PAN Card - Meaning

In India, all taxpayers are allotted a 10-digit identification number, or PAN number. The PAN card is an essential official document issued by the Income Tax Department. PAN stands for Permanent Account Number. It has an alphanumeric structure, meaning it combines alphabets and numbers.

The PAN number is used for storing and tracking information on one’s tax-paying history and can be shared across different platforms. Hence, each taxpayer is allotted a unique PAN number, and all tax-related information and personal details of the taxpayer get stored against it.

The PAN card contains your full name, date of birth, signature, and the PAN card number. It also contains your photo and can be used for photo identification.

In this article, we discuss PAN card meaning, eligibility, and benefits to understand why you must obtain a PAN card.

History of PAN Card in India

The government introduced the PAN card in 1972 under Section 139A of the Income Tax Act of 1961 as a part of the Taxation Act (Amendment). Before PAN, taxpayers were allotted GIR numbers. But it was not a centralised system and was prone to miscalculations and mistakes. Initially, PAN was optional, and it wasn’t made mandatory until 1976.

Initially, the National Securities Depository Ltd. (NSDL) and the Unit Trust of India (UTI) could both process PAN cards. But in 2003, the responsibility was shifted to NSDL.

Over the years, PAN has become essential for individuals and businesses to conduct a wide range of financial transactions. To make the process of obtaining PAN cards simple, the government has introduced both online and offline methods.

PAN Number Format

The PAN is necessary for conducting a variety of financial transactions, such as opening bank accounts, buying or selling immovable property, and applying for a credit card or loan. Moreover, it is a unique identification proof and helps with tax compliance. The IT Department uses a PAN number to track your activities, which stores all information about a taxpayer. Hence, you must understand the format of a PAN card.

Your PAN card contains the following information.

- Full name of the cardholder

- Cardholder’s father’s name

- PAN card number: It’s a 10-digit number containing alphabets and numbers

- Signature of the cardholder: The PAN card serves as a verification for the cardholder’s signature, which is essential for financial transactions

- Photograph of the cardholder: Individual PAN cards also serve as visual verification. However, PANs issued to corporations and firms don’t contain photographs

- Date of birth

- Hologram of the Government of India and the tag of the Income Tax Department

Decoding the PAN Card Number

As mentioned earlier, a PAN card has an alphanumeric structure that is unique to the taxpayer. The PAN card number contains details that help the concerned authorities track your financial activities.

- The PAN card contains 10 digits, of which the first three are alphabets.

- The fourth letter confirms the taxpayer’s category

- The fifth letter denotes the taxpayer’s surname

- The remaining numbers and the letter are chosen at random

Here is a list of taxpayers’ categories.

- A – Association of Persons

- B – Body of Individuals

- C – Company

- F – Firms

- G – Government

- H – Hindu Undivided Family

- L – Local Authority

- J – Artificial Judicial Person

- P – Individual

- T – Association of Persons for a Trust

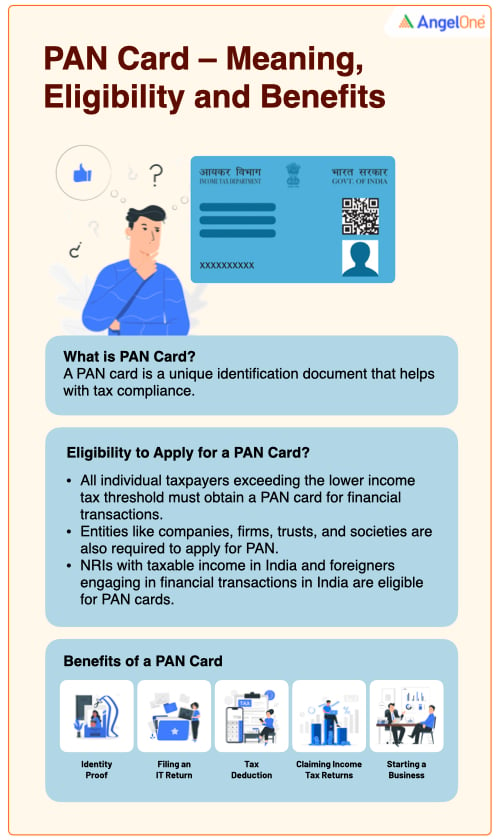

Who Can Apply for a PAN Card?

PAN is available to all types of taxpayers. Following is a list of entities that are issued PAN cards.

- All individual taxpayers whose income exceeds the lower income tax threshold are eligible for a PAN card. It is mandatory for conducting financial transactions.

- Individuals with a profession or business that generates an income of Rs 5 lakh and above

- Individuals who are registered under the state’s sales tax laws or the Central Sales Tax Act

- Individuals responsible for paying excise taxes

- Individuals who issue invoices as per Rule 57AE

- Individuals eligible to claim tax returns after the TDS is deducted from their income

- Hindu Undivided Families (HUFs)

- Entities engaged in imports and exports

- Companies registered under the Company Act

- Firms and Partnerships

- Trusts that are eligible to pay tax

- Societies

- NRIs with an income that is taxable in India

- Foreigners who plan to conduct financial transactions in India can also apply for PAN cards.

Read About How to Apply PAN Card Online?

Why Is PAN Card Important?

Here is a list of reasons why you must get a PAN card.

Banking: Banking is a sector where a PAN card is regarded as very important. A PAN card is an essential document necessary for banking operations, from account opening to other banking activities. A PAN is now required for tracking financial transactions and preventing fraud and money laundering activities. A deposit of more than Rs 50,000 daily requires PAN submission. Booking a fixed deposit of Rs 50,000 or more also requires PAN card submission.

Debit/credit card: You must submit a copy of your PAN card while applying for a debit or credit card.

Loan application: A PAN is necessary to complete a loan application.

Buying or selling property: If the property value exceeds Rs 5 lakh, the PAN card details of both the buyer and seller are mandatory. It is necessary for all types of property transactions, buying and selling.

Jewellery purchase: For a transaction value of more than Rs 5 lakh, a PAN card is required for buying jewellery.

Post office deposit: Post office deposits of more than Rs 50,000 require submitting a PAN card.

Purchasing a vehicle: Except for buying two-wheelers, PAN card information is required for buying and selling vehicles.

Demat account opening: To invest in the stock market, bonds, debentures, or mutual funds, investors need to open a Demat account. A PAN card is mandatory for a Demat account opening.

Insurance premium: If insurance premium payment exceeds Rs 50,000 in a fiscal year, PAN card submission is necessary.

Foreign currency exchange: A PAN card is required for foreign currency transactions.

Employment: Most employers will require a PAN card for salary accounting and tax processing.

Benefits of PAN Card

The PAN card offers the following benefits.

Identity proof: The PAN card is a unique identification document. It contains the signature of the cardholder, which facilitates signature verification during financial transactions.

Filing an IT return: Individuals and entities need PAN cards for Income Tax filing.

Tax deduction: PAN card helps in meeting tax compliance.

Claiming income tax returns: Sometimes taxpayers have more TDS deducted from their source of income than the eligible limit. A PAN card is mandatory to file an ITR and claim a tax refund.

Starting a business: To start a business, a company or business mandatorily needs a PAN card.

Final Words

A PAN card is a valuable document. Hence, every eligible person must obtain a PAN card to comply with the Income Tax regulations of the country. Failing to provide a PAN card may restrict your financial activities and lead to inquiries from the IT Department. Knowing its meaning and benefits, you can use your PAN card smartly.