Synthetic trading has been in the market for a few years, however, not many investors have been actively using this. Synthetic is essentially the term that has been given to financial instruments that are particularly engineered to simulate other instruments. This methodology alters key characteristics such as the cash flow as well as the duration. Usually, synthetics offer investors the flexibility of tailoring cash flow patterns, risk profiles, maturities, and others. These financial products are also structured in a certain way such that it suits the needs of the investor.

Why are Synthetic Positions Created?

When it comes to the creation of synthetic positions, there are several different reasons. For instance, a synthetic position may be undertaken for the primary reason to create the same payoff as that of a financial instrument using other financial instruments. Moreover, a trader can also choose to create a synthetic position using options. This method helps make the entire process easier compared to borrowing a certain stock at a particular price and then short-selling the stock. This process can also be used for long positions. With long positions, traders usually mimic long positions in a stock using options without having the obligation to invest any capital to actually complete the purchase of the stock.

For instance, as a trader, you can create a synthetic option position by simply purchasing a call option while also simultaneously selling a put option. Both of these can be done with the same stock. If both of these options have the same strike price, using this strategy would result in you having the same result compared to purchasing underlying security for the same stock at the same price.

All About Synthetic Options

Before we dive in to understand how these synthetic calls and puts work, let us gain an understanding of what synthetic options are and their benefits. It is key to note that by using synthetic options, plenty of problems can be minimised or even eliminated. The main reason for this is because synthetic options are less affected by the problem of options expiring worthless. Moreover, when it comes to synthetic options in comparison to the underlying stock, adverse statistics can work in the favour of synthetic options. This can be supported because the volatility, strike price, and decay play a comparably less important role in its ultimate outcome.

Types of Synthetic Options

There are 6 main types of synthetic options. Let us have a look at them.

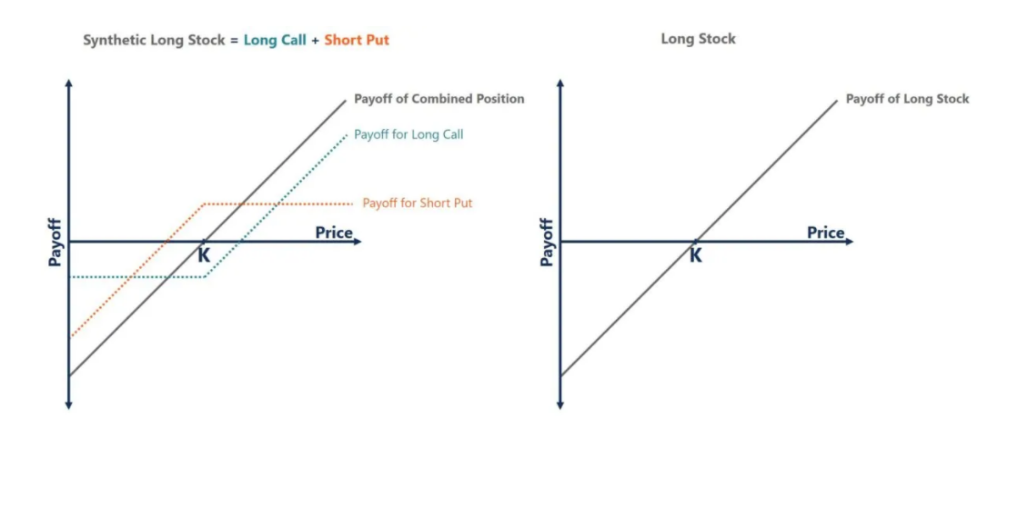

#1 Synthetic Long Stock (Long Stock)

Creating a synthetic long stock position will be accomplished by using a long call option and a short put option. As seen in the graph below, the payoff of a long call and a short put is similar to the payoff of a long stock position.

