Investing in the share market can be risky even for individuals with an abundance of capital and experience While some investors choose to purchase stock outright, those who find themselves more financially strained may resort to a number of investment strategies to reduce their exposure to risk. One of these measures is the purchase and sale of options.

Options are financial contracts that provide parties with a right, but not a commitment, to either buy or sell securities (stocks, bonds, commodities etc.) at a particular price and within a specified period of time. They derive their value from that of the security involved, referred to as an underlying asset, and traders essentially place bets on whether this asset’s value will appreciate or depreciate. There are majorly two types of options that traders deal in

- Call Options - This type of contract gives the trader to buy units of a security at a certain price within a specified time period.

- Put Options - These options allow traders to sell units of a security at a predetermined price, within a designated duration of time.

This article will primarily focus on Call Options.

Call options allow investors to gain decent exposure to a security for a limited time period and with low risks. However, they can also lead to a complete loss of premium if the option expires without the security reaching the strike price. Some traders may adopt more complex approaches with respect to purchasing call options, in order to ascertain the potential value of an investment while minimizing risks and losses.

This is done by simultaneously buying and selling call options on the same security, with identical expiration dates but varying strike prices. This approach is referred to as a vertical call spread and it can be categorized into two classes based on the relative values of the strike prices involved :

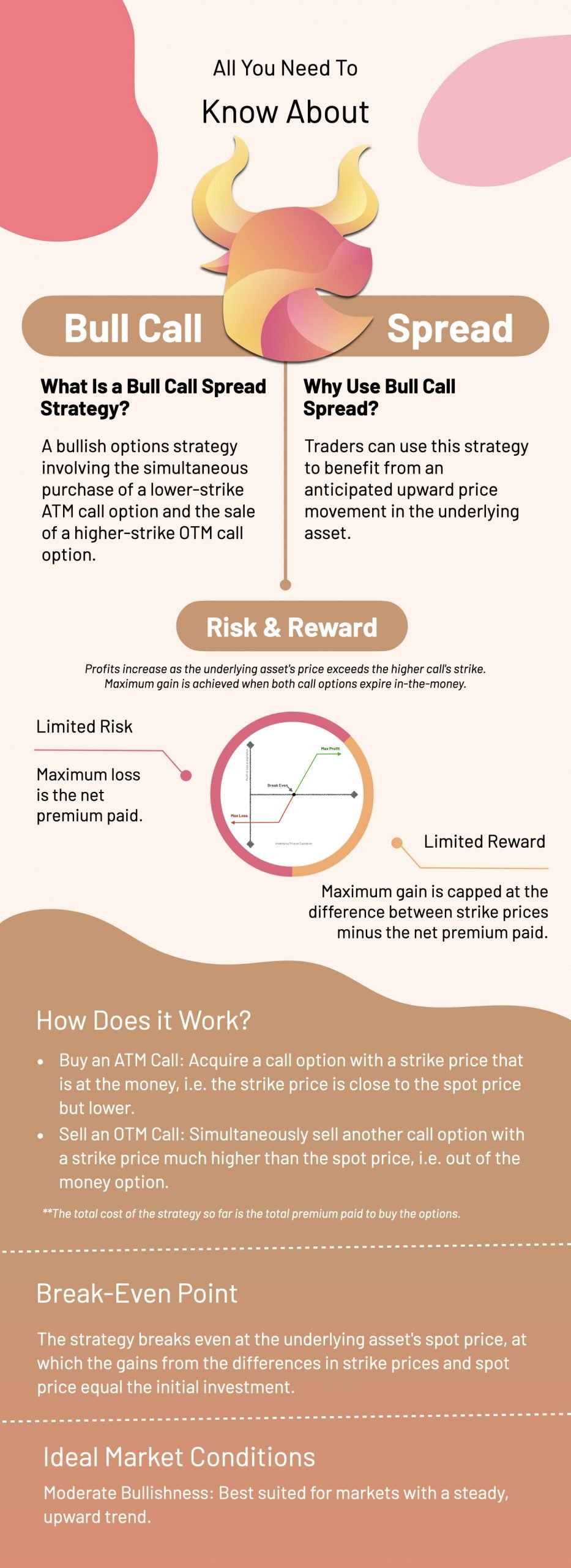

- Bull Call Spread : A trader purchases call options on a security at a particular strike price, while simultaneously selling the same number of options with an identical expiration date at a higher strike price.

