Until 2018, all futures and options contracts were settled in cash. In this settlement, the buyer or seller had to settle their position in cash without actually taking the delivery of the underlying security on the expiry of the contract. However, as per the SEBI circular dated April 11, 2018, physical settlement is compulsory if a trader holds stock futures & options contracts that are eligible for physical delivery upon expiry.

What is physical settlement?

Before we move further, let’s first understand what physical settlement is. A physical settlement means on the expiry of futures & options contract, actual physical delivery of stocks or commodities should be made in your Demat account instead of cash settlement. For instance, if you had sold XX company’s futures and have not rolled over or closed your position till the expiry date, then you will have to mandatorily give physical delivery of shares. On the other hand, if you had bought the future and not changed your position till expiry, then you will have to take the physical delivery of shares in your Demat account by paying the full value of the contract.

This physical delivery settlement process is carried out for all the stock derivatives (futures and options). However, index options such as NIFTY, FINNIFTY, and BANK NIFTY are settled on a cash basis only.

Following positions will be marked for physical settlement:

1. Futures

All stock futures positions that are open at the end of the expiry day will have to be compulsorily physically settled.

- Long futures position will result in buying (receiving) the shares

- Short futures position will result in selling (delivering) of the shares

2. Options

| In-the-money (ITM) Options Contracts | Bought/Sold a Call/Put Option & Carried the Position Till Expiry | Buy (Receive)/Sell (Deliver) the Stock |

| Long Call | Bought a call option | Buy stock by paying the full value |

| Short Call | Sold a call option | Sell stock by delivering the agreed quantity of shares at an agreed price |

| Long Put | Bought a put option | Sell stock by delivering the agreed quantity of shares at an agreed price |

| Short Put | Sold a put option | Buy stock by paying the full value |

Note: For Options Contracts, monthly expiry is considered to carry out the physical delivery settlement process.

Computation of value of the physical delivery settlement

Knowing how to calculate the settlement value for physical delivery is of utmost importance. Read on to know the computation for futures and options.

1. For Futures Contracts

The final settlement price of the contract will be the delivery settlement value. For example, consider you hold a long futures position of 1 lot of 200 shares of XYZ company till the expiry at ₹ 2000 each (as on the contract date). Then the settlement value will be ₹ 4,00,000 (2000 * 200) . In this case, to physically settle the shares you need to buy the stock by paying the total settlement value i.e. ₹ 4,00,000.

2. For Options Contracts

It will be calculated as below:

Strike prices of the options contracts * Quantity

Let’s understand this better with an example. You hold a short call options position of 1 lot of 250 shares of XYZ company till the expiry at ₹ 1800 each (This price is as on the date you entered into the contract and is known as the strike price). Then the settlement price will be ₹ 4,50,000 (1800*250). In this case, if the underlying price of XYZ company is ₹ 2000 then your contract is in In-the-money Position. Now, to physically settle the shares you need to have 250 shares in your Demat account against which you will receive ₹ 4,50,000 (1800*250) by the exchange.

