Mutual funds are some of the most well-known investment vehicles since they assist investors in achieving their financial goals. Additionally, mutual funds are tax-efficient investments. Investing in fixed deposits has significant disadvantages, particularly in the highest tax bracket, as interest is added to taxable income and taxed at your income tax slab rate. This is an area where mutual funds do very well. When you invest in mutual funds, you get access to professional money management and tax-efficient returns.

How Do Mutual Funds Earn Returns?

Mutual funds provide investors with two types of returns: dividends and capital gains. Dividends are paid from the company's profits if any. When businesses have extra cash, they may choose to distribute it to shareholders in dividends. Dividends are paid in proportion to the number of mutual fund units an investor holds.

A capital gain occurs when an investor realizes a profit when the selling price of security they own exceeds the buying price. Capital gains are realized due to the mutual fund units' price appreciation. Both capital gains and dividends are taxable in the hands of mutual fund investors.

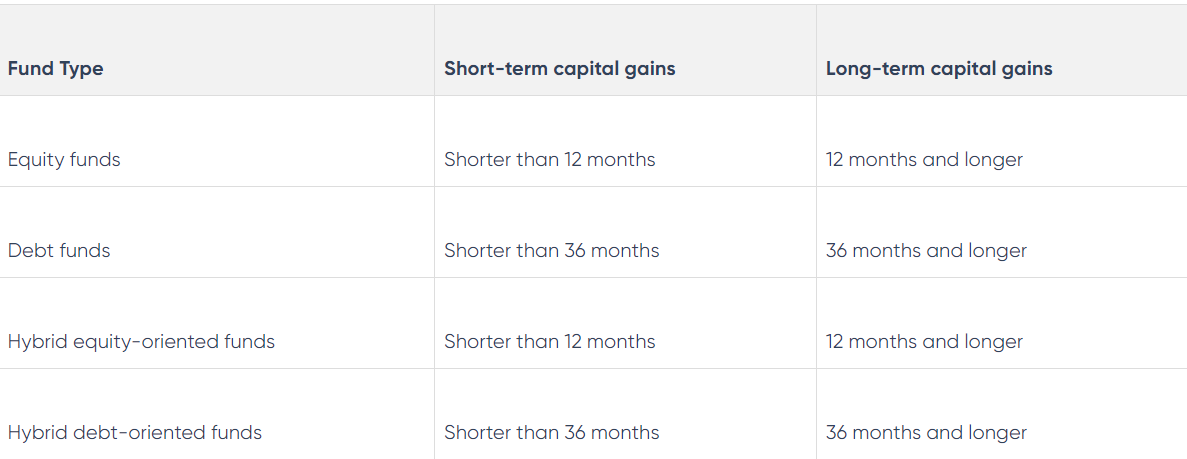

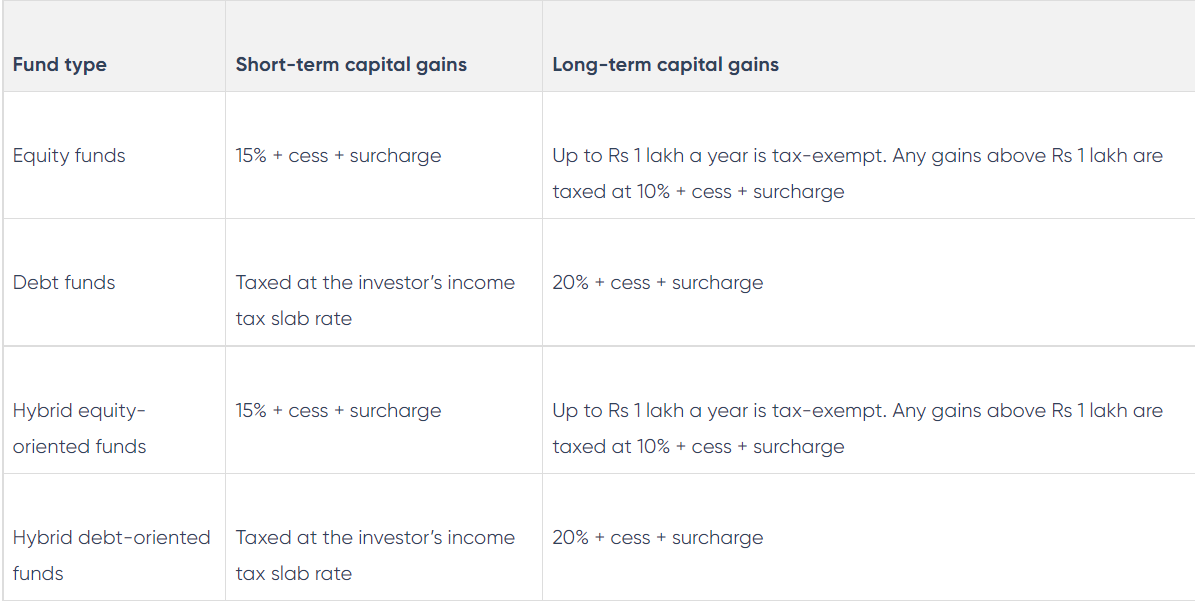

Mutual funds' short- and long-term capital gains are taxed differently.

Capital Gains Taxation on Equity Funds

Equity funds are mutual funds with a minimum equity exposure of 65 per cent. As previously stated, you earn short-term capital gains when you redeem your equity fund units during a one-year holding period. These gains are taxed at 15%, regardless of your tax bracket.

You earn long-term capital gains by selling your equity fund units after a one-year or more extended holding period. Capital gains of up to INR 1 lakh per annum are tax-free. Any long-term capital gains exceeding this threshold are subject to LTCG tax at a rate of 10%, with no indexation advantage.

Capital Gains Taxation on Debt Funds

Debt funds are funds with exposure to the debt of more than 65 per cent. As noted previously, you earn short-term capital gains upon redeeming your debt fund units during a three-year holding period. These profits are included in your taxable income and are taxed at your marginal rate of income tax.

