What is an equity research report?

The Indian financial ecosystem has evolved considerably in the last few decades. The availability of quality information has increased and so has the number of small investors. Equity research reports have come to signify quality information for the common investor. Research reports are documents produced by professional equity analysts that recommend actions like buy, sell and hold for a particular security to investors. Research reports also contain additional information like an overview of the company and the industry, financial metrics, target price, time period and risks. There are primarily two types of equity research reports - fundamental reports and technical reports.

Technical analysis is based on the historic price movements of a security. Analysts try to identify a pattern in the movement and recommend actions based on it in technical reports.

Fundamental analysis is based on qualitative factors such as the quality of management, expected growth, business strategy, etc. Based on these factors, analysts project future earnings and recommend action in fundamental reports.

Technical reports are better suited for day traders, while fundamental reports are suitable for long-term investors.

Since it takes time and expertise to prepare research reports, earlier only paid customers were given access. But now you can access research reports from most brokerage firms. Visit the website of the specific brokerage firm and look for brokerage reports under the “Tools and Research” section.

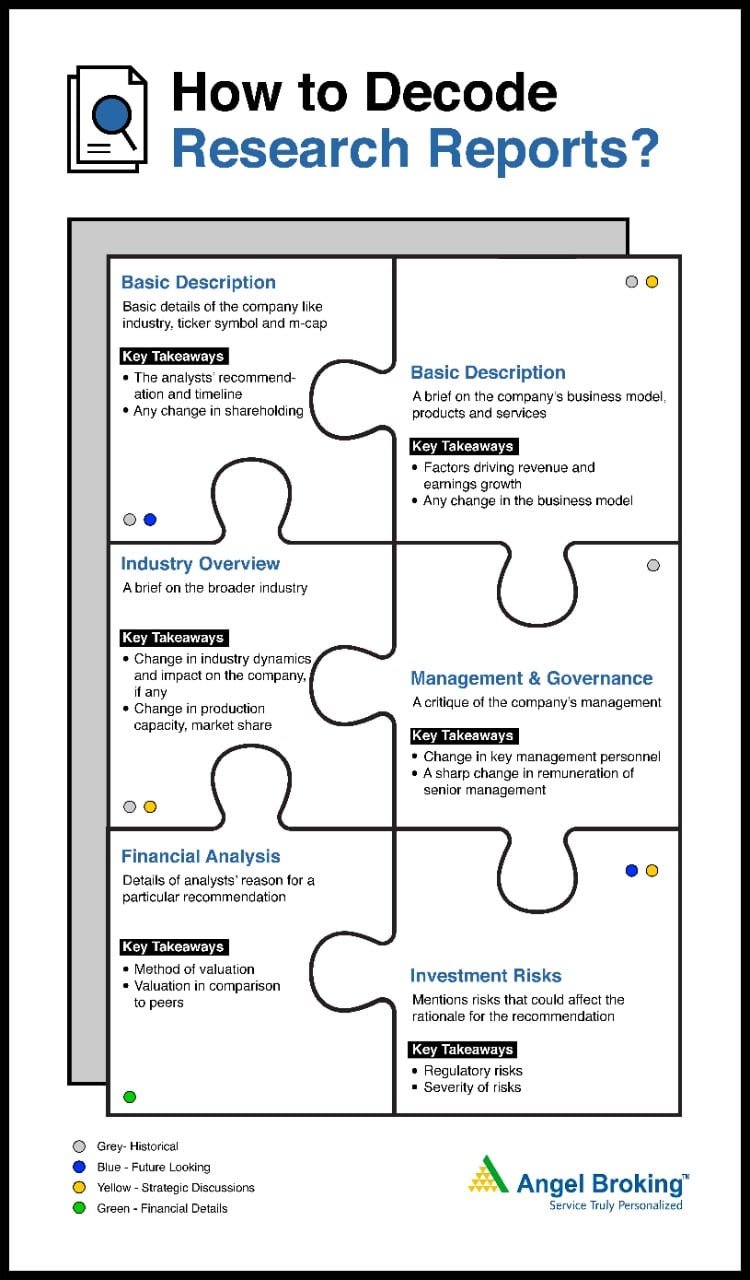

Sections of research reports

The exact structure of research reports varies from brokerage to brokerage. We will limit the discussion to fundamental research reports as they are read by a broader category of investors. We will use an Angel One report for the sake of understanding. The report analyses UltraTech Cement’s performance in the Oct-Dec quarter. Here is the link to the report: https://www.angelone.in/get-co-pdf/Ultratech%20Cement_FY20Q3_RU.pdf

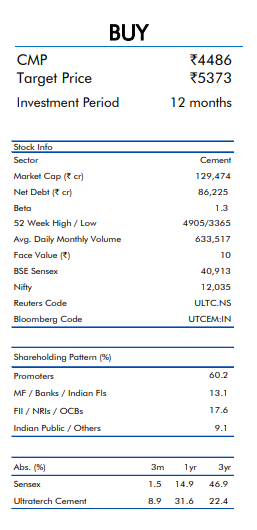

- Basic Description: Equity research reports generally start with some basic information about the company. The section contains the name of the company, ticker symbol, sector of operation, net debt, the stock exchanges it is listed on, and market capitalization. The shareholding pattern is also given in the section. You should have an eye for any change in the shareholding pattern. Increase in the shareholding of institutional investors is generally considered a positive signal for the long-term prospects of the company. The most important part of the basic description is, however, the analyst’s recommendation. The recommendation to buy or sell, the current price, the target price, and the investment period are written prominently on the top.

