Ever since India opened its gate to foreign investors in FY 1992-93, it has received a considerable amount of investment from foreigners in the form of FIIs (Foreign Institutional Investors) or FPIs (Foreign Portfolio Investors) investments. Money inflow from FIIs/FPIs is a crucial driver for the growth of the Indian markets. A few of the major reasons behind funds inflows from FIIs in the Indian stock market are mentioned below.

- Bigger growth opportunities as India is a developing country

- Well-developed primary and secondary markets

- High liquidity infused by the reduction in short-term interest rates by the central bank and currency depreciation.

- Other macroeconomic factors like a strong young population, diversity, and more

These FIIs investments hold an imperative role in the development and growth of the Indian economy. Read on to know how:

- Ensures capital flow into the economy

- Helps in improving capital structures through equity inflows

- Boosts competition in the financial market

- Positively affects the bond markets, the exchange rate, inflation, and overall market sentiment

- Acts as a trigger and a catalyst for the market performance

- Encourages investments from all classes of investors

FIIs holding in the Indian stock market

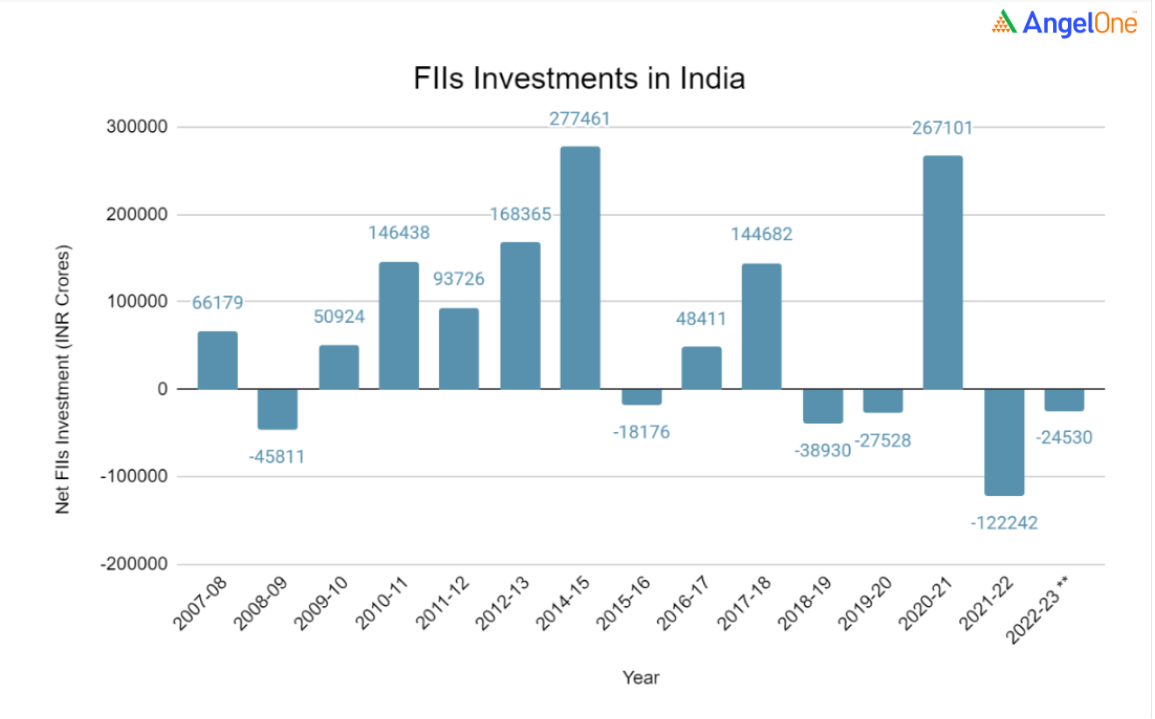

Now let’s take a look at the net historical FPIs investment details.

Source: NSDL

In the above graph, we can see that in the FY 2008-09 FIIs sold their investments at a very large scale because of the global economic crisis and skyrocketing inflation rates in India. However, in the year FY 2009-10, the net investment turned positive, and in the FY 2010-11 when the dust settled down, and after that net investment grew at a rapid pace.

This shows that FIIs sell their investments when the Indian economy is adversely affected along with weak global sentiments. However, it is also observed that soon after FIIs sell their investment, they reduce the disinvestment amount or begin investing again in the coming year when things start improving.

