A Demat account is an essential tool for trading and investing in the capital markets. However, as your financial needs evolve, you may find yourself with multiple Demat accounts, some of which remain inactive. It is wise to consider closing an unused or zero-balance Demat account. In this article, learn how to close a Demat account, the types of closures, and the points to check before closing one.

Key Takeaways

-

A Demat account can be closed online if all prerequisites, such as clearing balances, closing positions, and transferring holdings, are completed.

-

Dormant or unused Demat accounts should be closed to avoid unnecessary charges and reduce security risks.

-

Account closure is permanent and requires downloading all important statements before submitting the request.

-

Joint, HUF, and minor accounts require an offline closure process with additional documentation.

What is a Demat Account?

A demat account is an electronic account used to hold financial securities such as shares, bonds, exchange-traded funds, and mutual funds in digital form. It replaces physical certificates with secure electronic records, reducing risks of loss, damage, or forgery.

A demat account enables seamless settlement of trades, allowing investors to buy, sell, and transfer securities efficiently through a linked trading and bank account. It is essential for participating in the modern securities market, ensuring safe storage, easy tracking of holdings, and automatic crediting of dividends and corporate benefits.

Why Should You Close a Dormant Demat Account?

A dormant demat account should be closed to avoid unnecessary costs and reduce security risks. Even inactive accounts continue to attract Annual Maintenance Charges, making them an avoidable financial burden. Dormant accounts are also more vulnerable to unauthorised activity, since they are not routinely monitored.

Closing such accounts helps prevent potential fraud, eliminates the risk of penalties linked to prolonged inactivity, and simplifies the management of your investments. If the account is no longer required, closing it ensures cleaner records and protects you from future complications.

Types of Demat Account Closures

-

Transfer and Account Closure: This is when you have pending securities on the account that need to be transferred to another account.

-

Account Closure: This is a direct account closure procedure picked when the Demat account is inactive and has no pending holdings or transactions.

Points To Check Before Closing a Demat Account

-

Please note the below before you proceed with closure.

-

Account closure is permanent; you cannot reopen it with the same client ID. All the data associated with your account will not be available once the account is closed.

-

You cannot open a new account with Angel One within 90 days of closure

-

Ensure that you clear any negative balance

-

Download necessary reports like contract notes, ledgers, and P&L statements before closing the account, as these will not be available once the account is closed

-

Account closure can be done online for individual accounts only

-

Account closure request for HUF, minor, and joint accounts needs to be submitted offline

-

Before initiating the closure of your Angel One account, please ensure the following conditions are met:

-

Holdings: All equity holdings must be sold off or transferred to another DP/trading account

-

Funds: Ensure there are no funds in the account. All balances must be settled, and there should be no negative balance. Account closure will not be allowed in case of a negative balance.

-

Open Positions: All trading positions must be squared off.

-

SIPs and Mutual Funds: There should be no active SIPs or Mutual Funds linked to the account.

-

IPOs: There should be no active IPO orders.

-

Pledged Holdings: Any pledged holdings must be released.

-

Frozen Accounts or Delisted Company Holdings: If holdings are in a frozen Angel pool account or of a delisted company, the account will close once the pool account is unfrozen or the ISIN becomes active again.

Also, mark a fund payout (if applicable) online after the trade settlement. Once you mark a payout, you will receive it in the opted Bank account.

