Building a retirement corpus is a crucial financial goal in every individual’s life. But choosing the right investment instrument to park the hard-earned money puts every individual in a difficult position. If you are confused about where you should invest to lead a stress-free retirement life, you are at the right place. In this article, we will let you know about a few of the investment options available for retirement and the benefits they offer.

The 3 investment options that are often chosen to plan for retirement in India are,

- NPS (National Pension Scheme)

- PPF (Public Provident Fund)

- Mutual funds-SIP (Systematic Investment Plan)

What is NPS?

NPS or National Pension Scheme is a social security scheme introduced by the Government of India in 2004 for government employees to facilitate a regular income after retirement. Under the scheme, you need to allocate a certain amount from your income towards a pension account during the employment period regularly. In 2009, it was made available to all individuals.

What is PPF?

PPF or Public Provident Fund was launched in 1965 by the Government of India to help unorganized workers (who are not covered under EPF) build their retirement corpus. PPF is a long-term investment option with sovereign guarantee. Now, any Indian resident can invest in PPF.

What is SIP?

SIP or Systematic Investment Plan is a way to invest in securities where you can invest a fixed amount periodically in a specific fund. Mutual Funds SIP is where you can invest a fixed amount periodically in mutual fund schemes. The amount mandated for financing will be debited from your registered bank account every month to buy units of the mutual fund you opt to invest in.

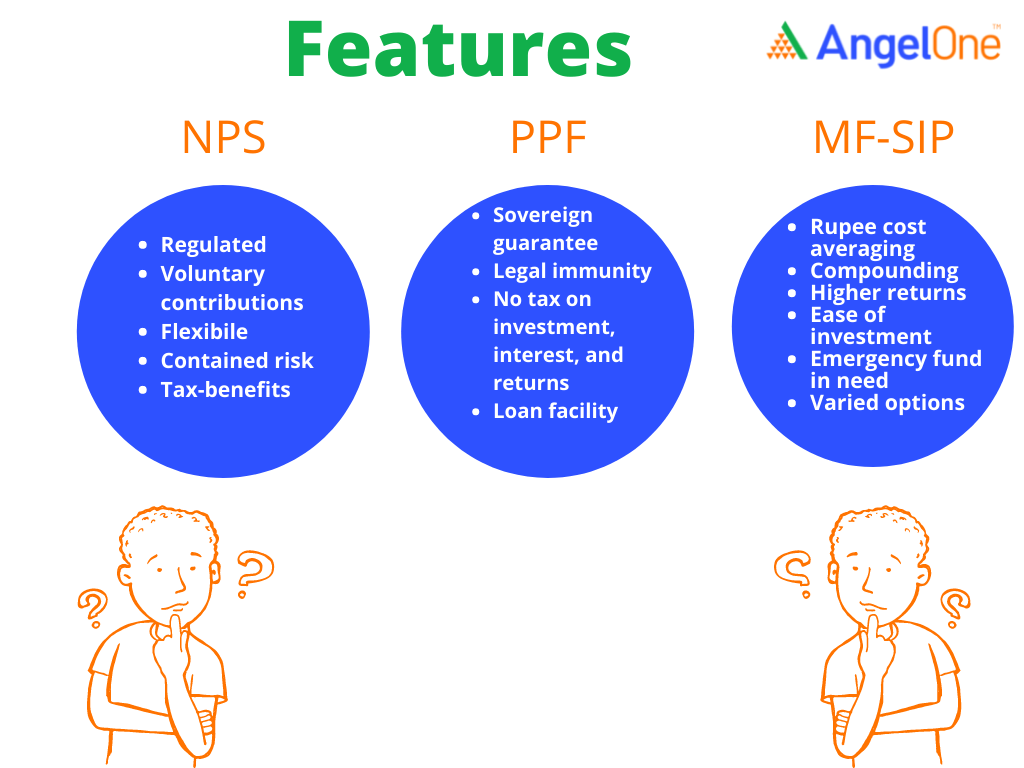

Features of NPS, PPF, and SIP

Comparison of NPS, PPF, and SIP

| Criteria | NPS | PPF | SIP |

| Return rate | Market-linked/ Debt-linked based on the scheme chosen | Floating Rate

Currently 7.1% (as of Mar-22) |

Market-linked/ Debt-linked based on the scheme chosen |

| Interest calculation | depends on the NAV at the point of calculation | Calculated on monthly basis between the 5th and last day of the month. (if fresh deposits are made before the 5th of each month, you get the interest for that month on that deposit. Otherwise, interest is calculated on the previous balance) | depends on NAV at the point of calculation |

| Returns | At the time of maturity or retirement, you will be eligible to withdraw up to 40% of the total corpus. The remaining portion of the corpus will get credited monthly to your account in the form of a pension.

|

Total corpus can be withdrawn in lumpsum | Total amount invested along with the returns can be collected in lumpsum |

| Security | Governed by PFRDA (Pension Fund Regulatory and Development Authority), Government of India | Backed by Government of India | Governed by SEBI |

| Lock-in Period | Till superannuation or 60 years of age | 15 years | No lock-in except for ELSS- Equity Linked Savings Scheme ( 3 years) |

| Extension | Till 70 years of age | Yes, for a block of 5 years | Can be renewed at the end of the term of the scheme |

| Eligibility | All Indian citizens between the age of 18-65 years | No age criterion.

All resident Indians. Minors less than 18 years to apply under parents/designated guardianship

|

No age criterion. Minors less than 18 years to apply under parents/designated guardianship |

| Minimum Investment | ₹ 1000/year

(If the minimum contribution is not made to the NPS account, then the account will become dormant. To revive the dormant NPS account, you will have to pay a penalty of ₹ 100 every year along with minimum contributions. Point-of-Presence (POP) charges will also be added for unfreezing the NPS account)

|

₹ 500/year.

(If you do not invest a minimum amount of ₹ 500 in a single financial year, your account will become inactive. You can revive the account by paying a penalty of ₹ 50 (for every financial year your account has been inactive) and a minimum deposit amount of ₹ 500)

|

Can be as low as ₹100/month depending on the scheme |

| Maximum Investment | No limit for salaried, Up to 20% of Gross Total Annual Income for self-employed

|

₹ 1.5 lakh/year | No limit |

| Tax Benefits |

|

up to ₹ 1.50 lakh under Section 80CCE of the IT Act.

|

up to ₹ 1.50 lakh on investments made towards ELSS in a financial year under section 80CCE of Income Tax Act, 1961 |

| Partial Withdrawal | Cannot exceed 25% of the total investment at the point of withdrawal.

(can be done only after 3 years from the end of the financial year of the beginning of investment)

|

Only one partial withdrawal per year.

(can be done only after 5 years from the end of the financial year of the beginning of investment)

|

No limit

Exception: No withdrawal will be allowed in ELSS schemes during the lock-in period of 3 years |

All the products have their unique strengths and weaknesses. Now that you have a ready reckoner to compare the features of NPS, PPF, and SIP, choose your investment product weighing the pros and cons considering your risk appetite, length of your investment horizon, how much corpus you want to accumulate, and all other factors. We suggest you make your research thorough and choose the investment option that aligns with your needs of retirement plan.

Disclaimer: This blog is exclusively for educational purposes and does not provide any advice/tips on Investment or recommend buying and selling any stock.