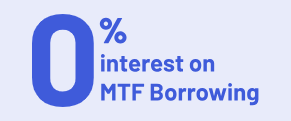

Trade Now with MTF

MTF is a facility that allows you to buy up to 4x more shares than your current cash balance by borrowing the remaining amount from Angel One.

You Pay

Angel One Funds

Buy Stocks Worth

Let's say you have ₹10,000 cash in your account and want to buy LIC shares trading at ₹1,000. You expect the stock price to increase by 10% to ₹1,100 in 10 days.

Here's how MTF benefits you:Click here to understand how interest is charged