When you exit units of a debt fund post a three-year holding period, you realize long-term capital gains. Post indexation, these gains are taxed at a flat 20%. Additionally, you are assessed applicable cess and surcharges on tax.

Capital Gains Taxation on Hybrid Funds

Capital gains on hybrid or balanced funds are taxed differently depending on the portfolio's equity exposure. If the fund scheme's equity exposure exceeds 65 per cent, it is taxed as an equity fund; otherwise, debt fund taxation regulations apply.

Therefore, it is crucial to understand the equity exposure of the hybrid fund you invest in; otherwise, you may get a rude shock at unit redemption. The following table summarizes the capital gains tax rate applicable to mutual funds:

Capital Gains Taxation on SIP Investments

SIPs are a type of investment in mutual funds. They are structured to invest a little sum in a mutual fund scheme periodically. Investors have the option of selecting their investment frequency. Weekly, monthly, quarterly, bi-annually, or annually are acceptable frequencies.

Let's assume that you make a one-year SIP investment in an equities fund and redeem your entire investment after 13 months. Each SIP instalment entails purchasing a specified number of mutual fund units. These units are redeemed on a first-in, first-out basis.

In this situation, the units purchased initially through the SIP are held for a lengthy period (at least one year), and you earn long-term capital gains on them. No tax is due if your long-term capital gains are lower than INR 1 lakh.

However, beginning with the second month, you earn short-term capital gains on the units purchased through the SIPs. These gains are taxable at 15% regardless of your tax bracket. You will be responsible for the appropriate cess and fee.

Tax on Securities Transactions (STT)

Apart from dividends and capital gains taxes, there is also a Securities Transaction Tax (STT). The government (Ministry of Finance) charges a 0.001 per cent STT when you purchase or sell equity fund units or hybrid equity-oriented fund units. No STT applies to the selling of debt fund units.

Conclusion

The more time you keep your mutual fund units, the more tax effective they become. Long-term capital gains are taxed lower than short-term capital gains.