To run a successful business, managing the working capital efficiently is important. The debtors turnover ratio is one of the vital financial metrics to determine a company's ability to convert credit sales into cash. In this article, learn about the debtors turnover ratio, its formula and calculation, along with the importance of the ratio.

What Is the Debtors Turnover Ratio?

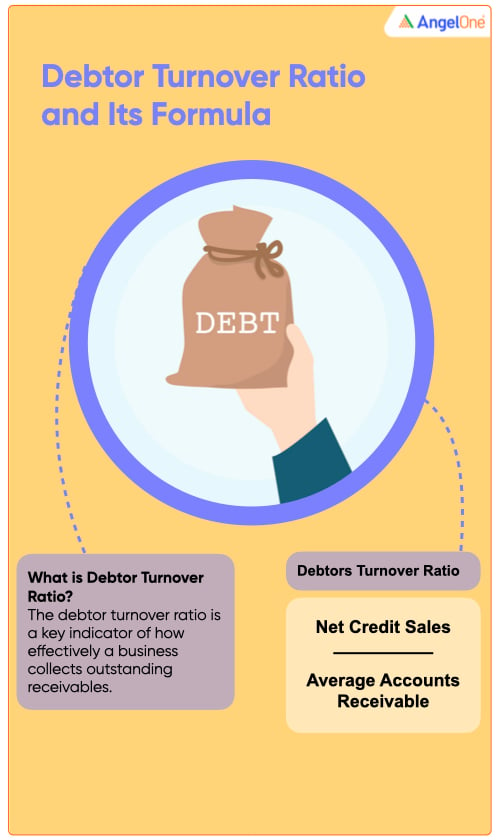

The debtors turnover ratio serves as a key indicator of how effectively a business collects outstanding receivables, thereby impacting its cash flow, liquidity, and overall financial health. In any business, sales can be made through cash transactions or on credit. When sales are made on credit, the customers who owe the money are referred to as debtors. The amount of money owed by these debtors is considered as accounts receivable. Therefore, the debtors turnover ratio and the accounts receivables turnover ratio are essentially the same thing.

The debtors turnover ratio represents the total number of times the average debtor's outstanding balance is collected as cash during the fiscal year.

Debtors Turnover Ratio Formula

The formula of the debtors turnover ratio is given below.

Debtors Turnover Ratio = Net Credit Sales / Average Accounts Receivable

Calculation of the Debtors Turnover Ratio

The debtors turnover ratio is calculated by dividing the net credit sales by the average accounts receivable. Here are the steps you need to take to calculate it:

Step 1: Determine the net credit sales

The net credit sales is calculated by subtracting the sales returns and allowances from the total credit sales.

Net Credit Sales = Total Credit Sales - Sales Returns and Allowances

Step 2: Determine the average accounts receivable

Now you need to determine the amount owed to any business by customers. Calculate the average accounts receivable by adding the beginning and ending accounts receivable balances and dividing the sum by 2.

Average Accounts Receivable = (Beginning Accounts Receivable + Ending Accounts Receivable) / 2

Step 3: Calculate the Debtors Turnover Ratio

Now apply the formula of the debtors turnover ratio.

Debtors Turnover Ratio = Net Credit Sales / Average Accounts Receivable

The resulting ratio will indicate how efficiently the company is collecting its accounts receivable and converting credit sales into cash.

Example of Debtors Turnover Ratio Calculation

Let us consider an example to understand the calculation of the debtors turnover ratio better.

Assume that a company had net credit sales of Rs. 5,00,000 during the fiscal year. At the beginning of the year, the accounts receivable balance was Rs. 1,00,000, and at the end accounts receivable balance was Rs. 80,000.

Average Accounts Receivable = (Beginning Accounts Receivable + Ending Accounts Receivable) / 2 = (1,00,000 + 80,000) / 2 = Rs. 90,000

Debtors Turnover Ratio = Net Credit Sales / Average Accounts Receivable

Debtors Turnover Ratio = Rs. 5,00,000 / Rs. 90,000 = ~ 5.56

Why Is Debtors Turnover Ratio Important?

- • Assessing efficiency: The ratio helps evaluate how efficiently a company collects its accounts receivable and converts credit sales into cash. A higher ratio suggests a faster collection of receivables, indicating effective credit policies and collection procedures.

- • Cash flow management: The ratio provides insights into a company's cash flow management. Efficient collection of accounts receivable ensures a healthy inflow of cash, which is crucial for meeting operational expenses, investing in growth opportunities, and managing financial obligations.

- • Credit risk evaluation: The debtors turnover ratio aids in assessing credit risk. A low ratio could indicate potential difficulties in collecting outstanding receivables, potentially leading to bad debts. It highlights the need to review credit policies, tighten collection procedures, or adjust credit terms to mitigate risks.

- • Comparison and benchmarking: The ratio allows for comparisons over time and against industry benchmarks. It also helps to determine how effectively the company manages its receivables relative to peers.

- • Financial health indicator: A company's ability to efficiently collect accounts receivable is a reflection of its financial health. A strong debtors turnover ratio indicates sound financial management, while a low ratio may raise concerns about liquidity, creditworthiness, or potential cash flow issues.

What are the Limitations of the Debtors Turnover Ratio?

As there are two sides to a coin, the debtors turnover ratio has its limitations as follows:

- • The ratio focuses solely on accounts receivable efficiency and does not provide a comprehensive view of overall financial health.

- • The accounts receivable keep changing throughout the year. Therefore, an average of the starting and ending values is taken.

- • The debtor turnover ratio of a company must be looked at in the context of the industry that it is in. If they are in a sector where revenue does not come in a continuous stream, then having a low debtor turnover ratio may not be a big concern.

Conclusion

By analysing the debtors turnover ratio, businesses, investors, and creditors can gain insights into a company's financial performance, risk management, and efficiency in managing accounts receivable. It serves as a valuable tool for assessing and improving overall financial health and cash flow management. And while investing in any company the important factor, besides investment objectives and risk appetite, is to evaluate the financial health of the company. Understand the financials of the company and make an informed decision.

If you are planning to start your investment journey, open a demat account now for free on Angel One. Happy Investing!

Learn Free Stock Market Course Online at Smart Money with Angel One.

Explore the Share Market Prices Today

| IRFC share price | Suzlon share price |

| IREDA share price | Tata Motors share price |

| Yes Bank share price | HDFC Bank share price |

| NHPC share price | RVNL share price |

| SBI share price | Tata Power share price |