The basics

While there is an endless list of trading strategies and analysis points that go into creating the portfolio of well-seasoned investors, if you are a novice investor who is looking to understand how to make portfolio for share market, there are some basic do’s and don’ts which you can follow in order to vitally avoid making some key mistakes. With a little more discipline and a patient approach to learning how to create a portfolio in the share market, you could set your investing journey off to a good start. Let’s take a look at some of these points, and try to understand what they are.

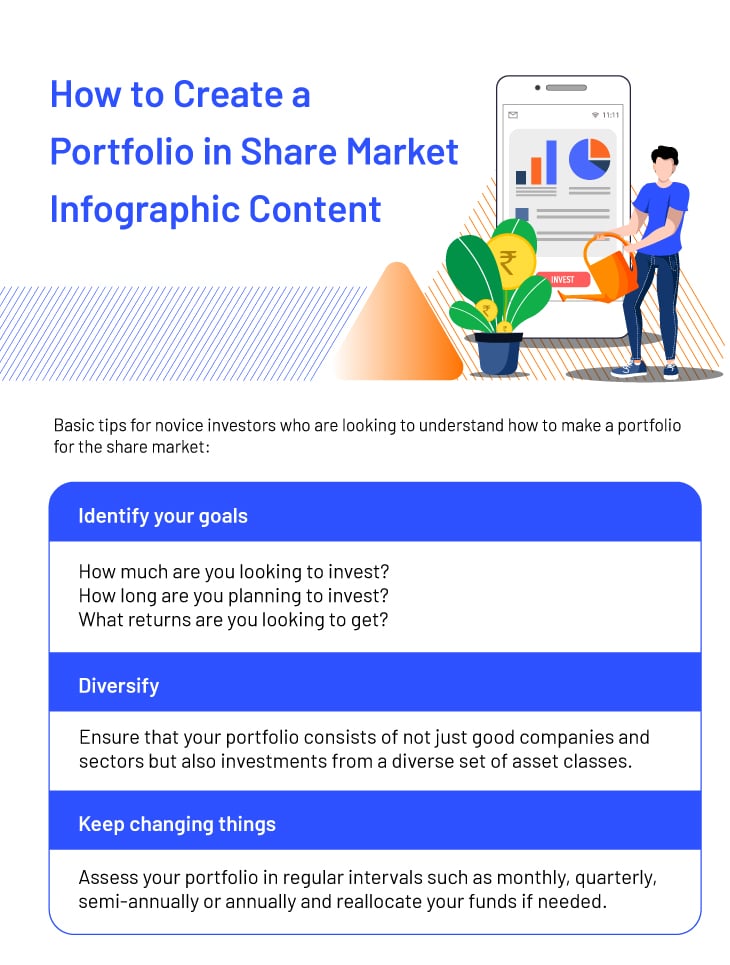

1. Identify your goals.

Now, the goal of every investor in the stock market looking to understand how to make a portfolio for the share market, is to generate returns; to invest a certain sum of funds, and to aid those funds in multiplying in value. However, further elaborating on these goals and subsequently clarifying them for yourself could help you better understand how to make a portfolio for the share market. Namely, how much you are looking to invest, otherwise known as your investment capability, how long you are looking to invest for, and what returns you are looking to get. An investor who is looking to understand how to make a portfolio in the share market in order to make long term returns will have a very different portfolio from an investor looking to make short term gains.

Similarly, if an investor has a high-risk appetite and investment ability, their profit and return maximising portfolio will look largely different from that of an investor who wants to invest a lower percentage of their earnings, is not willing to take on as much risk, and is looking to prioritize stability over volume of returns. Clarifying this before you begin understanding how to create a portfolio in the share market will help you start off on the right foot, and afford you and your portfolio some more clarity.

2. Diversify

Despite the large number of analysis and trading strategies and technical indicators, it is not possible for any one individual to accurately predict how the stock market will react, making any decision effectively a guess by the investor. The goal, therefore, is to ensure that your portfolio consists of not just good companies and sectors, but also a diverse set of investments. Investing in a number of sectors, and various stocks within those sectors will allow you to spread out your investments, minimizing your exposure to systemic risk.

In addition, while your entire portfolio might be designed to cater to certain time and investment based goals, it is not necessary that it contain a single type of stock only. Mix and match stocks with various qualities in order to hedge them against each other, increasing your overall returns and decreasing your losses. For instance, including stocks which offer routine dividend payments and that are linked to an essential sector will help balance out stocks on your portfolio that are looking to make larger returns in shorter periods of time, with the downside of exponentially higher risk.

3. Keep changing things up

The stock market is a volatile and non-stationary entity. Meaning that a stock that was performing well a year ago, needn’t necessarily perform well this year. While trying to understand how to make a portfolio for the share market, ensuring that your portfolio doesn’t go stale is a key task. Assess your portfolio in routine intervals such as monthly, quarterly, semi-annually or annually in order to make sure all your investments are up to date, and you are not holding onto stocks that are dragging your portfolio down.

Further tips for beginners:

Begin Early

The day you begin working, it is time to start saving. This is also one of the best times to save because you don’t have any financial commitments. An early saving adds to more saving which also means bigger investment.

Minimum Cost

At the time of investing capital, make investments in funds which have low fees. Save up on money which is otherwise needed for commission or management fees. Therefore, this keeps your investment cost to minimum.

Discipline

One of the best answers on how to trade in stock market is to trade in a disciplined manner. Timely and regular investments are important to build your portfolio.

Ask for help

Do not shy away from asking for help in understanding the share market. You can consult a mentor, friend, or even seek professional help from financial firms to get a better idea of your stock options. You can even lookup articles, take online courses, attend workshops or seminars, read books to know more about investing in the share market. Let your own discretion along with help from other resources help you make your way to a financially healthy future.

Beware of herd mentality

Asking for help is important; however, avoid succumbing to peer or market pressure. It may happen that a lot of people you know invest in a particular stock but you do not believe in it or you don’t understand that sector. You may not trust the company or find their financials credible. It is better to keep away from speculation which often drives hordes of investors to buy or sell a particular stock. Have faith in your diversified portfolio and your own research to help you surmount the pressure to follow the herd.

Consider a company’s potential

Once upon a time, Elon Musk’s Tesla had few buyers. Today, it is valued at billions, way ahead of its competitors in the technology market. Many investors refused to invest in Tesla because of its past performance. Past performance is a good metric to understand the robustness of a company, but you also need to consider the ideas and innovations that the company is working on. As long as the company has shown integrity, has its financials in place, and promises a good idea, you can risk investing in them.

Conclusion

Trying to understand how to create a portfolio for the share market can be a daunting task if you are a first-time investor. The sea of stocks, recommendations and investment options can result in severe choice overload. However, equipping yourself with the information mentioned in this article will help clear the fog a little, allowing you to make more informed decisions, and create a lean investment portfolio that best suits your investment ability and goals.

You now understand the essential working of how you can earn money from the stock market. Now, leverage the professional help from brokers at Angel One to get the best advice and guidance on how to earn profits from the share market

Learn Free Stock Market Course Online at Smart Money with Angel One.