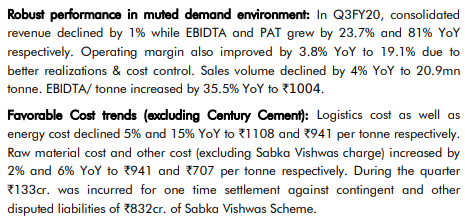

- Business description: In the section, analysts give a brief of the company’s business. You can learn about the products and services of the company, along with the key factors responsible for the revenue and earnings growth. The information given in the section is particularly important for new investors as it gives an idea of the company’s business. The information is largely sourced from regulatory filings and industry publications. The Angel One report talks about a reduction in logistics and energy cost and an increase in the cost of raw materials. It provides the reason for the improvement in the operating margin of the company.

- Industry overview: Data is meaningless without proper context. Just knowing about the business of the company would be useless without the knowledge of the industry dynamics. The section provides an overview of the broader industry and the competitive positioning of the company. The production capacity of the company, pricing strategy, market share, and distribution is also part of the section.

- Management and governance: The section discusses the management quality of the company. Some research reports do not have a section. It provides the capital allocation track record of the management, along with the history of senior management. The section also has the shareholding and remuneration of key management personnel.

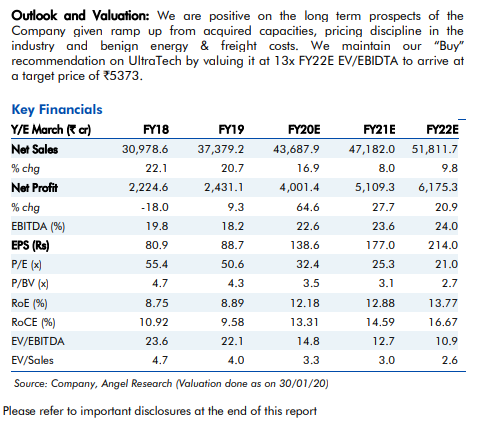

- Financial analysis: The section has a small write-up where the analysts provide an insight into their thinking. They reveal their reasons for the recommendation. If an analyst recommends buying, he/she will list the positives and the future outlook. The process is the same for a sell or hold rating. The section largely comprises conventional valuation metrics and formulas. In the Angel One report, the analysts are positive about the long-term prospects of UltraTech Cement. They list their reasons as higher production, pricing discipline, and low freight costs.

- Investment risks: All investments are prone to risks. In the section, analysts mention the various risks to the company that could affect their recommendation. The risks could be operational, financial, or regulatory. Analysts at Angel One flagged risks such as muted demand and lower government spending on infrastructure.

There is no set format for research reports, but most reports have the sections mentioned above. The chronology can be different and a section can be added or removed depending on the context of the report. For instance, the Angel One report is based on quarterly earnings and hence it has a section on con call highlights. Companies organize con calls with analysts to discuss financial results.

Things to remember while acting on a report

Though it is easy to access a research report, the investment risk has to be borne by the investor. It is important to develop your own parameters of checks and balances as acting blindly on the basis of a report could be counterproductive. Before reading a research report verify the credibility of the brokerage. Consider reports only from well-established and credible brokerages.

Another major factor is to look for the date of the report. Research reports give a time frame for the recommendation with the target price and the current market price. Reports from major brokerages are widely circulated and it is important to act on time. If a large number of investors take the recommended position before you, the stock price will react and you may not be able to reap the entire benefits. It is important to check the date and avoid acting on outdated reports.

To gain from the advice of professional analysts, try to follow research reports from the same brokerage for a long time. By following the recommendations over a period of time, you will be able to adjudge the quality of recommendations yourself. You can know about the shortcomings and the advantages of a particular brokerage or analyst only after reading the reports over a period of time.

Frequently Asked Questions

- Are all research reports free of cost?

No, you will not be able to read all the reports free of cost. Generally, the best quality reports are available only for paying customers of a brokerage firm.

2. Is brokerage firm responsible for any loss incurred by acting on a research report?

No, the brokerage firm is not responsible for any loss incurred by any investor acting on a research report. Research reports have a disclaimer at the end where it is clearly mentioned that investors should conduct their own evaluation before investing.

3. Can a research report be considered an official source of a company’s financials?

The information given in a research report is thoroughly checked at various levels but still, it cannot be considered an official source for a company’s financials. Companies file their financial result with the market regulator which is uploaded on the stock exchanges.

4. Are research reports limited to single companies?

There are various types of research reports. Some are dedicated to a single company, while some talk about the entire sector. Sectoral research reports give recommendations on all the major companies in the particular sector.

Learn Free Stock Market Course Online at Smart Money with Angel One.