Strike Price in Options

In finance, option is a contract that gives its buyer the right to buy/sell (from/to the seller of the contract) an asset at a predetermined price, on or until an agreed date. The predetermined price at which the asset can be traded under the contract is called the strike price. The asset in question could be anything, ranging from barrels of oil to publicly traded shares of companies.

Strike Price vs Spot Price

The seller of the contract must respect the right of the buyer of the contract to buy/sell the asset from/to him at the strike price (ie. price at which the deal for the options contract was struck). The strike price must be honoured regardless of the actual market price or spot price (ie. price of the asset in the spot market where it is directly bought/sold).

Example of strike price in options trade

Suppose a share of company ‘C’ is being traded for Rs 100 on a stock exchange on 23rd July. The buyer ‘B’ is expecting that the price will increase beyond Rs 120 by 28th July but is not too sure about it. Simultaneously, there is seller ‘S’ who is quite sure that the price will not increase much and therefore, he offers to sell an option contract to buy the underlying share at Rs 110 on 28th July for a premium of Rs 3 per share. B sees this offer on the exchange and decides to buy the option.

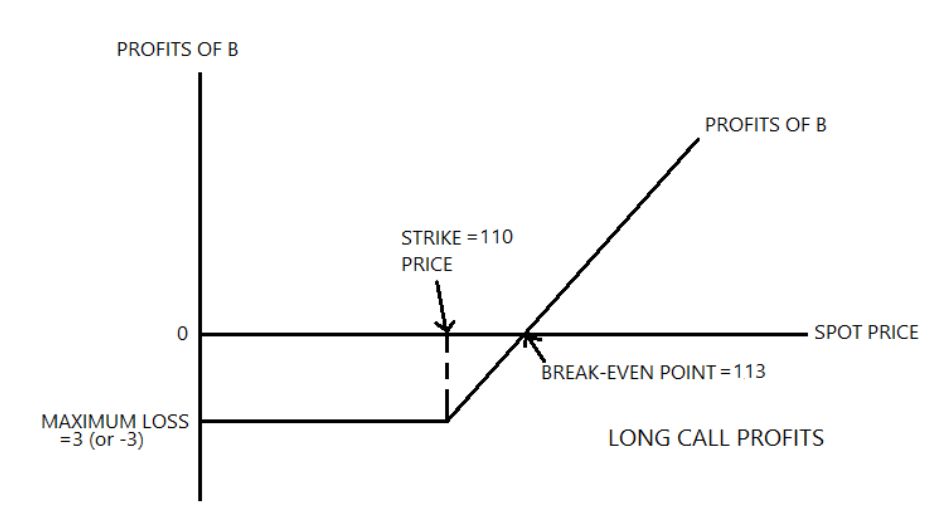

The option in question here is a call option that gives its buyer the right to buy the underlying product. B is going long on the call option and S is going short on the same and the strike price is Rs 110.

Now if on 28th July, the spot price of the share on the stock market hits Rs 120, then B can still buy the share at Rs 110 from S, sell the share at Rs 120 on the spot market and thereby make a profit of Rs 7 (as the premium of Rs 3 has been paid to S already). On the other hand if the price is Rs 113, then B can buy at Rs 110, sell at Rs 113 and thus (having paid Rs 3 premium) break even with zero profit or loss. If the spot price hits any price below Rs 113, B makes a loss of Rs 3 (ie. the premium paid for the option that was not exercised). The profit/loss of B is exactly equal to the loss/profit of S. Therefore, in a call option, the buyer makes a profit if the strike price is lower than the spot price.

One must note here that had B chosen to buy a futures contract with the same strike price and other details, then she would have lost the entire amount (strike price multiplied by the number of shares) had the price not gone in a way favourable to her. However, because this is an option, she can lose only the premium paid.

Strike price of a put option

A put option contract allows its buyer the right to sell the underlying asset at a predetermined strike price to the seller of the contract until or on a predetermined date. In order to get this right to sell the asset, the buyer of the option contract pays a premium to the seller of the contract.

With reference to the previous example, if S, instead of selling B the right to buy by taking a premium from her (as was the case in the call option), was to buy from B the right to sell her the share by giving her a premium at a strike price it would have been called a put option. S would have been the buyer of the option and B the seller.

In a put option, the buyer makes a profit if the strike price is higher than the spot price.

Factors determining the strike price

Strike price being a key component of an options contract it is based on a number of variables considered by the buyer and seller.

Risk to reward ratio

The ratio of how much money or value is being invested (ie. put at risk) to the expected returns in terms of money or other value is the risk-to-reward ratio. After calculating the different risk-to-reward ratios for various strike prices based on fundamental and technical analysis as well as their respective appetite for risk, the seller and the buyer agree on a strike price.

Implied volatility

While calculating risk, incorporating the implied volatility is important as it helps mathematically estimate the spot price of the underlying asset and thus the likelihood of being in the money. Higher volatility drives traders to take greater risks.

Liquidity

An options contract is liquid if it has a low lot size (ie. minimum quantity that can be traded at a time), a longer time period when the option can be exercised (hence higher chances of being in the money). Also a smaller tick size (ie. minimum change in price of a trading instrument for it to be noted on the exchange) allows for greater volatility in prices and thus higher liquidity. Higher liquidity creates higher volatility and higher risk.

What are multiple strike prices?

A single options contract can have only a single strike price. However, there can be a single strategy of a single buyer/seller involving multiple options and therefore multiple strike prices.

Strike price vs Exercise price

Strike price and exercise price are essentially the same depending on the status of the option contract. While strike price in options becomes available the moment the option contract is made available for trade as it is a part of the contract, it becomes the exercise price only when the option is exercised by the buyer of the option contract.

Conclusion

Now that you are familiar with the strike price meaning, start learning more important concepts before you start trading. If you are unsure about trading options by yourself, check out Angel One, India’s most trusted broker.