Are you looking for a retirement investment option that comes with the flexibility to choose the investment option and asset class? If yes then National Pension Scheme(NPS) is your go-to option. The long-term retirement investment option has been devised to suit the needs of the new age by introducing the elements of flexibility to choose among the asset class, investment options, professional management and many more. In this article, we will explain what are the type of schemes available with NPS, who are the fund managers and what are the asset classes available to invest in.

What are the asset classes available in NPS?

Let us know about the 4 asset classes with NPS in which you can channel your investment on subscription.

| Asset Class | Particulars | Maximum Allocation |

| Asset Class-E | Equity and related instruments | Upto 75% |

| Asset Class-C | Corporate debt and related instruments | Upto 100% |

| Asset Class- G | Government Bonds and related instruments | Upto 100% |

| Asset Class-A | Alternative Investment Funds including instruments like MBS, REITS, InvlTs, etc | Upto 5% |

Who are Pension Fund Managers(PFM) in NPS?

Pension Fund Managers (PFM) manage the pension fund. Moreover, they are responsible for investing the collected funds into asset classes as per the investment objective and guidelines of authority and investment Policy. The fund managers also perform a periodic review to ensure the underlying assets are performing well. Currently, NPS has 8 PFMs and a subscriber is mandatorily required to choose one from the available PFMs.

1. Birla Sunlife Pension Management Limited

2. HDFC Pension Management Company Limited

3. ICICI Prudential Pension Funds Management Company Limited

4. Kotak Mahindra Pension Fund Limited

5. LIC Pension Fund Limited

6. Reliance Capital Pension Fund Limited

7. SBI Pension Funds Private Limited

8. UTI Retirement Solutions Limited

What are the choices of investment in NPS?

Based on your risk appetite, financial knowledge and monetary goals, you can choose the percentage you want to allocate and invest in the four asset classes through any of the following 2 investment choices available:

- Active Choice: Individual Fund

- Auto choice: Lifecycle Fund

Active Choice

In this choice of investment, the decision of how much contribution should go to any/each of the asset classes remains with the subscriber of NPS. The subscriber has to provide the PFM, asset class as well as percentage allocation to be done.

You can select multiple asset classes under a single PFM as mentioned below:

- Up to 50 years of age, the maximum permitted equity investment is 75% of the total asset allocation after which the exposure to equity asset class will be reduced by 2.5% each passing year with 50% permitted for 60 years and above.

- You are free to invest up to 100% in asset classes C and G. In asset class A, maximum investment can be up to 5%.

- The total allocation across E, C, G and A asset classes must be equal to 100%.

Auto Choice

For those subscribers who do not have the requisite knowledge to manage funds in NPS and get risk aversive as they grow older, can opt for Auto Choice. In this option, the investments will be made in a life-cycle fund and the proportion of funds invested across three asset classes will be determined by a pre-defined portfolio.

Depending on the risk appetite of the subscriber, the following 3 options of LifeCycle funds are available within Auto choice:

- Aggressive

- Moderate

- Conservative

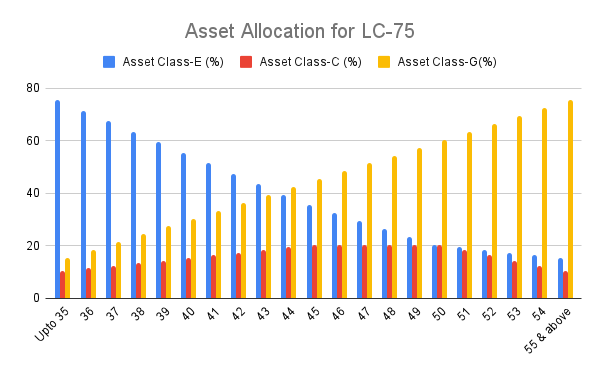

1. LC-75 or Aggressive Lifecycle Fund: This fund provides a cap of 75% of the total assets for equity investment. The exposure in equity investments starts at 75% up to 35 years of age and gradually reduces as per the age of the subscriber as shown in the graph below:

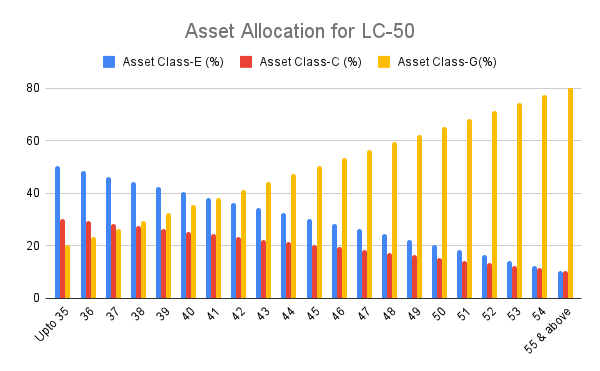

2. LC50 - Moderate Life Cycle Fund: This fund provides a cap of 50% of the total assets on the equity investment. The exposure in equity Investments starts at 50% up to 35 years of age and gradually reduces as per the age of the subscriber as shown in the graph below.

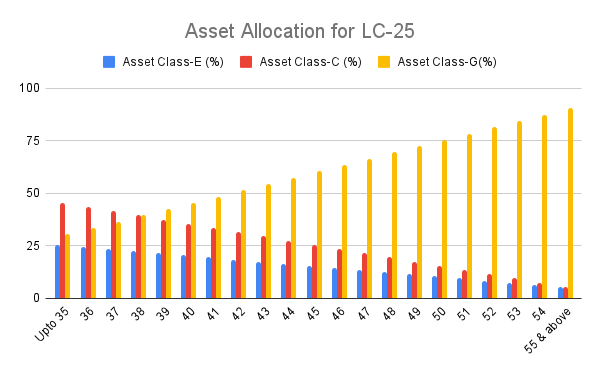

3.LC25 - Conservative Life Cycle Fund: This fund provides a cap of 25% of the total assets on the equity investment. The exposure in equity Investments starts at 25% up to 35 years of age and gradually reduces as per the age of the subscriber as shown in the table below

NPS also provides the flexibility of

- Having different investment choices (Auto / Active) for Tier I and Tier II NPS account

- Changing the asset mix and investment choice twice in a financial year for both Tier I and Tier II NPS Accounts

- Changing the Pension Fund Manager once in a financial year.

NPS has well-suited investment options for various risk appetites and also provides the flexibility to create an investment option that suits one’s risk appetite. Along with features like transparency, tax benefits, partial withdrawal options, minimal charges, etc. NPS makes a robust choice covering most of the needs of an investor looking for the right retirement plan.

Now that you are aware of all the investment options available with NPS and the flexibilities it provides you in managing your investment, if you are thinking of investing in NPS, click here to know how to apply for NPS online with Angel One.

Disclaimer: This blog is exclusively for educational purposes.