail here.

Advantages of Options Trading

- Low cost of entry - It allows the investor or trader to take a position with a small amount as compared to stock transactions. This phenomenon is called having high leverage. In contrast, if you are buying actual stocks, you have to shell out a large sum of money, which would be equal to the price of each stock multiplied by the number of stocks you buy.

- Hedging against risks - Buying Options is actually like buying insurance for your stock portfolio and minimising your exposure to risk. In many cases, the premium you end up paying is the maximum limit of your risk.

- Flexibility - Options give the investor the flexibility to trade for any potential movement in an underlying security. As long as the investor has a view regarding how the price of a security will move shortly, he can use an Options strategy.

Disadvantages of Options

- Lower liquidity - Not many people trade in the Options market hence, they are not easily available when needed. This could often mean buying at a higher rate and selling at a lower rate as compared to other more liquid investment Options.

- Risk - Depending on the type of option, an Options trader can stand to lose either just the premium or perhaps even an unlimited sum. Learn more about risks in Options trading here.

- Complicated - One needs to take a call on the price movement of a particular security and the time by which this price movement will occur. Getting both right can be tough.

As we have seen above, Options have both benefits and disadvantages, both of which should be considered before someone decides to trade in Options.

Conclusion

Options are one of the most useful tools in trading, which can give you some of the highest returns possible in the stock market, that too with very little initial investment. But study these instruments and understand the associated risks before venturing into trading them.

If you are new to the stock market, open a Demat account with Angel One today!