What is a trend line?

Trend lines are distinctive lines that traders draw on charts to link a sequence of prices. The trader can then utilize the resulting line to get a solid indication of the potential direction of an investment's value movement. The trendlines are drawn by connecting the significant support and significant resistance or significant higher highs and lower lows.

The trader can then utilize the resulting line to get a solid indication of the potential direction of an investment.

What’s the use of the trend line?

When it comes to trading and investing, the first and foremost step is to identify the trend. One can always get a better risk to reward when he/she makes his/her investments or takes a trade along with the side of the trend. Trendlines are very important when it comes to technical analysis.

When it comes to drawing a trendline, an analyst must have at least 3 points i.e. support and resistance for stronger confirmations. The trendline can be drawn on any timeframe and this quality makes the trendline a universal tool.

How to access the Trend Line tool?

On any charting platforms you use, most of them have Trend Line on the left column as a second option or one can access the Trend Line tool by simply pressing Alt + T. Look at the picture attached below for a better understanding.

Now that we have understood the meaning and how to access the Trend Line, let’s hop on to how to use Trend lines.

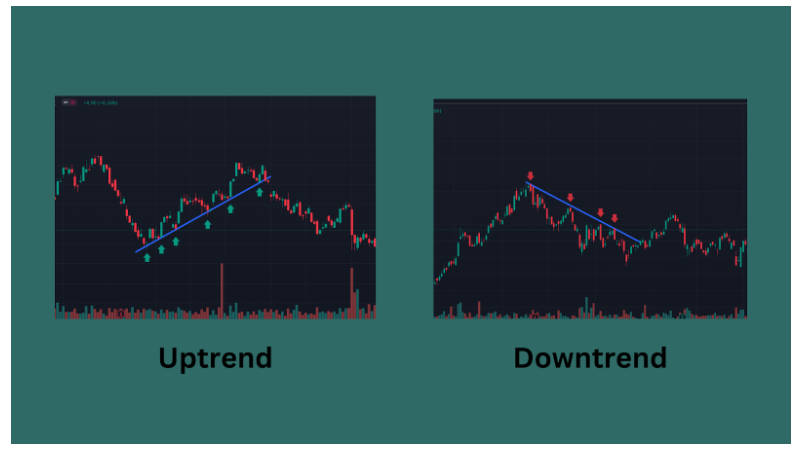

Once you have accessed the Trend Line tool, you need to look for 3 consistent support/resistance or higher highs/lower lows for a stronger confirmation. Start drawing a trendline from the first point, connecting the second one all the way to the third point. Once we are done with this, we will come to know the trend at that particular time frame. Now extend the Trend Line from the third point to some extent and wait for the price to come near the drawn Trend Line.

If there is any bullish candle pattern or any other bullish sign formed, one can initiate a buy once it’s confirmed with his/her other tools in the trading set-up. Similarly, If there is any bearish candle pattern or any other bearish sign is formed, one can initiate a sell once it’s confirmed with his/her other tools in the trading set-up. Refer to the pictures attached below for a better understanding.

Breakout trading with trendlines-

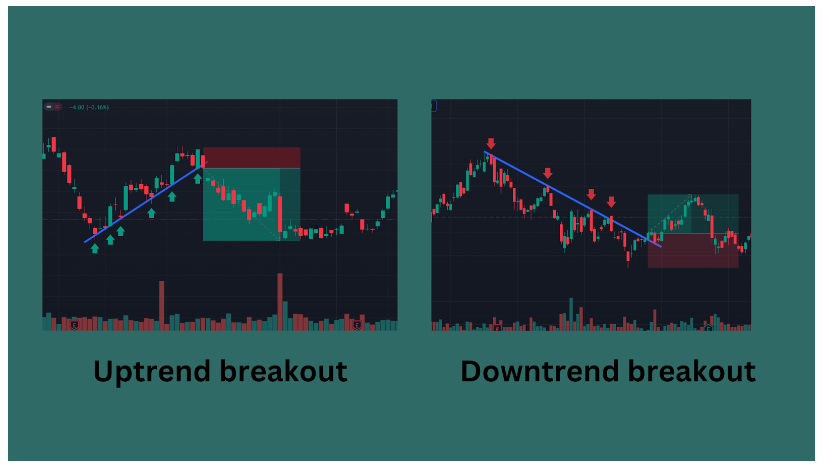

Now that we have understood how to identify trends with the help of a Trend Line, let’s understand an advanced concept that is breakout trading with a trend line.

It’s true that a trend is your friend, but it’s only a friend until its bends. We understand that we need to take a trade or make an investment along with the trend but what if the trend is changed?

Here comes the breakout trading.

Breakout Trading is a type of trading where one initiates a trade when the stock has broken the consolidation phase or a Trend Line. Once there is a breakout in an uptrend, one can initiate ‘sell’ and once there is a breakout in a downtrend, one can initiate a ‘buy’. Refer to the pictures below for a better understanding.

One should not depend solely on the breakout of Trend Lines as there is a high probability that it will be a fake breakout. Breakout with other strong confirmations can help to take great trades.

Limitations of Trend Lines-

Although Trend Lines is one of the most used tools when it comes to charting, it comes with its respective limitations. And the major limitation is one needs to readjust the trendline when more data comes in. One can’t forever rely on the Trend Line drawn, a new higher high or lower low comes with a demand for readjustment.

The second limitation is that should the Trend Line be drawn connecting the closing price of the candles or the highs/lows.

The third limitation specifically talks about smaller time frames; that is, Trend Lines drawn on smaller time frames tend to break very frequently as they have less quantity traded as compared to Trend Lines drawn on a larger time frame. The more the number of shares traded, the stronger the Trend Line.

Final words

Now that we have learned about one of the most important and basic parameters of analyzing a stock technically, it’s time to open Demat Account with Angel One and make healthy investment decisions.