Steps To Close the Demat Account

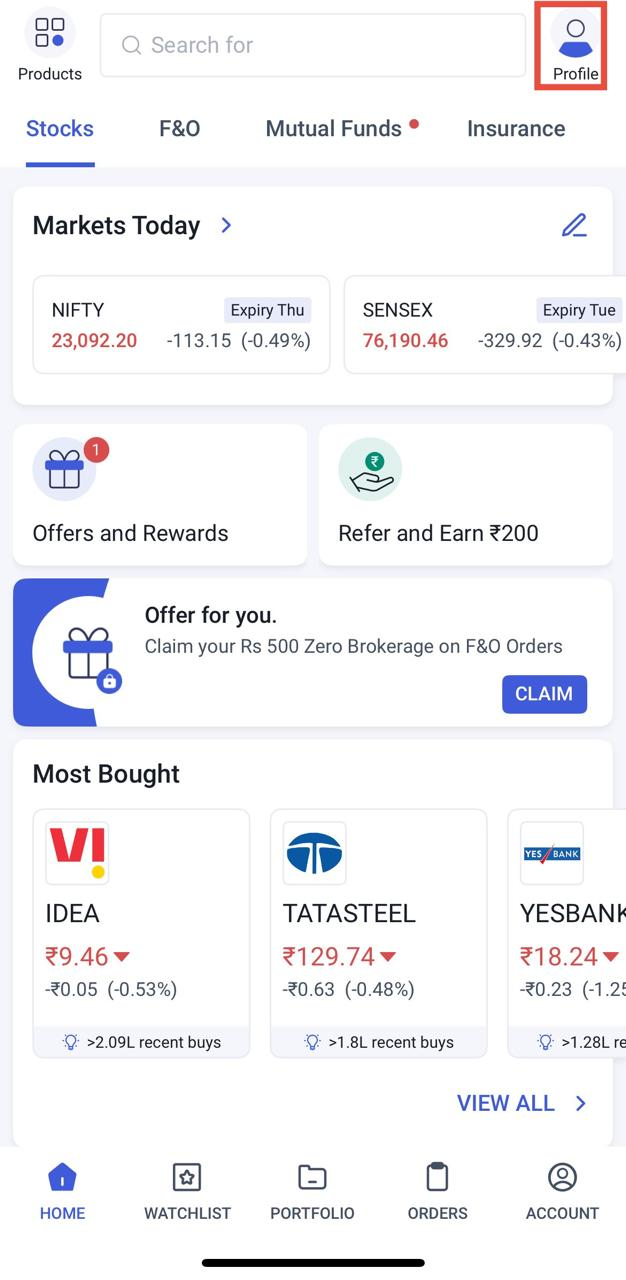

Step 1: Log in to your account using your mobile number/client ID and OTP

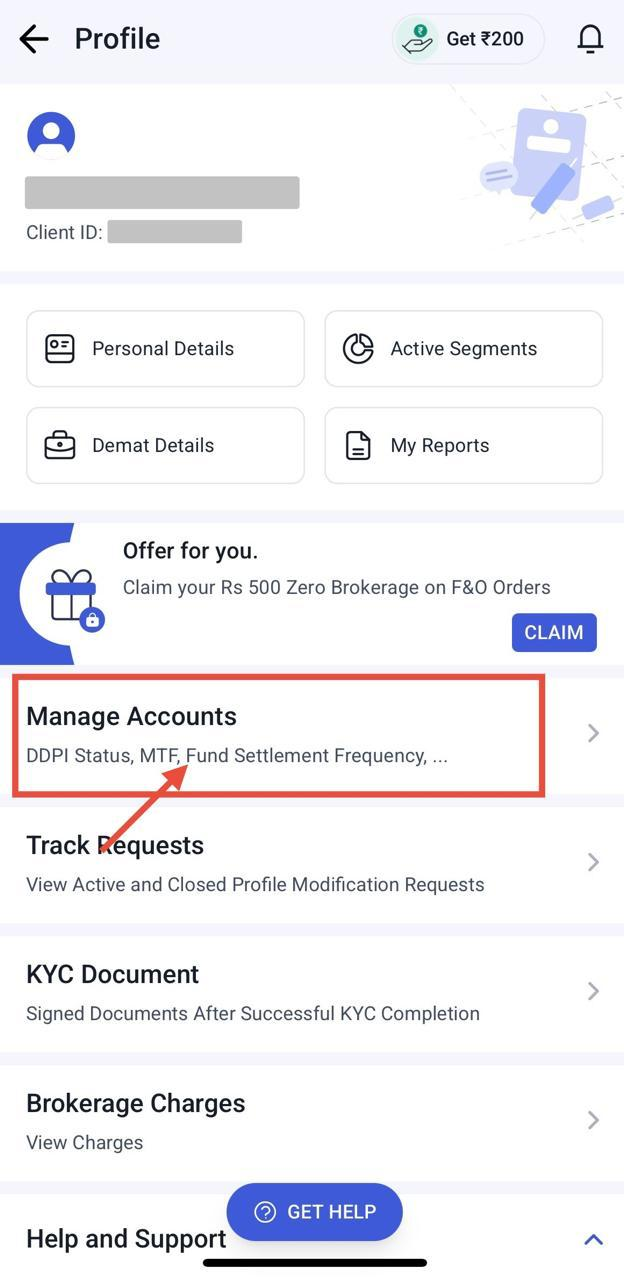