Reasons FIIs are selling their investments

In FY 2021-22 alone, FIIs sold their investments for approximately worth ₹1.22 lakh crores as against FY 2020-21 where they invested around ₹2.67 lakh crores. The Indian equities market has faced many challenges in the last year which is evident from the last year’s stats. There are multiple reasons because of which FIIs started pulling out their investments from the Indian markets since the last financial year. A few of the reasons are mentioned below.

- The Russia-Ukraine War

The Russia-Ukraine war took center stage in the last week of February. Uncertainties and geopolitical complexities that arose due to this war have created a fear among foreign investors. This has resulted in the FIIs outflows in India.

- High crude oil price

India is the 3rd largest consumer of crude oil and is also the 3rd largest importer of crude oil across the globe. The heat of the Russia-Ukraine war had a massive impact on the global economy as the crude oil prices spike. These soaring crude prices turned the Indian stock market volatile and resulted in the increase in the costs of transportation and an increase in inflation. This impact on the economy and imports influenced foreign investors’ sentiments which pushed them to pull their money out of the Indian stock market.

- Changes in the US economy

Indian markets are aligned with the US and the other global markets which means if the other markets start falling, Indian markets will also be impacted. 3 of the major reasons that are recently affecting the US economy are:- Higher inflation

- An expected rise in the interest rate to control inflation

- Rising inflation has led to a sharp jump in the US bond yields

These factors had an adverse impact on the Indian stock market which has worried investors and as a result, foreign investors are selling their investments.

However, it is expected that FIIs investments will increase in the near future due to forecasted growth in the Indian economy. Let’s understand this in detail.

Why are FIIs investments expected to rise soon?

A few of the reasons for an expected rise in investment by FIIs are mentioned below.

- Rise in exports

The Indian economy and exports go hand-in-hand. If there is an increase in the export numbers in India, it eventually adds to the growth of the economy. The Ministry of Commerce and Industry has revealed below statistics for the month of March 2022.- India achieved the highest monthly export amounting to USD 40.38 billion, an increase of 14.53% as compared to March 2021

- It exported petroleum products worth USD 7377 million in March 2022 as against USD 3609 million in March 2021, marking a growth of over 104.39%

When FIIs witness this positive growth in the Indian economy, they tend to get more attracted towards it and as a result increase their investments.

- Strong GDP projections

GDP projections help policymakers and the central bank to understand whether the economy is contracting or expanding and take action accordingly. Real GDP growth for FY 2022-23 in India is projected at 17.2% for Q1; 7% for Q2; 4.3% for Q3 and 4.5% for Q4 (Source: RBI). This GDP projection is based on various factors, a few of which are mentioned below.- Well-placed COVID safety protocols and the majority working population received vaccination that has increased the ability to operate safely in covid adverse situations

- Markets are adjusting to the global situations

- Correction in crude oil prices

- Improvement in the productive capacity as a result of the government’s thrust on capital expenditure and exports

- With an expected significant improvement in the country’s economic scenario, investors from across the world are expected to start investing again in the Indian markets

- Positive government reforms

The government of India has taken various initiatives to improve the economy and FIIs investments in the country. They have also introduced business-friendly policies and introduced various initiatives such as ease of doing business, Make in India, digitalization, and more. A few of these government initiatives in the Union Budget of 2022-23 are mentioned below.- Identification of 4 priority areas, namely, PM GatiShakti, Inclusive Development, Productivity Enhancement and Investment, and Financing of Investments

- Announcement of production linked incentive (PLI) for various industries such as domestic solar cells and module manufacturing, bulk drugs, manufacturing of advanced chemistry cells, and more

- Effective capital expenditure is expected to rise by 27%

Source: IBEF

Conclusion

FIIs or FPIs are one of the important drivers of the Indian financial markets but they have been on a selling spree since last year. However, FIIs are likely to make a comeback in the near future considering India’s fundamental position among growing economies, policy support for economic growth, strong expected GDP growth, and more such factors. In addition to these, an expectation that India will continue to remain the fastest-growing economy in the world has made the Indian stock market an attractive investment opportunity for foreign investors.

Learn Free Stock Market Course Online at Smart Money with Angel One.

Explore the Share Market Prices Today

| IRFC share price | Suzlon share price |

| IREDA share price | Tata Motors share price |

| Yes Bank share price | HDFC Bank share price |

| NHPC share price | RVNL share price |

| SBI share price | Tata Power share price |

Disclaimer: This blog is exclusively for educational purposes.