Futures are widely used in various markets to hedge against price volatility, and by speculators who want to take advantage of price movements. A futures contract gives a buyer or seller the right to buy or sell a particular asset at a specific future price.

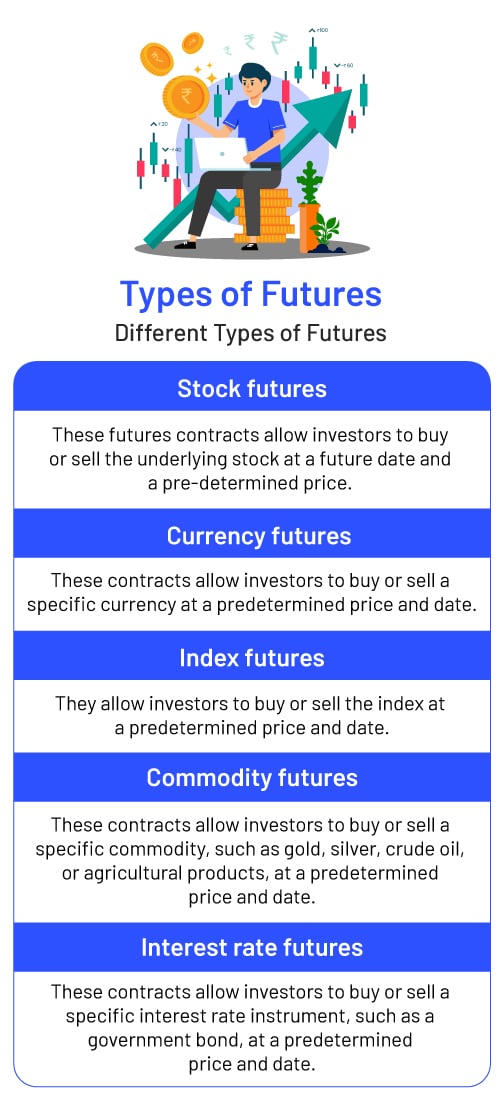

There are many types of futures, in both the financial and commodity segments. Some of the types of financial futures include stock, index, currency and interest futures. There are also futures for various commodities, like agricultural products, gold, oil, cotton, oilseed, and so on.

Let’s look at different types of futures.

Stock Futures

Index futures first appeared in India in the year 2000. These were followed by individual stock futures a couple of years later. There are several advantages of trading in stock futures. The biggest one is leverage. Before trading in stock futures, you need to deposit an initial margin with the broker. If the initial margin is, say, 10 per cent, you can trade in Rs 50 lakh worth of futures by paying just Rs 5 lakh to the broker. The larger the volume of transactions, the higher your profit. But the risks are also more significant. You can trade stock futures on stock exchanges like the BSE and NSE. However, they are available only for a specified list of stocks.

Index Futures

Index futures can be used to speculate on the movements of indices, like the Sensex or Nifty, in the future. Let’s say you buy BSE Sensex futures at Rs 40,000 with an expiry date of the month. If the Sensex rises to 45,000, you stand to make a profit of Rs 5,000. If it goes down to Rs 30,000, your losses, in that case, would be Rs 5,000. Index futures are used by portfolio managers to hedge their equity positions should share prices fall. Some of the index futures in India include Sensex, Nifty 50, Nifty Bank, Nifty IT etc.

Currency Futures

One of the different types of financial futures is currency futures. This futures contract allows you to buy or sell a currency at a specific rate vis-à-vis another currency (Euro vs USD, etc.) at a predetermined date in the future. These are used by those who want to hedge risks, and by speculators. For example, an importer in India may purchase USD futures to guard against any appreciation in the currency against the rupee.

Commodity Futures

Commodity futures allow hedging against price changes in the future of various commodities, including agricultural products, gold, silver, petroleum etc. Speculators also use them to bet on price movements. Currency markets are highly volatile and are generally the domain of large institutional players, including private companies and governments. Since initial margins are low in commodities, players in commodity futures can take significant positions. Of course, the profit potential is enormous, but the risks tend to be high. In India, these futures are traded on commodity exchanges like the Multi Commodity Exchange (MCX) and the National Commodity and Derivatives Exchange.

Interest rate futures

An interest rate future is one of the different types of futures. It’s a contract to buy or sell a debt instrument at a specified price on a predetermined date. The underlying assets are government bonds or treasury bills. You can trade these on the NSE and the BSE.

Types of Futures Traders

There are two main types of futures traders: hedgers and speculators.

- Hedgers

Hedgers are typically commodity producers, such as farmers or mining companies, who use futures contracts to shield themselves from potential price fluctuations in the market. For instance, consider a cocoa grower who fears that the price of cocoa may decrease by the time of harvest. To mitigate this risk, the grower can sell a futures contract at the current market price. By doing so, he locks in a selling price for his cocoa ahead of time. When harvest time arrives and if the market price has indeed dropped, he can purchase cocoa at the lower price to fulfil his contract. This strategy allows the grower to effectively sell his cocoa at a higher price while buying it back at a lower cost, benefiting from the price difference. Other examples of hedgers include pension funds, insurance companies, and banks, all of which use futures contracts to manage their exposure to market risks.

- Speculators

Speculators are primarily individual investors and independent floor traders who engage in futures trading with the main goal of making a profit. Unlike hedgers, speculators are not concerned with the underlying commodity; instead, they aim to capitalise on price movements. They buy futures contracts they believe will increase in value and sell those they anticipate will decline. By predicting market trends and acting on their insights, speculators seek to earn profits from the price discrepancies in the futures market. This group plays a crucial role in providing liquidity to the market, as their activities can influence price movements and market dynamics.