Step 2: In manage accounts, click on ‘close demat & trading account

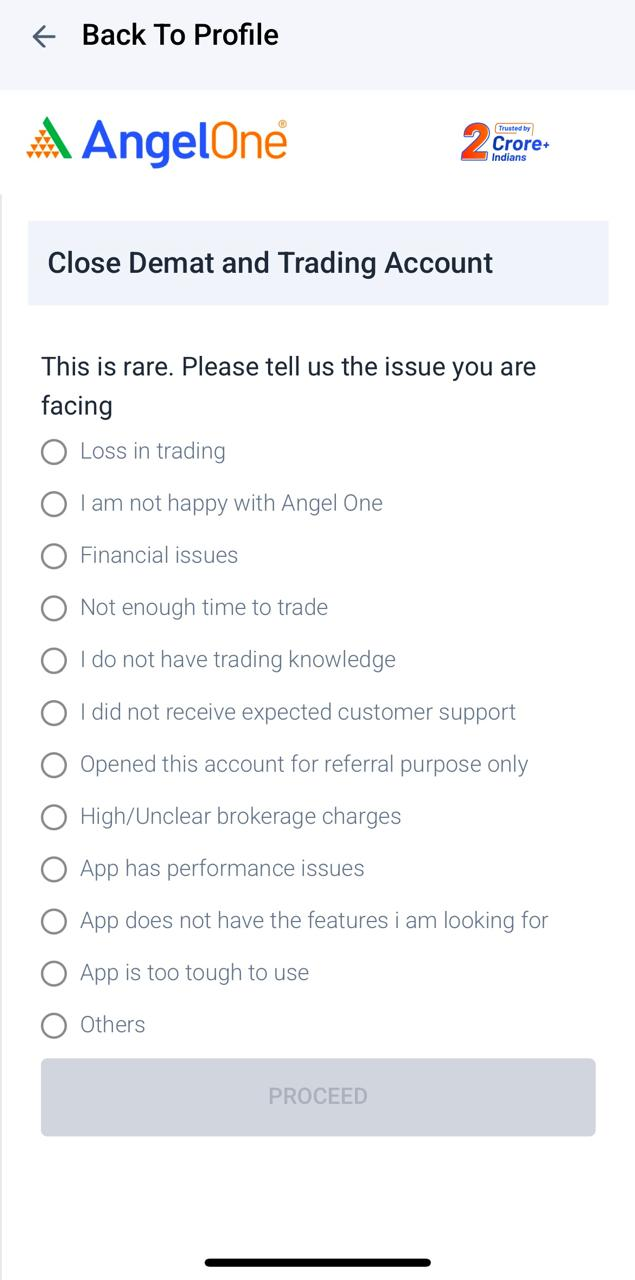

Step 3: Select the reason and click on ‘Proceed’

