A tension-free retirement life is everyone’s goal. A sizable retirement corpus can be created if you carefully invest in a secure scheme in your working years. One of India’s popular retirement investment options is National Pension Scheme (NPS). Here, we are to explain everything you need to know about NPS. Read along to know if NPS can serve the needs of your retirement plan.

What is NPS?

NPS (National Pension System) is a defined contribution based pension scheme launched by the Government of India with the following objectives:

- To provide old age income

- Reasonable market-based returns over the long run

- Extend old age security coverage to all citizens

- Tax benefits

It is based on a unique Permanent Retirement Account Number (PRAN) which is allotted to each subscriber upon joining NPS.

Introduced in 2004, NPS was previously available only for the Central Government employees. However, it was made available for all Indian citizens in 2009. The scheme is regulated by the Pension Fund Regulatory and Development Authority (PFRDA).

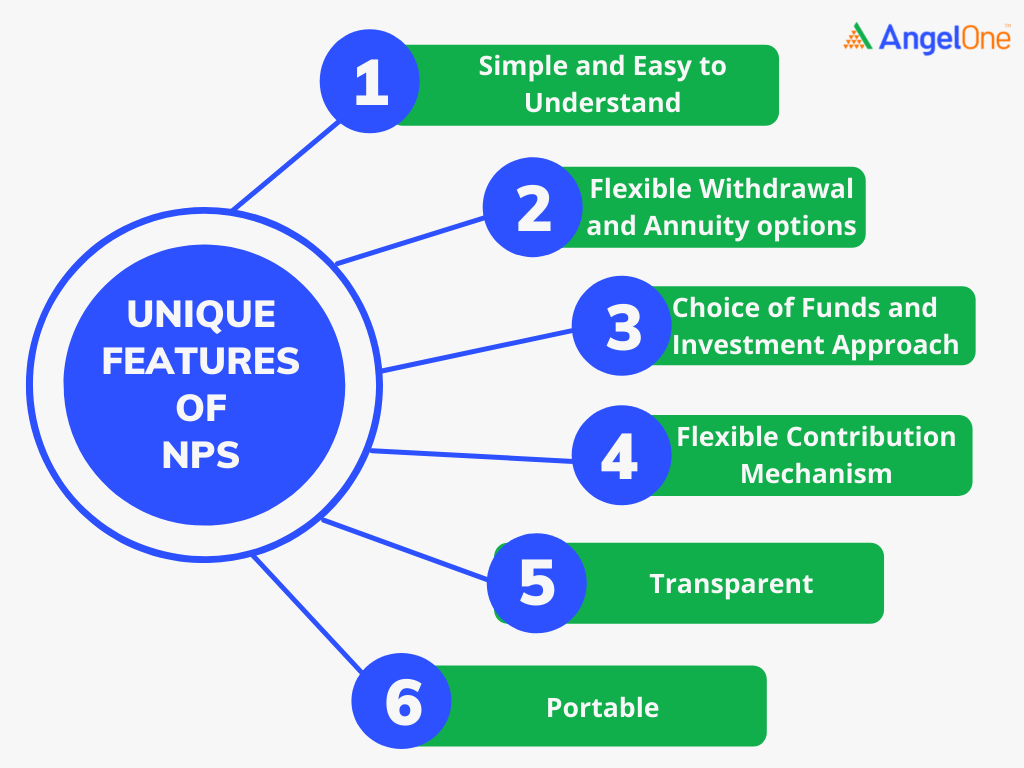

Unique Features of NPS

1. Liquidity and Flexibility with Two Account Types

The National Pension System (NPS) provides individuals with the opportunity to make systematic investments through two distinct types of accounts, offering both liquidity and flexibility. Upon opening an NPS account, subscribers are assigned a unique Permanent Retirement Account Number (PRAN), which is used to manage their contributions and oversee fund management within the scheme.

Tier I Account: The Tier I account functions as a pension account with specific withdrawal restrictions. Individuals can open this account with a minimum deposit of Rs. 500. This account is designed to ensure long-term savings for retirement, with limited liquidity to encourage disciplined investment.

