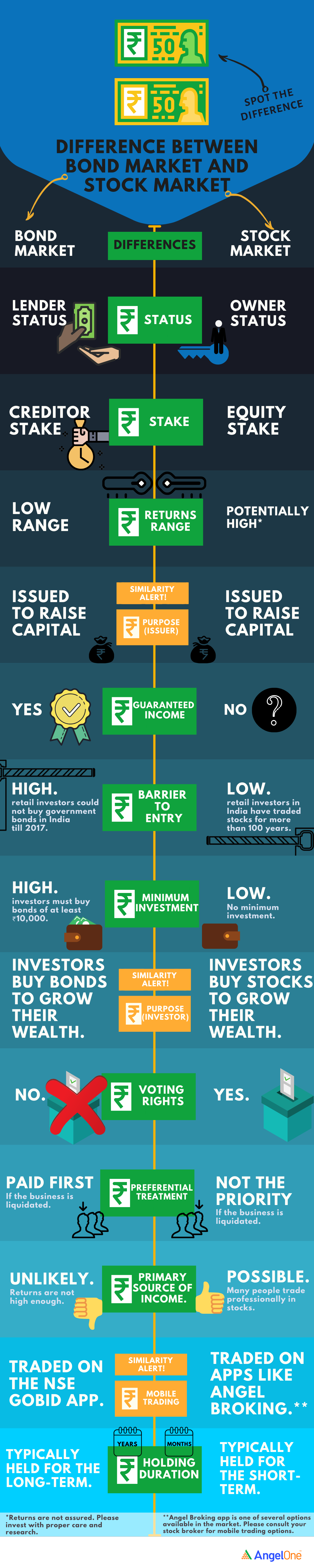

Stocks and bonds are two essential instruments that constitute the portfolio of an investor. Both these can generate a return on investments. Companies use these to raise capital for expansion purposes. However, there are differences between them. Let us take a look.

Differences between stocks and bonds:

When a company is selling stocks, it is essentially splitting the company into several small parts (shares) and then selling a portion of these through an initial public offering (IPO). When a person buys a stock or a share, it makes them a partial owner of the company, however small that might be.

When an institution is issuing a bond, it is issuing debt. It is borrowing money from the public and will have to return the money with interest. You can say it’s like taking a loan from a bank. Bondholders do not have any ownership rights. They are mostly lenders to the company. For the same reason, stockholders have voting rights, but bondholders don’t.

Companies mainly issue stocks. On the other hand, the government, companies, and financial institutions issue bonds.

Maturity: This is another crucial factor to note when we look at the bond vs stocks comparison. Bonds mature after a specific period. Bonds have a fixed maturity date, and after that, issuers are expected to pay back the principal and interest to investors. On the other hand, stocks do not have a maturity period. Investors can sell a stock when they want to.

Risk: Every investment is subject to risks. However, when we look at stocks and bonds, stocks are riskier. If a stock you own performs poorly or has financial trouble, you’ll see a dip in its price. This could mean that you lose some or all of your original investment. So stockholders are more likely to be affected by changes in the economy and industrial performance. Investors thus study the fundamentals of a company and its stock price before investing in a stock.

Bonds are considered comparatively less risky than stocks for several reasons. They carry the promise from the issuer to pay interest at fixed intervals. Most bonds accumulate a fixed rate of interest until maturity.

On the other hand, the payout for stocks is in the form of dividends. When companies make profits, they may choose to distribute these gains by declaring dividends. However, these payouts are uncertain, and corporates can go on for a few years without declaring them.

Based on their risk, bonds are rated by credit rating agencies. The rating indicates how likely a bond is to pay principal and interest on time. The highest and best rating that a bond can have is AAA. A high rating also indicates lower risk.

Returns: You can expect lower but more stable returns from bonds. Stocks, on the other hand, can deliver potentially high returns. Over a while, stocks have the potential to deliver returns that beat inflation.

Repayment priority: How do stocks and bonds fare in case of repayment to investors when a company is liquidated? In case a company is liquidated, the shareholders have the last claim on any residual cash. Bondholders, on the other hand, have a much higher priority, though it depends on the terms of the bond. This is another reason why bonds are less risky than stocks.

What they mean for investors

Now that we have answered the bonds vs shares question, we need to understand what shares and bonds mean to the investor.

In the short term, stocks are riskier, but when the investment is done wisely and spread over different stocks, they can provide superior returns. Stocks are therefore suitable for investors who have a long term investment horizon and can stomach short term risks.

On the other hand, bonds are preferred by investors when income is their priority. While prices of bonds may fluctuate, on maturity, you get back the initial investment with interest.

An investor should have a portfolio which is spread across stocks and bonds. The asset allocation will depend on several factors like the age of the investor, his goals, his investment philosophy and his/her risk appetite. Having bonds in the portfolio would balance the intrinsic volatility one associates with stocks. Investors are recommended to go for strategic asset allocation to determine what percentage of investments should be in each.

Learn Free Stock Market Course Online at Smart Money with Angel One.