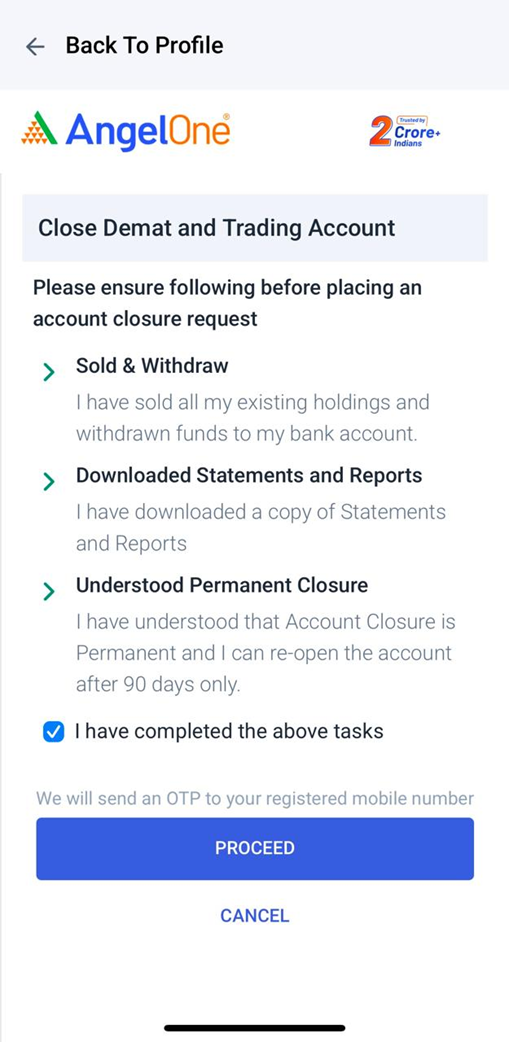

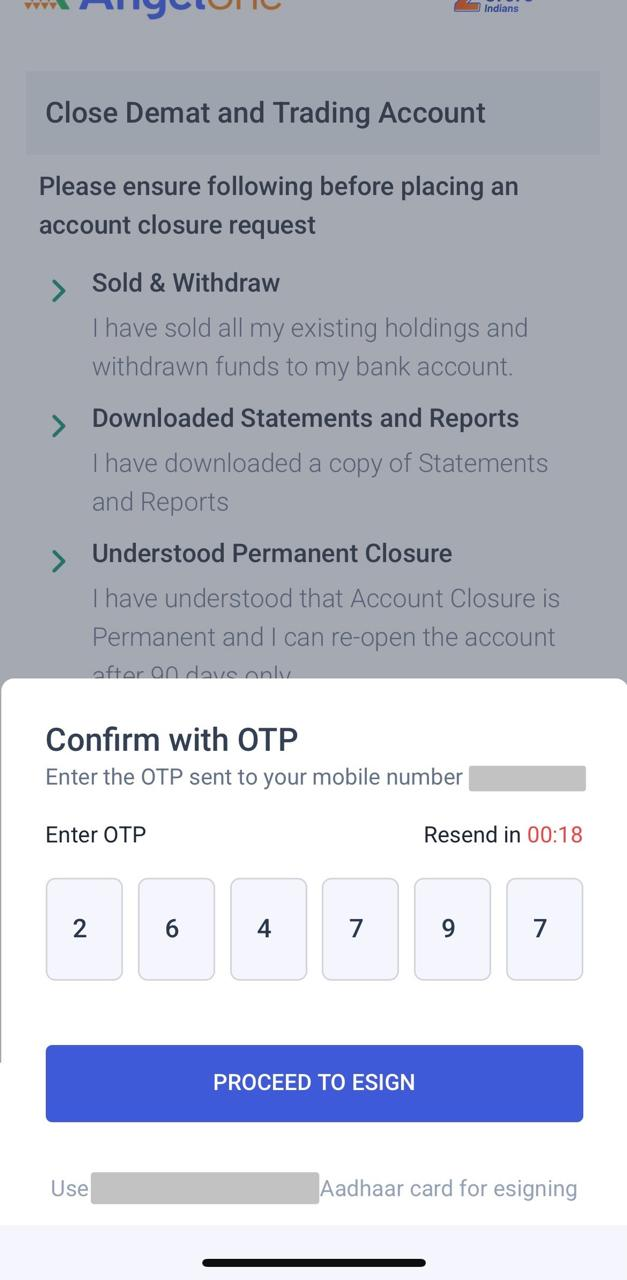

Step 4: Go through the Instructions carefully and proceed with the process. Ensure to complete all the tasks and proceed further to get the OTP