Tier II Account: The Tier II account offers greater liquidity, allowing for investments and withdrawals at the subscriber's discretion. However, a Tier II account can only be opened if the subscriber already has an active Tier I account. The minimum deposit required for a Tier II account is Rs. 250.

NPS accounts can be opened through intermediaries appointed by the Pension Fund Regulatory and Development Authority (PFRDA), which include trustee banks, custodians, Central Recordkeeping Agency (CRA), points of presence (PoP), and annuity service providers.

2. Flexible Investment Options

NPS offers flexibility in investment through two main options:

- Auto Choice: This default option automatically manages fund investments based on the subscriber's age. As the individual ages, the fund manager adjusts the investment mix to reduce risk exposure.

- Active Choice: In this option, subscribers can choose their preferred asset classes and allocate funds accordingly. There is a cap of 50% for investments in Asset Class E (Equities). Other asset classes include Asset Class C (Corporate Debt Securities) and Asset Class G (Government Securities).

Subscribers have the flexibility to switch between these investment options and change their fund manager, although such changes are subject to certain constraints.

3. Partial Withdrawal Facility

One of the significant benefits of the NPS is the option for partial withdrawal. Subscribers can withdraw up to 25% of their contributions in the Tier I account to address financial needs before retirement, particularly during emergencies.

However, partial withdrawals are subject to the following conditions:

- Subscribers must have contributed to the scheme for a minimum of 10 years.

- There must be a minimum gap of 5 years between consecutive withdrawals.

These features make the National Pension Scheme a versatile and flexible retirement planning tool, providing both long-term security and short-term liquidity options to meet varying financial needs.

Who Can Join NPS?

An individual's eligibility for the National Pension System (NPS) varies based on the different NPS models available. These models are designed to cater to various sectors, including government employees, corporate employees, and all citizens of India.

Government Sector National Pension System Model

The Government Sector NPS model is tailored for employees of the central and state governments, excluding those in the armed forces. Under this scheme, a government employee contributes 10% of their salary to the National Pension System, matched by an equal contribution from the government. Notably, central government employees receive a higher government contribution of 14%.

All states in India have adopted the NPS, with the exception of the Government of West Bengal. This model ensures that government employees have a structured and supported path towards building their retirement savings.

Corporate Model of the National Pension System

The Corporate Model allows corporate employees to benefit from the NPS through their employers. To be eligible, individuals must be Indian citizens between the ages of 18 and 60 and meet the Know Your Customer (KYC) requirements. This model is applicable to various entities, including:

- Companies registered under the Companies Act.

- Entities registered under different Co-Operative Acts.

- Central or Public Sector Enterprises.

- Proprietary concerns.

- Partnership firms or Limited Liability Partnerships (LLPs).

- Organizations incorporated by order from a State or Central Government.

- Societies or trusts.

This model provides a structured retirement savings plan for employees of these entities, enhancing their financial security in retirement.

All Citizens Model of NPS

The All Citizens Model of NPS is open to all Indian citizens who meet specific eligibility criteria. Individuals can voluntarily enroll and contribute to the NPS for their retirement savings. The eligibility requirements are as follows:

- The individual must be between 18 and 60 years old on the date of application with a Point of Presence (PoP) service provider.

- The individual must fulfill the KYC requirements as specified in the Subscriber Registration Form and submit all necessary documents.

This model offers a flexible and inclusive option for all Indian citizens to plan for their retirement, ensuring broad accessibility to the benefits of the NPS.

Types of accounts in NPS

There are 2 types of NPS accounts:

- Tier-1 account

- Tier-2 account

| Category | Tier-1 account | Tier-2 account |

| Subscription | Mandatory | Voluntary |

| Initial contribution | ₹ 500 | ₹ 1000 |

| Minimum contribution/year | ₹ 1000 | ₹ 250 |

| Maximum contribution | No limit | No limit |

| Withdrawal | Restricted | Allowed |

| Tax Benefits | Available | Unavailable |

Investment Options in NPS

NPS offers you the flexibility to select the investment strategy, professionally managed Pension Fund Managers as per your choice. You need to choose one among the eight Pension Fund Managers and your choice of investment ( Auto or Active) under four asset classes:

- Equities

- Corporate Bonds

- Government Securities

- Alternative Investment Funds

Click here to learn more about the PFMs and the type of investment choices available with NPS.

