Managing investments effectively is crucial for building wealth and achieving financial goals. One of the most critical steps in this process is portfolio management, which involves selecting, maintaining, and adjusting a mix of assets that aligns with your risk tolerance, investment horizon, and financial objectives. With Angel One, you can efficiently manage your portfolio using a user-friendly interface that simplifies the investment experience

What is a Portfolio?

A portfolio is a collection of financial assets like stocks, bonds, mutual funds, and other securities held by an investor. It provides a detailed overview of all your holdings and positions, allowing you to track your investments efficiently. However, keeping track of multiple assets manually can be overwhelming. Angel One’s Portfolio feature simplifies this by consolidating all your investments into a single view.

Key Terms in Your Portfolio

Understanding the terms in your portfolio is essential for effective management.

- Gain/Loss: Shows both overall and daily gains/losses for your investments.

- Invested value: The total amount invested in a specific asset or product.

- Current value: The current market value of your invested assets.

- Symbol: The ticker symbol of the security.

- Quantity: The number of units held in a specific asset.

- Returns: For mutual funds, you’ll see both absolute returns and XIRR (Extended Internal Rate of Return), which provides an annualised return rate.

- Average price: The mean price of the securities bought or sold.

- LTP (Last Traded Price): The price at which the last trade occurred.

Why Reading Your Portfolio Is Important

- Transaction verification: Ensures all trades are correctly debited or credited.

- Performance tracking: Allows you to monitor gains and losses, helping you make better investment decisions.

- Investment decisions: Provides insights that can guide future investment actions based on past performance.

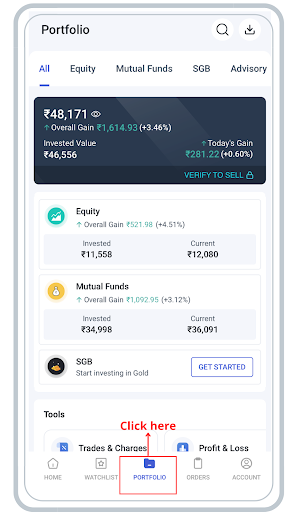

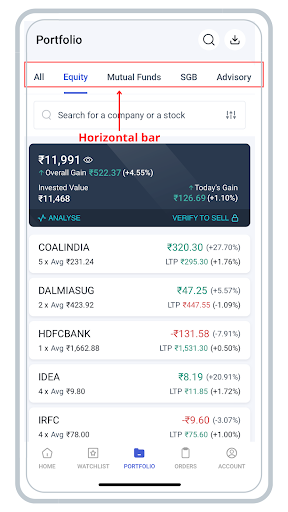

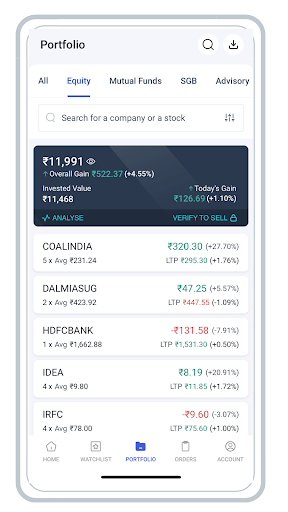

How to View Your Portfolio on Angel One

Viewing your portfolio on Angel One is quite simple. Here’s a quick guide to get you started:

1. Log in to the Angel One app.

2. Navigate to the ‘Portfolio’ section.

3. Select the segment (Equity, Mutual Funds, etc.) you wish to view from the top horizontal bar.

4. Explore your portfolio to see a consolidated view of all your investments.

This eliminates the need to juggle multiple tabs, allowing you to manage your investments seamlessly.

Understanding Portfolio Management

Portfolio management blends art and science, involving strategic investment decisions across diverse asset classes. It aims to optimise returns by balancing risk and reward, ensuring the investor's portfolio is aligned with their financial goals. A well-managed portfolio is diversified, including various asset classes such as stocks, bonds, mutual funds, and more, tailored to the investor's risk appetite.

Key Aspects of Portfolio Management

- Assessment of financial goals: A thorough assessment of financial goals is the foundation of effective portfolio management. This involves defining specific, measurable objectives that align with an investor's aspirations, such as saving for retirement, funding a child's education, or buying a home. By clearly identifying these goals, investors can create a focused investment strategy that prioritises the allocation of resources toward achieving them.