Step 5: Enter the OTP and Proceed to E-Sign

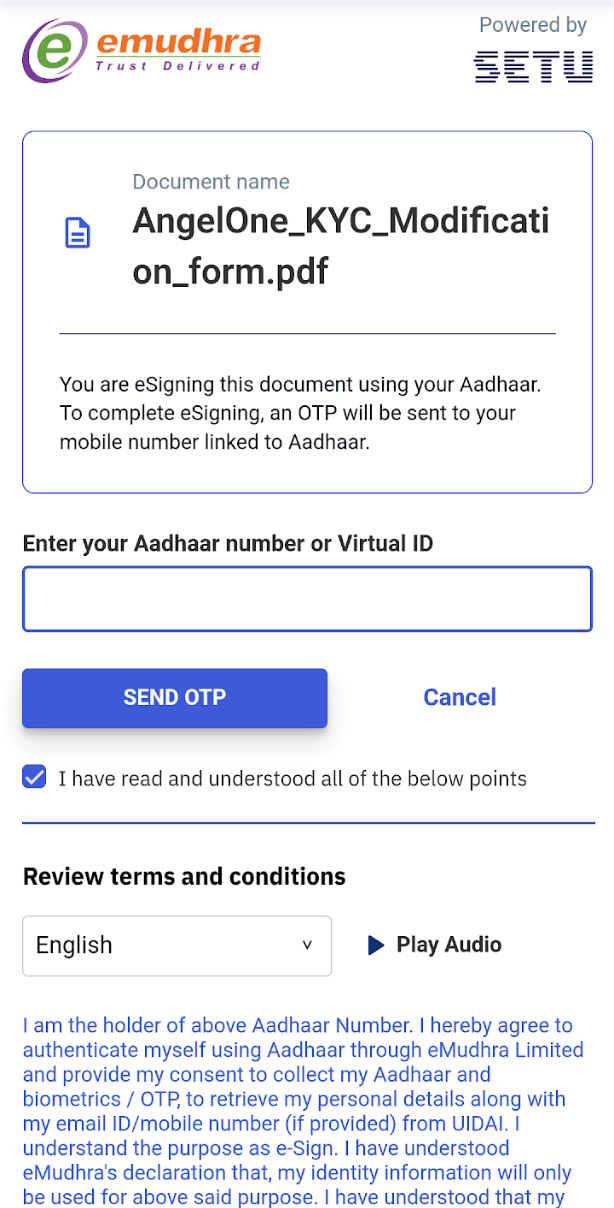

Step 6: You will be redirected to e-sign the request. Enter the Aadhar details & OTP sent on the mobile number linked to the Aadhaar card.

Step 7: The request will be processed in 3 working days.

2. In the case of transfer and account closure:

If you have any holdings in your account, you can either sell your holdings or transfer them to another DP. You can close your account through an online process after selling your holdings. If you want to transfer the assets along with account closure, please follow the process below:

-

For closure cum transfer, you can create a ticket here or email us at support@angelone.in. from your registered email id

-

The following documents are required for the closure cum transfer process:

-

Angel One account closure form duly signed by the account holder. Please click here to find the account closure form.

-

CML/CMR copy of the Target DP duly signed and stamped, where holdings need to be transferred

Account Closure for Joint Holders, Minors, HUF Account Holders

For joint account holders, minors, and HUFs, please note that the online closure process is not available. You will need to create a ticket here or email us at support@angelone.in from your registered email ID.

Joint holders with no Holdings

-

Documents Required

-

Account closure form duly signed by all the holders

Joint Holders with Holdings

-

Documents Required

-

Account closure form with signatures of all holders

-

CML copy of the joint account of the DP where holdings need to be transferred. CML copy must be signed and stamped by the target DP

HUF with no holdings

-

Documents Required

-

Account closure form duly signed by the KARTA along with the HUF stamp

HUF with holdings

-

Documents Required

-

Account closure form duly signed by the KARTA along with the HUF stamp

-

CML copy for the HUF account where holdings need to be transferred. CML copy must be signed and stamped by the target DP

Minors with no holdings

-

Documents Required

-

Account closure form duly signed by the minor’s guardian

Minors with holdings

-

Documents Required

-

Account closure form duly signed by the minor’s guardian

-

CML copy for the minor account where holdings need to be transferred. CML copy must be signed and stamped by the target DP

Reasons and Impact of Closing a Demat Account

Closing a Demat account is a significant financial decision that requires careful consideration. Investors often review their account usage, costs, and security needs before initiating the closure process. Since a Demat account holds financial assets electronically, it is important to understand why closure may be necessary and what steps must be taken to ensure a smooth transition. The sections below outline the key reasons for closing a Demat account and the essential factors to review before proceeding.

A. Reasons to Close a Demat Account

Investors may consider closing a Demat account when it remains inactive or is no longer needed. Dormant accounts still attract Annual Maintenance Charges, making them an unnecessary cost. Some investors also consolidate multiple accounts to simplify portfolio management. Others may close an account due to low usage, a shift in investment strategy or dissatisfaction with a broker’s services. Closure also reduces potential security risks linked to unmonitored accounts.

B. Things to Consider Before Closing

Before closing a Demat account, holders must ensure all securities are transferred or sold, as untransferred assets may become inaccessible. Any outstanding dues or negative balances must be cleared to avoid rejection of the request. Investors should also download important reports, including transaction statements and tax documents, as these may not be available after closure. Once closed, the account cannot be reopened, and a fresh KYC process will be required to start investing again.