Investors come in various shades. Some prefer high-risk-high-reward investments, while others are more comfortable investing in low-risk, fixed-income investment options. For the latter category of investors, there are many types of government securities in India that may be ideal investment choices. They bear exceptionally low risk, and in addition to this, they also come with the advantage of guaranteed income or returns on investment. For risk-averse investors who seek low-risk investment products, there are different types of government securities available in the Indian financial markets.

What are government securities?

Government securities or G-Secs are essentially debt instruments issued by a government. These securities can be issued by both the central government and the state governments of India. When you invest in such options, you generally gain a regular interest income. Since these investment products are backed by the government, the risk associated with them is almost negligent.

What are the different types of government securities available?

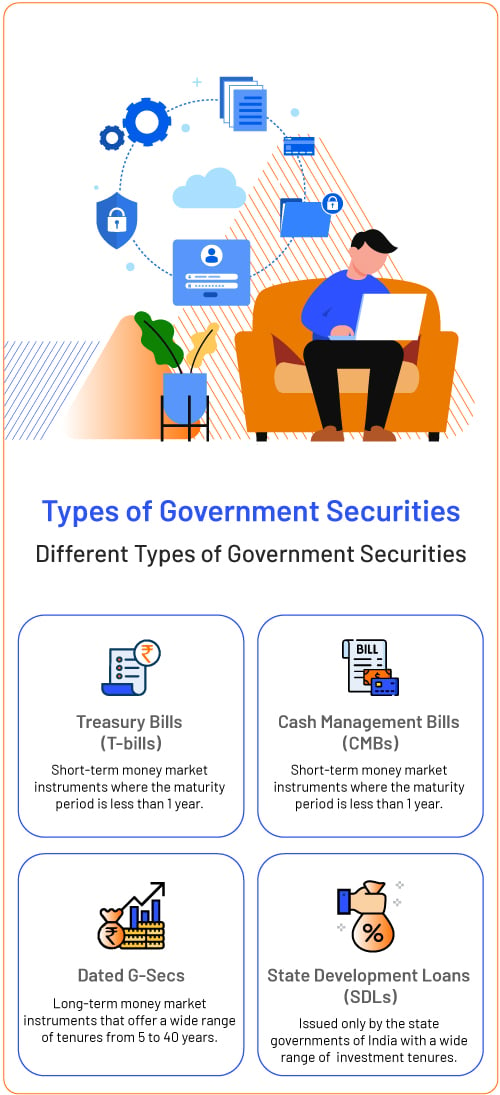

If you’re interested in investing in such low-risk products, there are many types of government securities in India for you to choose from. They can broadly be classified into four categories, namely Treasury Bills (T-bills), Cash Management Bills (CMBs), dated G-Secs, and State Development Loans (SDLs).

Treasury bills (T-bills)

Treasury bills or T-bills are issued only by the central government of India. They are short-term money market instruments, which means that their maturity period is less than 1 year. Treasury bills are currently issued with three different maturity periods: 91 days, 182 days, and 364 days. T-bills are quite unlike other kinds of investment products available in the financial markets.

Most financial instruments pay you interest on your investment. The Treasury bill, on the other hand, is what is commonly known as zero-coupon securities. These securities do not pay you any interest on your investment. However, they’re issued at a discount and are redeemed at face value on the date of maturity. For instance, a 182-day T-bill with a face value of Rs. 100 may be issued at Rs. 96, with a discount of Rs. 4, and redeemed at the face value of Rs. 100.

Cash Management Bills (CMBs)

Cash Management Bills (CMBs) are relatively new to the Indian financial market. They were only introduced in the year 2010 by the government of India and the Reserve Bank of India. CMBs are also zero-coupon securities and are very similar to Treasury bills. However, the maturity period is the one major point of difference between the two types of government securities. Cash Management Bills (CMBs) are issued for maturity periods less than 91 days, making them an ultra-short-term investment option. CMBs are strategically used by the government of India to meet any temporary cash flow requirements. From the investor’s point of view, Cash Management Bills can be used to meet short-term goals.

Dated G-Secs

Dated G-Secs are also among the different types of government securities in India. Unlike T-bills and CMBs, G-Secs are long-term money market instruments that offer a wide range of tenures, starting from 5 years and going all the way up to 40 years. These instruments come with either a fixed or a floating interest rate, also known as the coupon rate. The coupon rate is applied on the face value of your investment and is paid to you on a half-yearly basis as interest.

