As finance is evolving and becoming more complex, understanding the true potential of a stock needs the use of specialised tools. The leverage ratios are one such important tool. They indicate the health and financial stability of a company.

You as an investor can use financial leverage ratios to understand two different perspectives about a company. On one hand, they show the ability of a company to repay its long-term liabilities if it has to liquidate its assets, i.e. solvency of the company. On the other, they indicate the leverage a company gets by using its debt.

In this blog, you can learn all about leverage ratios and why they are so important for you as a tool for fundamental analysis.

What Is Leverage Ratio?

To put it simply, leverage ratios are financial tools that gauge a company's financial structure through its balance sheet. These solvency ratios show the cushion provided by assets against long-term debt. However, they also show the potential financial benefits if the debt is optimally utilised.

But first, you should understand how financial leverage works. Let’s take an example.

Suppose Company A takes a long-term loan of ₹10 lakh to buy machinery and pays 8% p.a. interest on it. Clearly, the machinery is an asset for the company. If the goods produced from this machinery provide 20% of the machinery cost as profits annually, it means that the capital and reserves of the company increase by 12% (20 - 8) annually.

Do you see, how the company can increase its assets only using external debt? This is called financial leverage. Leverage ratios are critical to analysing the health of a business and how likely it is to remain afloat even in adverse circumstances. As an investor, you should check these ratios before making any investment decision.

Types of Leverage Ratios Used in Stock Analysis

Now that you have become familiar with the concept of leverage ratios, it is time to learn about some of the key ratios that you should use to analyse your stocks.

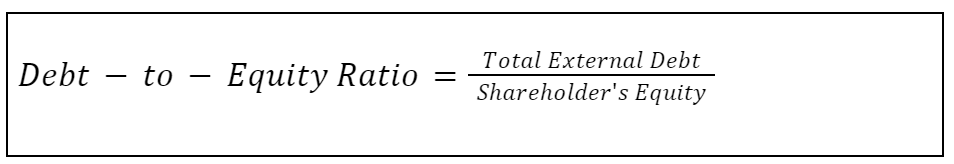

1. Debt-to-Equity Ratio

The debt-to-equity ratio (D/E ratio) is the one that is most used. To be precise, it gives the ratio for the liabilities side of the balance sheet. By comparing external debt with shareholder equity, you can see whether the company uses more debt to finance its assets.

The ideal debt-to-equity ratio (D/E) varies depending on industry, company size, and risk tolerance. However, a generally accepted range is between 0.5 and 1.5.

- If a company maintains the ratio between these levels, it shows the optimum utilisation of both resources.

- A higher D/E ratio means a company has overborrowed. However, it may not show a doomsday if the company strategically uses these funds to achieve high growth.

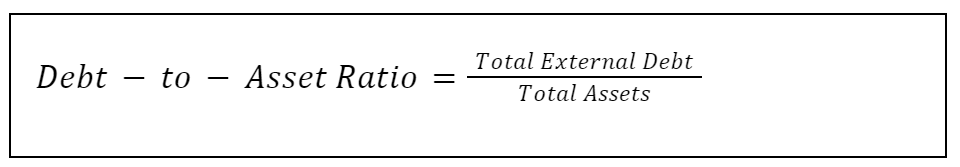

2. Debt-to-Assets Ratio

A Debt-to-Assets ratio (D/A ratio) is used to show the percentage of assets financed using debt.

- It shows the extent to which the company’s assets are financed using external debt.

- If a company has a higher D/A ratio, its potential to borrow further is reduced, limiting growth.

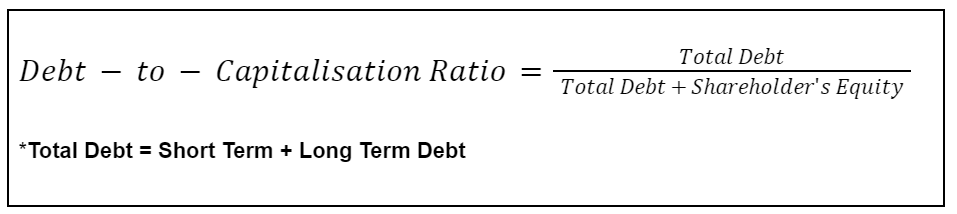

3. Debt-to-Capitalisation Ratio

If you want to measure the level of debt in the company’s financial structure, you can use the Debt-to-Capitalisation ratio. This leverage ratio formula is:

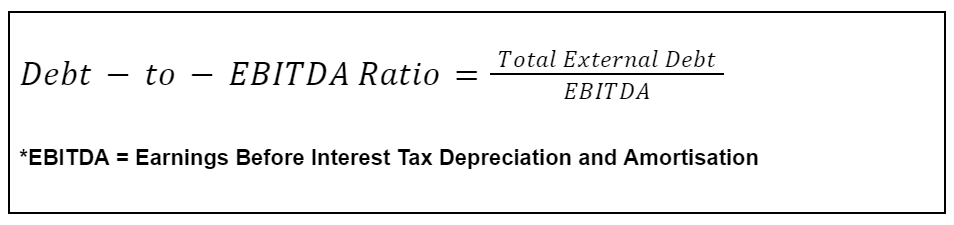

4. Debt-to-EBITDA Ratio

Remember the example we took earlier to understand about financial leverage? The company uses borrowed funds to build assets that increase the company’s earnings. And what exactly does the company use to repay this debt? Earnings right?