- Diversification: Diversification is a critical strategy in portfolio management that involves spreading investments across various asset classes, such as stocks, bonds, real estate, and commodities. The primary objective of diversification is to reduce risk; by not putting all your eggs in one basket, the impact of poor performance in a single asset can be cushioned by the stability of others.

- Active monitoring: Active monitoring of the portfolio is essential for optimising performance and responding to changing market conditions. This involves regularly reviewing the portfolio to assess whether it aligns with the investor's financial goals and risk tolerance. Market conditions can shift due to economic indicators, geopolitical events, or changes in interest rates, impacting the performance of various assets.

Portfolio Management Services (PMS) in India

Professional portfolio management services (PMS) provide expert guidance to help investors navigate complex markets. In India, PMS comes in two main types:

- Discretionary PMS: Offers a hands-off approach to investing, where the fund manager takes full responsibility for making investment decisions on behalf of the client. This service is tailored to the client's risk tolerance, financial goals, and investment preferences. The fund manager conducts thorough market research and analysis to identify suitable investment opportunities and builds a diversified portfolio accordingly.

- Non-Discretionary PMS: The fund manager allows clients to retain control over their investment decisions while still benefiting from the expertise of a fund manager. In this model, the fund manager provides advisory services, including market analysis, investment recommendations, and strategic insights, but the final decision on whether to buy, sell, or hold investments lies with the client. This approach is particularly appealing to investors who prefer to have a more active role in their portfolio management.

Selecting a Professional Portfolio Manager

Choosing the right portfolio management service is crucial for optimising your investments.

- Investment approach: Look for managers who focus on value and growth investing, emphasising capital preservation and identifying high-potential stocks.

- Service efficiency: Opt for PMS that provides online access, regular performance reports, and a dedicated fund coordinator to address queries.

- Competitive edge: Consider services that offer flexibility, such as no entry load, zero lock-in period, and the ability to switch strategies.

- Personalised services: The best PMS offers tailored services, including direct interactions with the fund manager, which enhance the overall investment experience.

Features and Benefits of Portfolio Management with Angel One

Angel One offers an intuitive platform that makes portfolio management accessible and efficient. The platform is designed to help investors track their holdings and make informed decisions.

Key Benefits of Angel One’s Portfolio Management:

- Customised solutions: Tailored investment strategies based on individual financial goals and risk profiles.

- Comprehensive overview: Provides detailed insights into your holdings, from equities to bonds, under one umbrella.

- Real-time tracking: Monitor your investments in real-time, helping you stay informed about market movements and portfolio performance.

- Simplified user experience: Easy-to-navigate interface that makes viewing and managing your investments hassle-free.

Understanding Portfolio Rebalancing

Portfolio rebalancing is a critical aspect of effective portfolio management. It involves adjusting the asset allocation to maintain the desired balance between different investments. For example, if your target allocation is 50% equity and 50% debt, and the market shifts this to 30% equity and 70% debt, rebalancing would involve purchasing more equity to restore the balance.

When to Rebalance Your Portfolio

- Changes in risk profile: As your risk tolerance evolves, your portfolio should be adjusted accordingly.

- New financial goals: Adding new goals, like saving for a child’s education, may require adjusting your investments.

- Approaching retirement: As retirement nears, your portfolio should become more conservative to protect against market downturns.

Steps for Effective Rebalancing

- Set a target asset allocation based on your goals and risk appetite.

- Make sure your portfolio is in line with your goal allocation by reviewing it on a regular basis.

- Adjust holdings by buying or selling assets as necessary to maintain the desired balance.

- Consider tax implications, especially for capital gains, to minimise your tax liabilities.

