In March 2020, well before the COVID-19 induced national lockdown was announced in India on March 24th, 2020, the stock markets corrected by more than 30 percent in about 21 trading days- at an unprecedented pace of market correction never witnessed in the past. Markets began to discount the effects of the global pandemic by pricing in the sliding economy and its repercussions such as job losses, business disruption, and low corporate profits. The markets did not have to wait for these events to play out for real before correcting them. When investors began pondering about the next best strategy to augment their wealth, value stocks seemed to instill hope again.

What is a Stock market correction?

When the stock market steadily keeps going upward for an extended period, there creates a buzz forecasting a stock market correction. A Stock market or Share market correction is usually a 10-20 percent drop in the price of a stock or value of a market index from its recent high point. Generally, a market correction is generally a short-term phenomenon, lasting for a few weeks or months. It is not synonymous with a crash or a bubble and the corrections are seen as a regular part of investing.

What triggers a Stock market correction?

During a stock market’s continuous rise over a prolonged period, a majority of investors wish to make money leading to an unfounded excitement. This is what makes the stocks sell above their real value and the market correction occurs when the stocks fall back to their original value. Corrections are witnessed when an event creates panic selling and smart investors do not sell when there is a market correction as they might forego the time needed to recover from the losses.

Investing in Value Stocks

Value stocks are shares of those companies whose prices are lower than what their company fundamentals suggest they ought to be, i.e., their intrinsic or book value. Investing in value stocks or value investing is a long-term, conservative approach that involves buying and holding the share prices of a company currently at a lower value than their intrinsic value.

Adoption of value investing method for stock selection is generally based on two principles – Intrinsic Value and Margin of Safety.

Intrinsic value: The intrinsic value of a stock is determined based on the company’s fundamentals and performance- such as cash flow, revenue, earnings, along with a variety of other information such as brand, business model, etc.

By identifying and buying stocks that are lower than their intrinsic value, the investor hopes to see better returns when the market recognises that stocks are underpriced because if the fundamentals are robust as per analysis, the stock value should rise.

Margin of Safety: The second principle of value investing is the margin of safety which is the difference between the intrinsic value of the stock and its market price. The higher this difference, the wider shall be the margin of safety, and the less likely the investor is to lose money when the stock does not perform as per expectations.

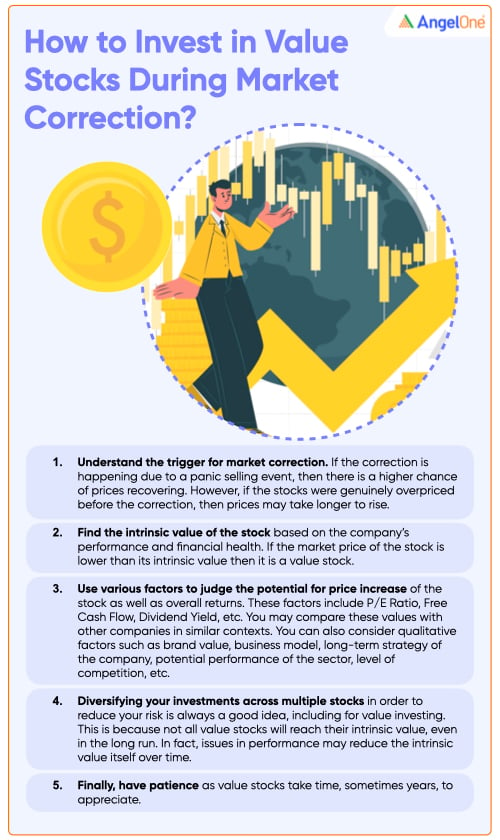

How to Invest in Value Stocks

Investing in value stocks requires a great deal of patience, hard work, and tons of research. Once you decide on the value stocks, be ready to buy and hold on to them over the long haul.

Research and Analysis

Finding out the intrinsic value of stock always entails meticulous research of the company’s fundamentals. Considering a few important aspects of these fundamentals would help identify a good value stock.

- P/E Ratio: The foremost fundamental of a value stock that needs to be looked into is its P/E or price-to-earnings ratio. It indicates whether the stock price matches accurately with the company’s earning potential. A low P/E ratio may signify an undervalued stock.

- Free cash flow: It is the amount of money generated by the company after all its expenses. Companies with high free cash flows but a few weak earnings reports may cause their stocks to be undervalued. Nevertheless, they are good value stocks to invest in.

- High dividend: If a company’s dividend yield is higher than that of its competitors, the share value could be underpriced relative to its dividend. However, a word of caution is that the company could also be in financial trouble and paying unsustainable dividends.

- Company’s Relative performance: Despite strong fundamentals, a company might, over time, lag behind its competitors due to some discrete events in the company’s history. If such a company’s stocks drive too low during a share market correction, then it is a good time to buy these value stocks.

- Company Goals: It is important to research and understand not just a company’s long-term plans and goals, but also its management team, and business principles. Ensure that these plans and goals shall strengthen the company’s position in the market over the long-term before investing in their stocks.

Value Stock Portfolio Diversification

Despite being undervalued, investing in value stocks too entails a certain amount of risk. For instance, there is always a probability of undervalued companies decreasing from their current value or may never get their intrinsic value. Despite thorough research and analysis of a company’s fundamentals, it is never a good idea to put all of your eggs in the same basket.

Diversification of the portfolio always helps in minimising the risk and offsetting the losses and underperformance of a company. Investing in value stocks of different companies could be a smart way to diversify your stock portfolio.

Have Patience in Holding the Stocks

You would see the prices of value stocks rise and fall almost frequently and there shall surely be moments when you would be tempted to sell the stocks for better returns. But remember that value investing emphasises long-term goals and it is better to be prepared to hold your position for years together for steady and reliable returns.

Investing in value stocks during a Stock Market Correction

Investment professionals, by and large, believe that value stocks perform better when the economy is in a decline and the market corrects itself. A market correction is a favourable time to invest in value stocks of companies with robust fundamentals and long-term growth agenda. During a share market correction, high-value stocks ensure better returns but are also available at a lower price. However, it is important to thoroughly evaluate and carefully understand the company’s previous growth performance, quality of its business and management, and its long-term endurance, before deciding to buy its value stocks.