NSE has remained the world’s largest derivatives exchange for the third consecutive year.

Derivative products like futures and options in Indian stock markets have become important instruments of price discovery, portfolio diversification, speculation, price stabilization, offset risk, etc. Derivative trading is one of the chosen financial instruments among experienced traders. As the name suggests, derivatives derive their value from an underlying asset. Let us learn what assets are chosen as underlying assets for derivatives.

Before diving into underlying assets, let us learn what are derivatives.

What are Derivatives?

Financial contracts that derive their value from the underlying asset are known as derivatives. The value of derivatives is directly or indirectly influenced by the price of the underlying asset. Derivatives are usually traded by predicting the underlying asset’s future price movement.

What is an underlying asset?

An underlying asset is defined as the asset on which the financial instruments such as derivatives are based. These assets give derivatives their value. The underlying assets can be stocks, market indices, currencies, commodities, etc.

For example, an option on stock ‘X’ gives the holder the right to buy or sell ‘X’ at the strike price up until expiration. The underlying asset for the option is the stock of ‘X’.

An underlying asset is an item within the agreement that provides value to the contract. The underlying asset supports the derivatives contract to which the parties involved agree.

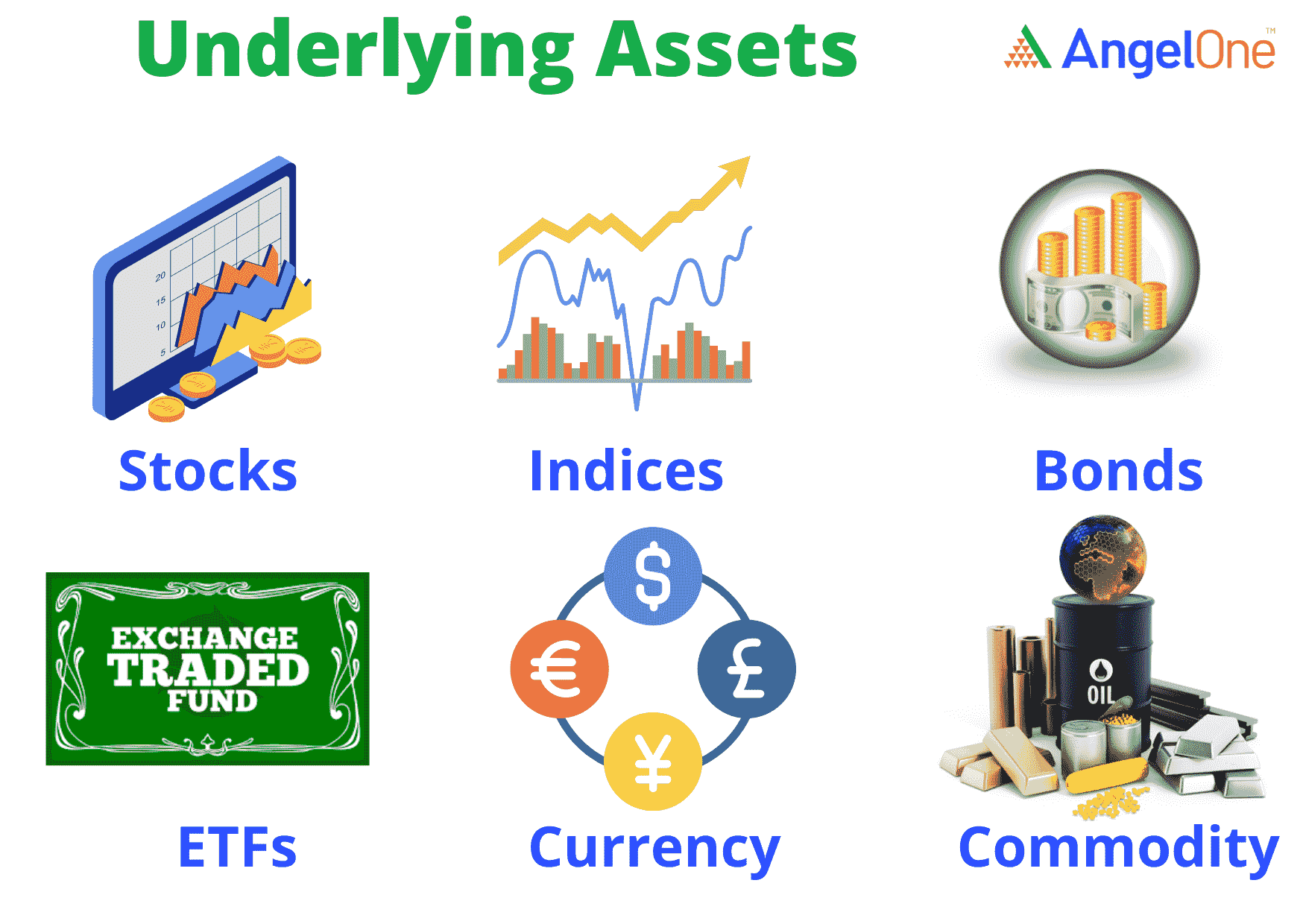

Types of underlying assets

There are different types, or classes, of underlying assets, and they come with unique characteristics that, in turn, affect the nature and structure of the derivatives associated with each type of underlying asset.

1. Stocks

In the capital market, one of the most widely used underlying assets is stocks. Since stocks are so widely traded in the financial markets, it gives derivative investors more options to speculate and hedge. Exchanges have laid down criteria for stocks to be used as underlying assets in F&O trading.

2. Stock Market Indices

A stock market index is the statistical measure of the performance of the market, reflecting the ups and downs in it. It indicates the overall sentiment of the market. A derivative contract can have market indices as an underlying asset. Index futures and index options are the derivative instruments that have market indices as the underlying asset.

3. Bonds and other debt instruments

Bonds of different types and other debt securities that attract an interest rate are also used as underlying assets in derivatives such as Interest rate futures.

4. Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) are a basket of securities that tracks an underlying index and are traded on stock exchanges.ETF futures and options are derivative products built on existing exchange-traded funds (Derivatives on ETF are still not available in India). Derivatives in the ETF market operate the same as an individual equity option or futures contract.

5. Currencies

Currency is a medium of exchange for goods and services. It is a generally accepted form of payment, usually issued by a government and circulated within its jurisdiction. Currency is used as an underlying asset in currency derivatives like currency options, currency futures, currency swaps, etc.

In India, the three stock exchanges BSE, NSE, and Metropolitan Stock Exchange of India have segments for currency derivatives.

6. Commodities

Commodity is defined as a tangible good that can be bought and sold or exchanged for products of similar value. Much like equity derivatives, commodity derivatives are traded having commodities as underlying assets in exchanges like MCX, NCDEX, etc.

Commodities are again divided into soft commodities and hard commodities. Hard commodities include crude oil, metals, etc., and other energy and mining raw materials while soft commodities generally have a shelf life and include agricultural commodities like wheat, soybean, corn, cotton, etc. Click here to know the commodities that are used as underlying assets in the Commodity derivatives market. Don’t miss out on these key details if you are trading in commodities

Underlying Assets are basic building blocks for derivatives contracts. It could be highly speculative in nature and trading against those assets require a comprehensive knowledge of trading, leverage, hedging, and speculation. Derivative trading requires a skill-set and strategies that are different from normal equity trading.

Remember that derivative trading is strongly influenced by the prices of the underlying assets and various risks that affect them. Now that you have learned about the types of underlying assets in derivatives trading, click here to know the types of derivatives in India.

Disclaimer: This blog is exclusively for educational purposes.