The advance-decline ratio (ADR) is a significant indicator in market analysis, measuring the proportion of advancing stocks to declining stocks on a specific stock exchange. The ADR provides a comprehensive overview of market sentiment and potential trends by calculating the ratio of higher-closing stocks to lower-closing stocks. This article explores the details of the Advance/Decline Ratio, its uses, and its importance in recognising market opportunities.

What Is the Advance/Decline Ratio (ADR)?

One popular market-breadth indicator in technical analysis is the advance-decline ratio (ADR). To calculate the ADR, the number of equities that ended higher and lower than their closing prices of the previous day is compared. The number of advancing stocks is divided by the number of dropping stocks

How the Advance/Decline Ratio (ADR) Works?

Investors often compare the moving average of the ADR with the performance of major market indexes such as the Nifty Bank or Nifty 50. This comparison helps determine if a few companies drive the overall market performance.

Such insights can clarify the reasons behind a market rally or sell-off. A low ADR can indicate an oversold market, while a high ADR can suggest an overbought market. Therefore, the ADR can signal potential changes in market direction.

Recognising directional changes is crucial for successful technical analysis strategies. The ADR is a valuable metric that helps traders quickly gauge potential trends or the reversal of existing trends.

Although the ADR provides a snapshot of the ratio of advances to declines on its own, combining it with other metrics can yield powerful financial insights. Solely relying on the ADR for trading is uncommon.

The ADR can be calculated over various periods, such as one day, week, or month. Analysts and traders appreciate the ADR because it's a convenient ratio that is easier to communicate than absolute numbers (for example, saying 15 stocks ended higher while 8 declined is more cumbersome than saying the ADR is 1.88).

Types of Advance/Decline Ratios (ADR)

There are two primary ways to use advance-decline ratios: as standalone numbers and by examining their trend. As a standalone number, the ADR helps reveal whether the market is overbought or oversold. By examining its trend, one can determine whether the market is bullish or bearish.

A high ADR might indicate an overbought market, while a low ADR could mean an oversold market. Conversely, a steadily increasing ADR suggests a bullish trend, and a decreasing ADR indicates a bearish trend.

The Advance/Decline (A/D) Line Formula

Plotting the difference between the number of advancing and falling stocks each day is the Advance/Decline (A/D) Line indicator. The A/D Line formula is as follows:

A/D=Net Advances+Previous Advances

Net Advances are the difference between the number of advancing stocks and declining stocks each day. Previous Advances are based on the indicator reading of the prior day.

The A/D Line is a cumulative indicator that illustrates whether more stocks are advancing or dropping, giving insights into the market's mood. This statistic validates price movements in key indices. When divergences occur, it might notify traders about impending reversals.

Example of an Advance/Decline Ratio

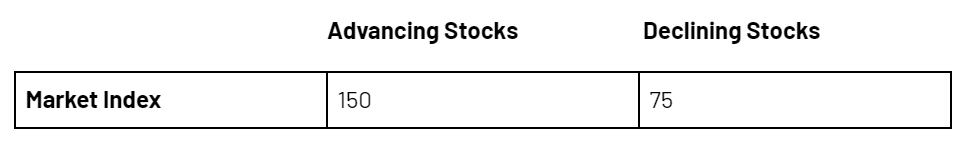

Take a look at the following table, which shows how many stocks for an imaginary stock market index were rising and falling on a given day:

To calculate the Advance/Decline Ratio (ADR) for the Market Index:

- ADR = Advancing Stocks / Declining Stocks

- ADR = 150 / 75

- ADR = 2.0

Interpreting the Advance Decline Ratio

Understanding market mood and possible trends may be gained by interpreting the advance-decline ratio. A high ADR denotes a robust market with more rising stocks and a favourable outlook. On the other hand, a low ADR denotes a sluggish market with more equities in decline, signalling a gloomy outlook. Traders can determine if the market is in a bullish or bearish phase and adjust their strategy accordingly by examining the ADR's trajectory over time.

How to Calculate the Advance-Decline Ratio Line?

The following actions must be taken in order to calculate the Advance-Decline Ratio Line:

- Find out how many stocks are rising and falling on a given day.

- Subtract the number of decreasing stocks from the number of advancing stocks to find the Net Advances.

- Use the Net Advances as the initial value for the indicator if this is your first time computing the A/D Line.

- If the Net Advances are positive, compute the Net Advances for each day going forward and add the amount to the A/D Line value from the day before. If the Net Advances are negative, deduct them.

- To compute and update the Advance Decline Ratio Line, repeat steps 1-4 on a daily basis.

These instructions will let you track the A/D Line over time and make good use of it as a market analysis tool.

What Can You Learn From the Advance Decline Ratio Line?

The Advance Decline Ratio (ADR) Line helps validate the strength of a trend and offers insights into the general sentiment of the market. This indicator indicates whether the bulk of stocks are driving the general direction of the market. When the market is increasing and experiencing widespread involvement, the ADR Line rises; when the market is dropping, the ADR Line sinks, indicating a severe downturn. Divergences between the ADR Line and the market trend may indicate impending trend reversals, providing traders and investors with important information.

Differentiation Between the Arms Index (TRIN) and the Advance-Decline Ratio Line

The Advance Decline Ratio Line is a longer-term indicator that shows the equilibrium between rising and falling equities over time. As an indicator with a shorter time horizon, the Arms Index (TRIN) contrasts the ratio of rising stocks to the ratio of advancing volume. Because these two indicators have different computations and periods, they offer diverse information, which makes them complementary instruments for market analysis.

Drawbacks of Using the Advance-Decline Ratio Line

There are various restrictions with the Advance Decline Ratio Line. Because of the existence of small, speculative businesses that eventually fail or become delisted, it could not always offer reliable readings for NASDAQ stocks. Furthermore, the ADR Line assigns equal weight to each stock, which makes it a more accurate indicator for small- to mid-cap companies than for large- or mega-cap companies. It is essential to remember that the ADR Line should not be the only technical indicator employed while making trading choices.

Conclusion

The Advance Decline Ratio Line provides information on the market's mood and the trend's strength. Seeing probable trend reversals and validating the strength of current trends aids traders and investors in making well-informed decisions. Despite some drawbacks, the Advance-Decline Ratio Line may be valuable for investors looking to make stock market choices when combined with other technical indicators and fundamental analysis.

Learn Free Stock Market Course Online at Smart Money with Angel One.