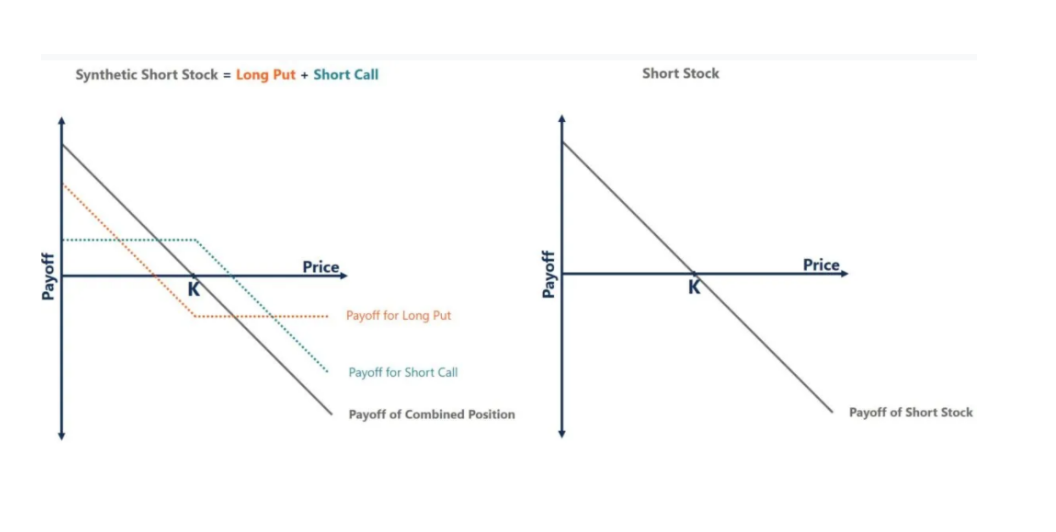

#2 Synthetic Short Stock

As an alternative to directly shorting a company, an investor may opt into a synthetic short stock position by taking a short call and a long put. The graph below illustrates how holding this portfolio is equivalent to shorting the underlying stock.

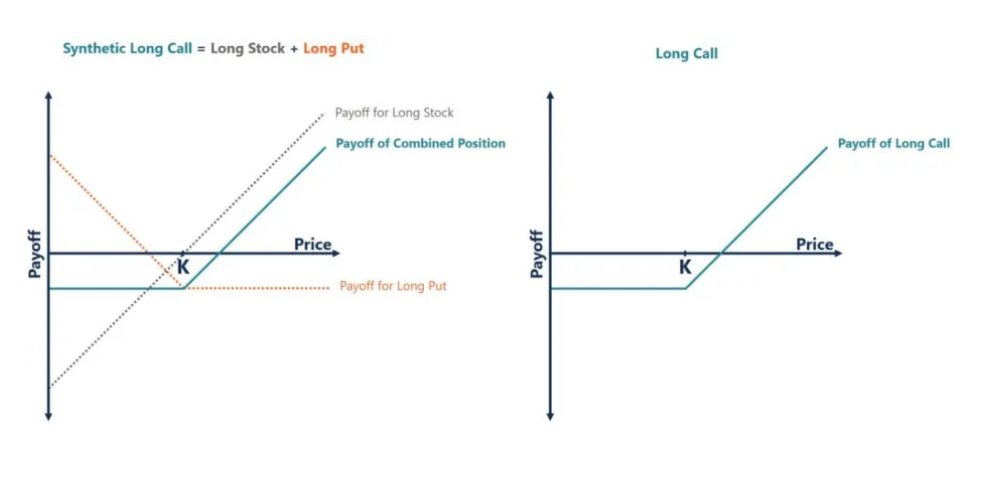

#3 Synthetic Long Call

Creating a synthetic long call position is accomplished by keeping the underlying stock while simultaneously going into a long put position. Following is an illustration of how holding the synthetic call pays off in the same way investing in a long call position.

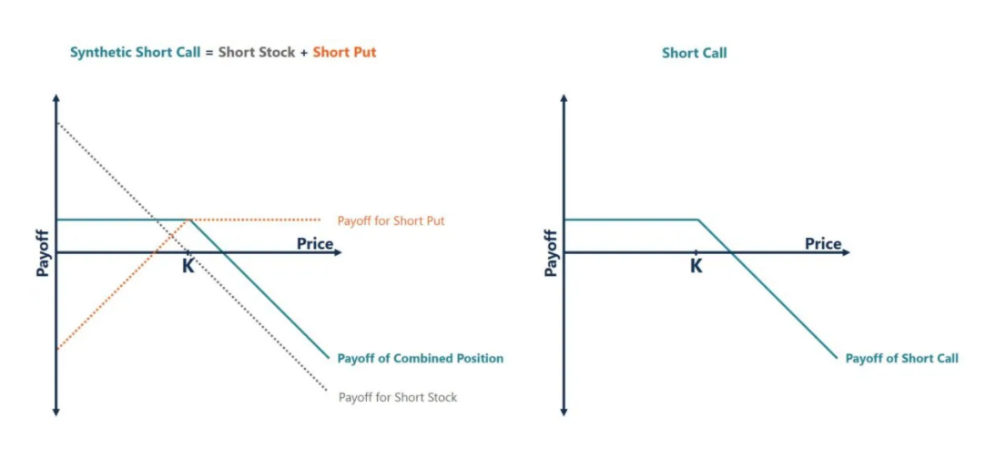

#4 Synthetic Short Call (Short Call)

To build a synthetic short call position, one must first short sell the stock and then get into a short position on the put option. The graph below illustrates how these two transactions are equivalent to establishing a short call position.