The government issues these funds to finance a fiscal deficit.

The PDO or the Public Debt Office of the Reserve Bank of India serves as the depository or registry of government securities. Also, it deals with the repayment of the principal amount on maturity, the coupon payments, and the issuance of these securities.

Dated securities are so named as the date of maturity is expressed explicitly in these securities. Also, the interest rate might be expressed as the coupon rate in these securities.

Mostly, commercial banks and other institutions invest in and hold these securities, the former in the form of Statutory Liquidity Ratio (SLR). These securities are also tradeable in the stock market. They can be stowed as collateral to borrow under market repo or even under the Liquid Adjustment Facility (LAF) of the RBI. These securities can be used as collateral for the Securities Guarantee Fund (SGF) and also for Collateralized Borrowing and Lending Obligation (CBLO).

The secondary market for dated government securities is also quite liquid and vibrant. These securities can be traded on the RBI’s Negotiated Dealing System -Order Matching system, commonly known as the NDS-OM, NDS-OM Web and Stock exchanges, and Over-the-counter. Short selling is also allowed to an extent but under certain restrictions.

There are around 9 different types of dated G-Secs currently issued by the government of India. These are listed below.

- • Fixed-Rate Bonds - These are bonds with a fixed coupon rate. The rate does not vary for the entire tenor of the bond, that is, till it matures.

- • Floating Rate Bonds - These are bonds without a fixed coupon rate. The rate is re-set at previously announced intervals, and a spread over the base rate is also added.

- • Capital Indexed Bonds - These are bonds with an interest rate that is a fixed percentage over an acceptable inflation index, providing an effective shield to the principal amount against inflation to the investors.

- • Inflation Indexed Bonds - These are bonds with an interest rate that is a fixed percentage over the wholesale price index (WPI) or consumer price index (CPI), providing an effective shield to both the principal as well as the coupon amount against inflation to the investors.

- • Bonds with Call/Put Options - These are bonds issued with an option wherein the issuer can ‘Call’ or buy back the bond, or the investor can ‘Put’ or sell the bond to the issuer within the currency period of the bond.

- • STRIPS - Separate Trading of Registered Interest and Principal of Securities. STRIPS let investors hold and trade the individual interest and principal components of eligible Treasury notes and bonds as separate securities.

- • Sovereign Gold Bonds - These are the securities wherein their prices are linked to the commodity prices viz gold.

- • Other special securities e.g.: 75% Savings (Taxable) Bonds, 2018

- • Zero-Coupon Bonds– These bonds are redeemed at par and issued at a discount to face value, hence, the difference between the issue price and the redemption price is the returns gained by the investor. Although these bonds are not susceptible to reinvestment risk but are susceptible to interest rate risks, thereby making their prices extremely volatile.

Tap Stocks– These are gilt-edged securities that are released into the market slowly when the predetermined market price levels are reached and have not been completely subscribed. They are of two kinds- Short tap stocks are short-dated stocks, and Long tap stocks are lengthier dated stocks.

Partly Paid Stocks– These are the stocks wherein the principal amount is paid in installments over a fixed tenure. It meets the needs of both government and investors when the former does not need funds immediately, and the latter has a regular flow of funds.

State Development Loans (SDLs)

As the name implies, SDLs are issued only by the state governments of India to fund their activities and to satisfy their budgetary needs. These types of government securities are very similar to dated G-Secs. They support the same repayment methods and come with a wide range of investment tenures. The only difference between dated G-Secs and SDLs is that the former is issued only by the central government, while the latter is issued solely by the state governments of India.

Conclusion

Given that there are many different types of government securities in India, it’s easy to choose the best alternative for your portfolio. Since the investment tenure is one of the main points of difference between these G-Secs, you can choose the product that aligns best with your investment timeline. In addition to offering you guaranteed income or returns, investing in government securities also helps you balance the risk factor in your investment portfolio.

Explore the Share Market Prices Today

| Tata Steel share price | Adani Power share price |

| PNB share price | Zomato share price |

| BEL share price | BHEL share price |

| Infosys share price | ITC share price |

| Jio Finance share price | LIC share price |