The debt-to-EBITDA ratio shows how many years of earnings are required to repay the debt. It also shows whether the debt has caused additional burden on the company’s resources, or generated enough value. This leverage ratio formula is:

- Comparing the debt burden to earnings can give you a fair idea of the company’s solvency.

- As an investor, it can be very important to check this ratio.

- A higher ratio shows that the company is not generating enough earnings from the debt.

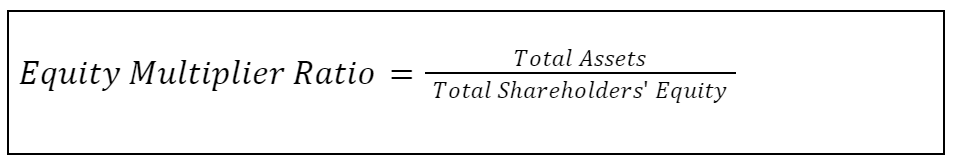

5. Equity Multiplier Ratio

The equity multiplier ratio uses assets and debt to ascertain whether the company is relying more on equity or borrowed funds to build its assets.

A higher equity multiplier shows that a company uses a higher proportion of debt to finance its assets.

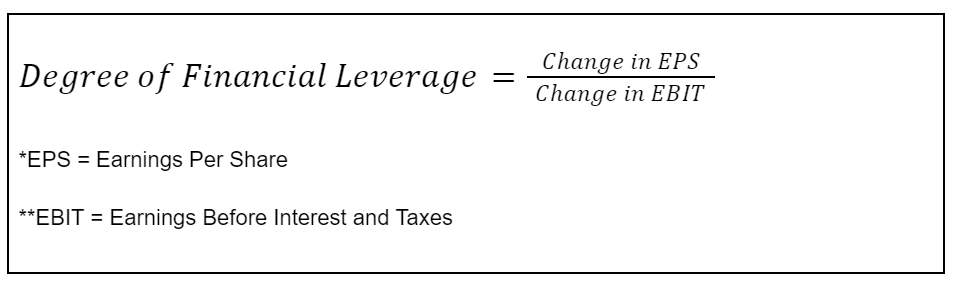

6. Degree of Financial Leverage (DFL)

One of the most important leverage ratios is the DFL or Degree of Financial Leverage. It shows the level of effect that debt has on the earnings of a business. The leverage ratio formula is:

It shows the fluctuation in earnings due to the borrowings of a company. The percentage change allows investors to assess whether the company is earning more even after paying the interest amount.

Why Are Leverage Ratios Important for Stock Investors?

You might ask now, as an investor, why should you use a leverage ratio? Here are the main reasons:

- It helps you assess the financial health of the company.

- Understanding the capital structure can help you predict whether the company will remain profitable or not.

- Risk and return are in a constant tango in the stock markets. Understanding what a leverage ratio means can help you notice a significant risk within time.

- You can compare different stocks and choose the best ones that balance your portfolio while providing high returns.

How to Interpret Leverage Ratios?

While financial numbers are seen as a reliable measure, it's crucial to interpret them within the right context. The same is true for financial leverage ratios. Many factors affect the interpretation of the ratio. You should keep the following in mind while using leverage ratios for decision-making:

- Sector/Industry type: It is important to consider the type of industry a company belongs to. Some industries are capital-heavy and need more borrowing. The ideal ratios can vary from industry to industry, and it is important to choose the right peers to compare the leverage ratios.

- Company’s financials: If the financial statements show high growth, it is possible to have a higher leverage ratio. However, it can be a problem if the company has a stable income and a high financial leverage.

- Historical track record: While reading the leverage ratios of a company, it is important to compare them with past years as well. Suppose a company has a high leverage ratio, but it has dropped significantly in comparison to the previous year, It shows an improvement rather than an alarm.

- Economic conditions: Companies with a high financial leverage are ideal in a growing economy. But, they may face higher default risk during times of recession.

In Conclusion

If you truly want to understand the financial health of a company to make correct investment decisions, you should use leverage ratios. To become an informed investor, you should interpret these ratios correctly and compare them to the industry peers. It will help you ace your investment game.

Now that you understand how leverage ratios can help you make effective stock investments, open your Demat account today with Angel One to start your investment journey!