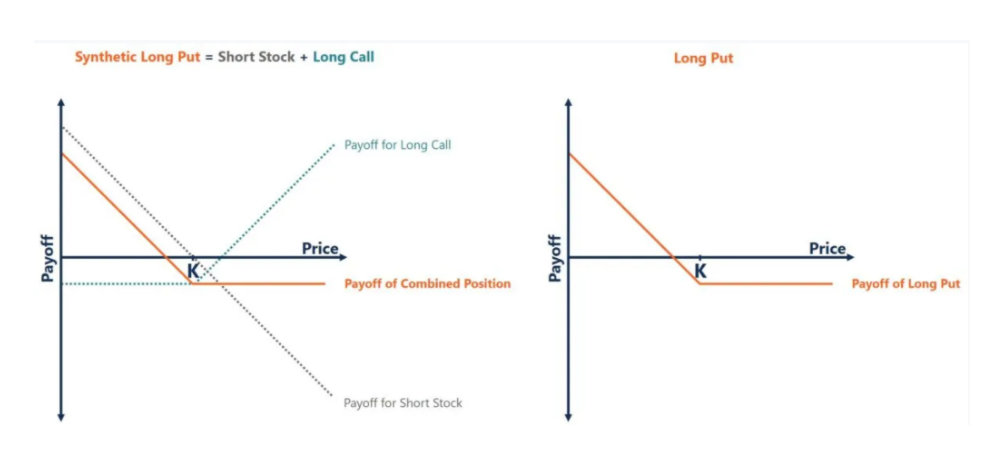

#5 Synthetic Long Put

The synthetic long put position is constructed by short-selling the underlying stock and taking a long position on the underlying call option in the same transaction. The graph below illustrates that keeping these two positions will be equivalent to holding a long put option position in the future.

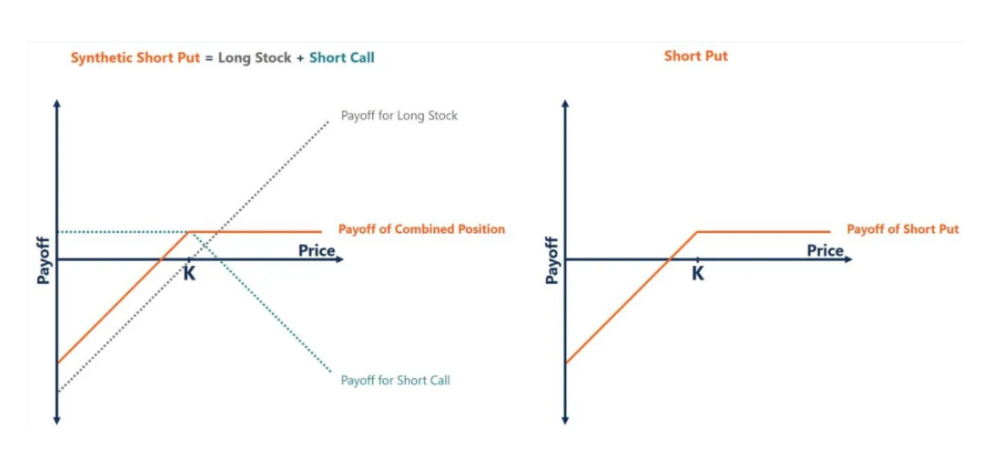

#6 Synthetic Short Put (Short Put)

Creating a synthetic short put position is accomplished by holding the underlying stock while simultaneously taking a short position on the underlying call option. The reward of these two positions will be the same as the payoff of a short position on the put option, as shown in the table below.

In a Nutshell

Synthetic trading offers many benefits such as providing equal rewards with respect to a normal call or put options while also helping mitigate the risks of trading. Such advantages have encouraged investors to adopt synthetic trading more in comparison. However, you will need to have a trading and Demat account to carry out synthetic trading. Make sure that you have them to start your synthetic trading journey.