The Permanent Account Number (PAN) card is a crucial identification document for individuals earning taxable income in India (both residents and non-residents) and entities in India. It serves as a unique identification number that helps track financial transactions, file taxes, and comply with various legal and financial requirements. The PAN card also serves as important ID proof for a lifetime and is not affected by the address change of the cardholder. Getting a PAN card in India is easy if you have all the required documents. In this article, learn how to apply for a PAN card online and offline and also know about the documents required, fees and charges involved.

How To Apply for a PAN Card Online?

You can apply for a PAN card online in two ways - through the NSDL website or the UTIITSL website.

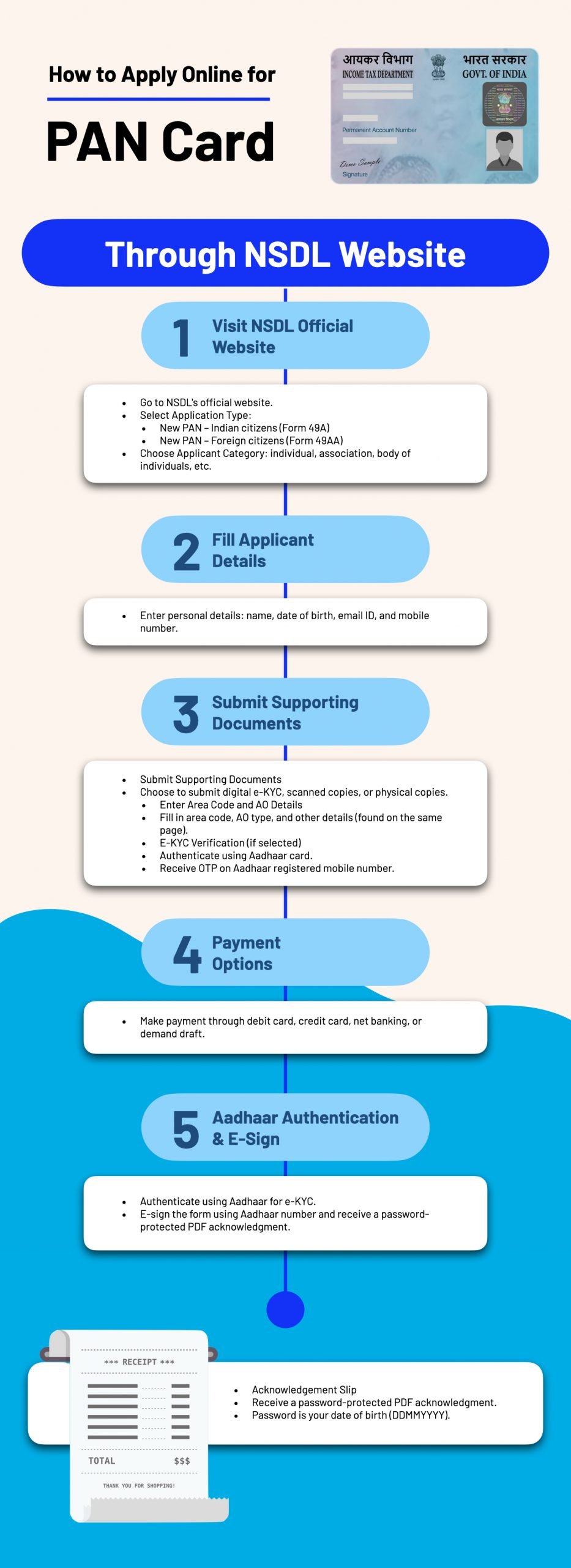

Steps to apply for a PAN card online through the NSDL website

- Visit the official website of NSDL.

- Select the type of application – New PAN - Indian citizens (Form 49A) or foreign citizens (Form 49AA).

- Select the category – individual/association/body of individuals, etc.

- Fill out the applicant’s details like name, date of birth, email ID, and mobile number.

- Read and click on the checkbox on the screen and then submit the form.

- Now click on ‘Continue with PAN Application Form’.

- On the next page, you will be given options to submit the supporting documents. You can choose to submit your digital e-KYC or submit scanned copies, or mail copies physically.

- Now enter the area code, AO (Assisting Officer) type, and other details. You can find these details in the below tab on the same page.

- On selecting e-KYC, you can use your Aadhaar card for verification. An OTP will be sent to your mobile number registered on the Aadhar card.

- You can select the Aadhaar card as the identity proof for date of birth and address.

- Click on ‘Proceed’.

- You can make the mentioned payment through one of the given options, debit card, credit card, net banking or demand draft.

- To authenticate using an Aadhaar card, click on the ‘Authenticate’ option.

- On clicking on ‘Continue with e-KYC’, you will get an OTP on the Aadhaar card registered mobile number.

- Enter the OTP to submit the form.

- Once this is done, you need to e-sign the form. Click on ‘Continue with e-sign’ and enter your Aadhaar card number. Again an OTP will be sent. Enter the OTP.

- You will get an acknowledgement slip as a PDF document. The document is password protected and your date of birth is the password. The format is DDMMYYYY.

Steps to apply for a PAN card online through the UTIITSL website

- Open the UTIITSL website and select PAN Services.

- A new page will open. Select ‘PAN CARD for Indian Citizen/NRI’.

(https://www.pan.utiitsl.com/panonline_ipg/forms/pan.html/preForm) - Choose ‘Apply for a New PAN Card (Form 49A)’

- Here you can choose ‘Digital Mode’ or ‘Physical Mode’ at your convenience. On choosing ‘Physical Mode’, you need to submit your duly filled and signed printed application form at the nearest UTIITSL office. In “Digital Mode’ your application form can be signed through an Aadhaar-based e-signature and is submitted online.

- Now fill in the important details like the name of the applicant, mobile number, etc.

- Verify the entered details and click on submit.

- Make the payment online through a debit card, credit card or net banking.

- You can download the payment confirmation receipt and save it for future reference.

- Take a printout of the filled form along with the payment receipt. Affix two passport-sized photographs. Sign across the space provided for your signature.

- Attach all the mandatory documents required as proofs, i.e., identity and address proofs.

- You can submit all these documents (online filled application form printout, payment receipt, address proof, date of birth proof) at the nearest UTIITSL office or send them a courier within 15 days of submitting the online form.

You May Also Be Interested to Know PAN Card Verification

How To Apply for PAN Card Offline?

- Download the Form 49A available on the Income Tax or UTIITSL official website. Take a printout of the form.

- Fill out the form with the right details and attach two passport-size photographs to it.

- You can submit the application fee as a DD (Demand Draft) in favour of ‘NSDL – PAN’ payable at MUMBAI’UTITSL.

- Attach your address, and date of birth proofs and self-attest them.

- Send the application to the address provided on the NSDL official website.

List of Documents To Submit for PAN Card

To apply for a new PAN card you need to submit an identity proof with address and date of birth proof. Here is the list of documents that can be submitted.

- Aadhaar Card

- Voter ID

- Passport

- Driving licence

- Photo ID card

- Ration Card

- Birth certificate

- Arm’s licence, Pensioner’s Card, Central government health scheme card

- Certificate of Identity signed by the gazetted officer, Municipal Council, Member of Parliament, or Member of Legislative Assembly.

Also Know How to Check PAN Card Status?

Fees Charged for a PAN Card

- For an Indian communication address, it is Rs. 93 excluding the GST.

- For foreign communication addresses, it is Rs. 864 excluding the GST.

Conclusion

A PAN card serves as important identity proof and while getting it make sure that all the details entered in the form are correct.