- Bear Call Spread : A trader purchases call options on a security at a particular strike price, while simultaneously selling the same number of options with an identical expiration date at a lower strike price.

Bull Call Spread

Let us take a closer look at Bull Call Spread. When defining what a bull call spread is, its core identifying tenets are that the premiums on the purchased options are generally higher than that of the ones sold and they always require some upfront investment. This is why it is referred to as a debit call spread.

The purchase of options at lower strike prices is referred to as the long call and the sale at higher strike prices as the short call. Together the two transactions are referred to as the call legs of the spread.

So, what exactly is a Bull Call Spread strategy?

This particular strategy involves two call options, skilfully creating a range with a lower and higher strike price. The Bull Call Spread strategy is tailor-made for traders who anticipate only moderate price increases. While it allows traders to limit their losses, it simultaneously caps their potential gains a delicate balancing act.

Now, let's dissect the construction of this strategy step by step:

Step 1: Purchase lower strike calls.

Step 2: Sell an equal number of higher strike calls with the same expiration date.

Since the lower strike calls are more expensive than the higher strike calls, this strategy incurs a net debit, meaning there is a fund outflow from your trading account. The bull call spread serves as a lower-risk alternative to buying a naked call option.

To truly grasp the risk profile of this strategy, allow us to present a hypothetical case study.

Imagine two situations: Situation 1 involves only a Long Call option trade, and on other hand, in situation 2 a trader employs the Bull Call Spread strategy.

In Situation 1, let's say you possess a moderately bullish view on a stock called ABC, and you purchased a June series 70 strike call option for Rs 13. In Situation 2, your outlook on the underlying stock remains the same, but you opt for the Bull Call Spread strategy. Thus, you buy a June series at 70 strike call option for Rs 13, while simultaneously selling a June series 100 strike call option for Rs 5 (resulting in a net cash outflow of Rs 8). This strategy is commonly referred to as the Debit Bull Spread.

Now, let's compare the risk profiles of Situation 1 and Situation 2:

Situation 1 (Long Call):

- You Pay (Net Debit): Rs 13

- Max Risk: Rs 13

- Max Reward: Unlimited

- Breakeven Point: 83 (Strike Price + Premium Paid)

- Max Risk on Net Debit: 100% (Rs 13)

Situation 2 (Bull Call Spread):

- You Pay (Net Debit): Rs 8

- Max Risk: Rs 8

- Max Reward: 22

- Breakeven Point: 78 (Lower Strike Price + Net Debit)

- Max Risk on Net Debit: 100% (Rs 8)

From this illustration, the advantages of the bull call spread become evident. It offers a lower risk profile with more favourable breakeven points while still presenting an attractive potential reward. The risk is limited, and the profit potential is within reach.

Now, let us delve into the crux of this strategy: selecting the long call strike and short call strike. Typically, one would engage in a bull call spread when they anticipate an increase in the underlying asset's value. The maximum profit occurs at the higher strike price, while the maximum loss is realized at the lower strike price.

So, which options should you choose for the long and short sides of the strategy?

For the long side (option you're buying), it is advisable to select a lower strike price that is at the money (ATM), meaning it is close to the underlying asset's price.

On the other hand, the short side (higher strike call) of the bull call spread involves selling a call option at a higher strike price against the one you just bought.

When selecting the strike price for the short side, consider the following factors:

- Time Decay: Opt for a strike price that allows the spread to generate superior profits through time decay. The premium you receive when the option expires worthless should be significant enough to impact your net debit, consequently affecting your risk and breakeven points.

- Maximum Return on Maximum Risk: As a general rule, aim to double the amount of your maximum risk for any spread trade you execute. Therefore, it is prudent to seek spreads that offer over 200% of the maximum return on maximum risk if the stock moves towards the upper strike price. (In our previous illustration, you may observe that the max reward stands at 250% of max risk.)

In conclusion, if you are a trader who prefers low-risk endeavours, the Bull Call Spread strategy is a perfect option to consider. Opting for a naked long call option (at-the-money) can decimate your position swiftly if your direction proves incorrect. Conversely, with a bull call spread, the impact is more gradual, allowing you to exit the trade before significant damage ensues.

Embrace the power of options, unlock their potential, and navigate the intriguing landscape of the Bull Call Spread strategy. Remember, in the realm of options trading, knowledge and strategy are the keys that unlock the doors to success.

Learn Free Stock Market Course Online at Smart Money with Angel One.