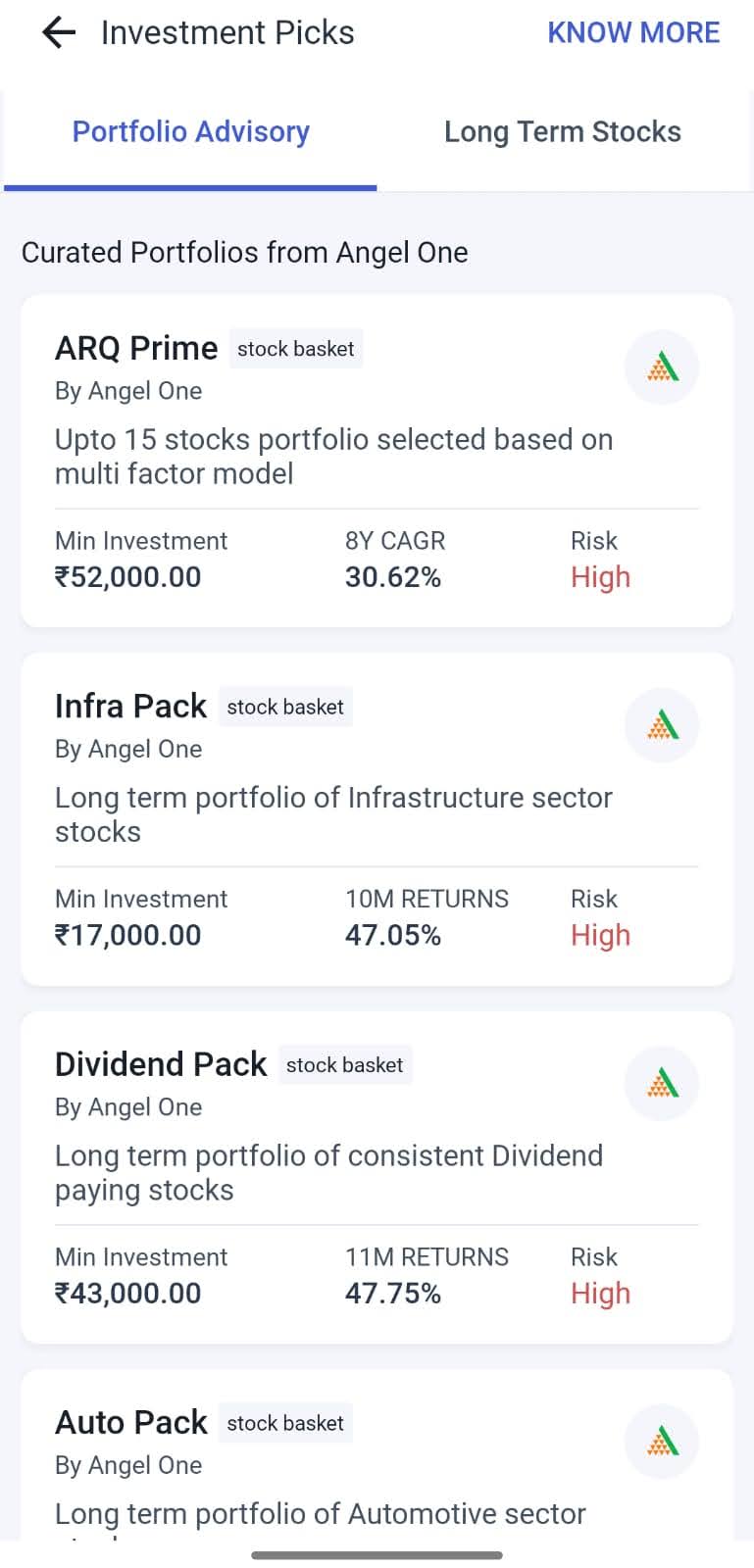

The Role of Angel One Portfolio Advisory

Effective portfolio management is essential for long-term financial success. Angel One simplifies investment management through a comprehensive and user-friendly platform designed for all investors. Angel One prioritises your financial well-being with a transparent, SEBI-registered service, that safeguards your interests.

Portfolio advisory with Angel One is not just about picking stocks; it’s a comprehensive service that covers wealth management, budgeting, savings, and more. Our advisory service simplifies stock market investments with clear guidance, empowering you to make informed decisions.

Conclusion

Effective portfolio management is essential for long-term financial success. Angel One simplifies investment management through a comprehensive and user-friendly platform designed for all investors. Whether you're experienced or a beginner, our portfolio management tools offer valuable insights and control to navigate market complexities.