Tax Benefits under NPS

Tax Benefit available to Individuals:

Any individual who is a subscriber of NPS can claim tax benefit under Sec 80 CCD (1) within the overall ceiling of ₹1.5 lakh under Sec 80 CCE.

Exclusive Tax Benefit to all NPS Subscribers u/s 80CCD (1B)

An additional deduction for investment up to ₹ 50,000 in NPS (Tier I account) is available exclusively to NPS subscribers under subsection 80CCD (1B). This is over and above the deduction of ₹1.5 lakh available under section 80C of the Income Tax Act, 1961.

Exit from NPS

One can exit from the NPS scheme after 10 years of account opening or on the attainment of retirement age

Pre-mature Exit:

- Exit before attaining the age of retirement/60 years of age

- Up to 20% of the corpus can be withdrawn in lumpsum

- Balance 80% amount to be invested in annuity

- If corpus < ₹ 2.5 lakh, one can withdraw the entire corpus

Exit on retirement

- Exit when a subscriber retires/attains 60 years of age

- Up to 60% of the corpus can be withdrawn in lumpsum

- Balance 40% amount to be invested in annuity.

- If corpus < ₹ 5 lakh, one can withdraw the entire corpus

- Upon exit at the retirement age i.e.60 years, subscriber can avail of either of the following flexibilities:

- Continuation of NPS account:

Subscriber can continue to contribute to NPS account beyond the age of 60 years/superannuation (up to 70 years). This contribution beyond 60 is also eligible for exclusive tax benefits under NPS. - Deferment (Annuity as well as Lump sum amount):

Subscriber can defer Withdrawal and stay invested in NPS up to 70 years of age. Subscribers can opt for any of the following:

- defer only lump-sum withdrawal

- defer only annuity

- defer both lump-sum as well as annuity

- Start your Pension:

If a subscriber does not wish to continue/defer the NPS account, he/she can exit from NPS.

Note: Upon the death of the subscriber, the entire accumulated pension corpus (100%) would be paid to the nominee/legal heir of the subscriber.

Partial withdrawal from NPS

The following conditions have to be fulfilled for premature withdrawal from NPS

- Subscriber should be in NPS at least for 3 years

- Withdrawal amount will not exceed 25% of the contributions made by the subscriber

- Withdrawal can happen a maximum of 3 times during the entire tenure of the subscription.

- Withdrawal is allowed only for the specified reasons, for example;

- Higher education of children

- Marriage of children

- For the purchase/construction of a residential house (in specified conditions)

- For treatment of critical illnesses, etc.

NPS SIP and same-day NAV

One of the standalone features of NPS that makes it attractive when compared to other retirement products are

- Same day NAV

- SIP like in mutual funds.

With the D-Remit facility, you can activate SIP in NPS and also get the same-day NAV for your investment.

Charges in NPS

The applicable transaction and service charges in NPS are minimal compared to other funds.

Following are the maximum management fees permissible for different slabs of Assets Under Management (AUM) by Pension Fund Managers

| Slabs of AUM managed by the Pension Fund ( in crores) | Maximum Investment Management Fee (IMF) |

| Up to ₹10,000 | 0.09% |

| ₹10,001 – ₹50,000 | 0.06% |

| ₹50,001 – ₹1,50,000 | 0.05% |

| ₹1,50,000 and above | 0.03% |

With less than 0.1% management fees, NPS is the lowest cost managed fund compared to the asset management companies that charge an expense ratio ranging from 0.50% to 1.50% for Mutual Funds.

NPS is indeed a long-term investment product, designed to keep pension in mind after retirement. However, as a product, it has evolved in recent times and addressed almost every aspect of our investment, whether it is for retirement, tax saving, short-term goals, etc. Now that you are aware of how NPS works, if you find it a suitable retirement plan for you, you can learn how to apply for NPS with Angel One.

Disclaimer: This blog is exclusively for educational purposes.