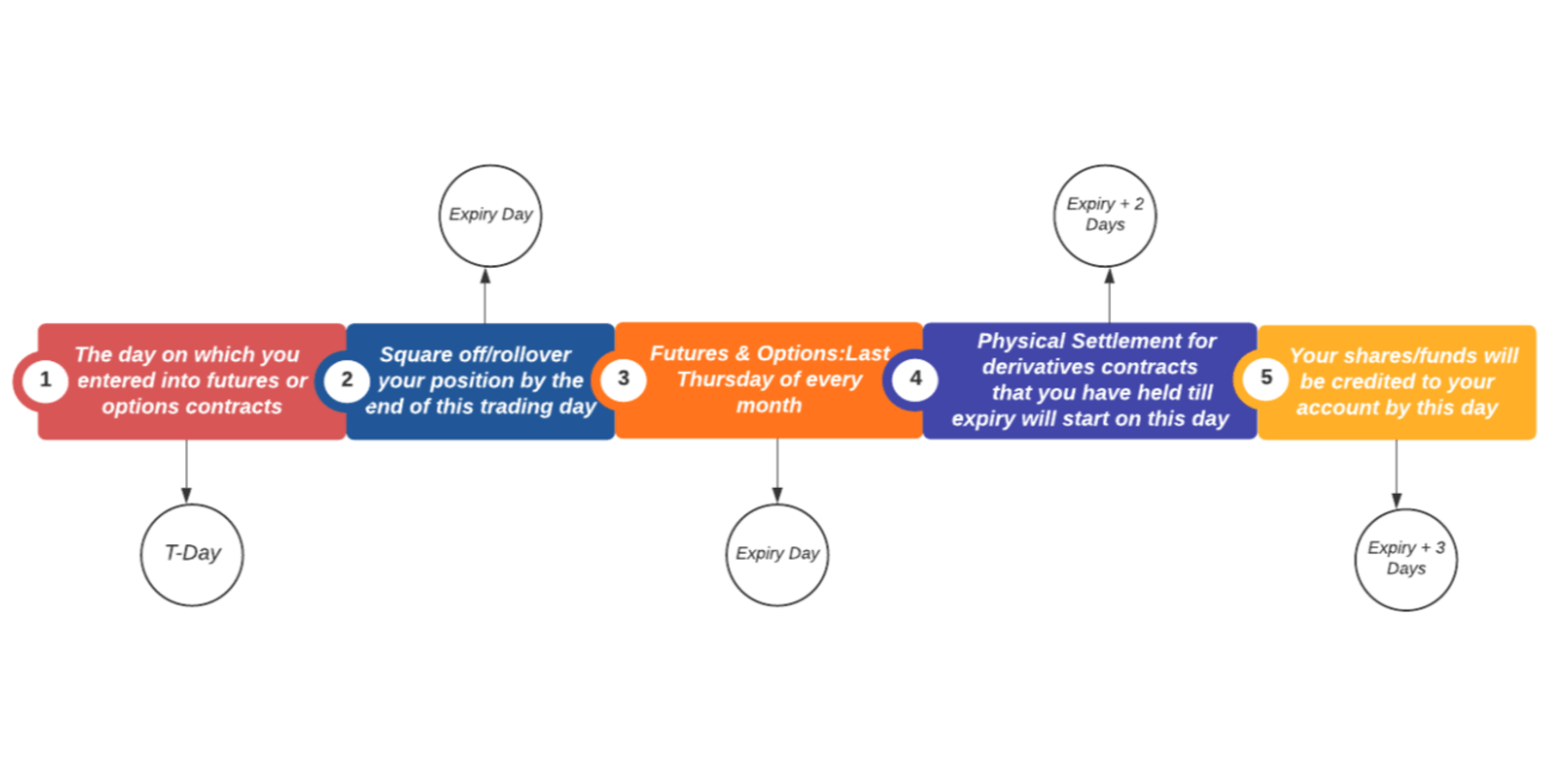

What is the timeline for a physical settlement?

How will your margin requirements change for physical delivery settlement?

For Futures and ITM Short (Call & Put) Options Positions

On the expiry day, the margin requirement for these positions will increase to 40% of the contract value or SPAN + Exposure, whichever is higher.

For ITM Long (Call & Put) Options Positions

As per the exchange circular, the margin required for all the existing long ITM positions will start increasing 4 days before the expiry date (i.e. last Thursday of every month) in a staggered manner as mentioned below.

| Day | Margin Applicable |

| Expiry Day - 4 (Friday End Of The Day) | 10% of the delivery margin computed |

| Expiry Day - 3 (Monday End Of The Day) | 25% of the delivery margin computed |

| Expiry Day - 2 (Tuesday End Of The Day) | 45% of the delivery margin computed |

| Expiry Day - 1 (Wednesday End Of The Day) | 70% of the delivery margin computed |

What will happen in case of failure to deliver the securities/insufficient funds in a physical settlement?

- In case of short delivery under the physical settlement - The shares will undergo an auction and a penalty will be imposed

- In case of insufficient funds - A margin shortfall penalty will be levied and can trigger a risk-based square off

- In case of failure to fulfill margin requirements - A margin shortfall penalty will be charged

Conclusion

The physical delivery settlement had a significant impact on the derivatives market and helped in reducing the volatility in the market. Also, it has made maintenance of Demat accounts mandatory for the traders. Considering all of this, it is advisable for you to square off/rollover your positions before expiry to reduce a load of higher margins, penalties, maintaining sufficient balance, and price risk.