In addition to trading assets in the financial markets, large-scale traders and investors like institutional participants and hedge funds typically also employ arbitrage strategies to earn profits. These strategies are tuned to limit the various risks that are typically involved with investment options, while providing the investor with a fair amount of returns.

Fixed-income arbitrage strategies are one among the many popular methods that are used to profit off from minor pricing differences in various asset classes. Continue reading to get to know more about fixed-income arbitrage.

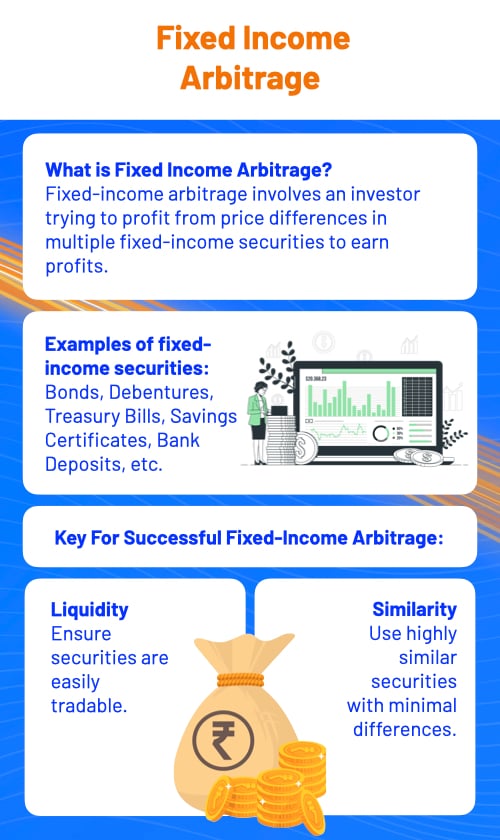

What is fixed income arbitrage?

Before we get into the details of fixed income arbitrage, let’s first get a proper understanding of fixed income securities.

A fixed-income security is a financial instrument, where the issuer is mandated to make periodic fixed interest payments for a certain specified period of time to the investor. Bonds, debentures, treasury bills, savings certificates, and bank deposits are few of the examples of fixed income securities. These securities are typically viewed as low-risk investments when compared to other market-linked options like stocks. Furthermore, many fixed-income securities like debentures, convertible bonds, and treasury bills are listed and traded in the market just like the stock of a company.

Okay, so now that you’re clear with what fixed income securities are, let’s get back to fixed income arbitrage strategies.

Fixed-income arbitrage involves an investor trying to exploit price differences in various fixed-income securities to earn profits. Under this strategy, you are required to go long on a security, while simultaneously shorting the same security to capture the minor price difference. Fixed-income arbitrage strategies are typically market-neutral, which means that you get to enjoy returns irrespective of how the market swings in the future.

Since the price differences in fixed-income securities generally don’t last for a long time, an investor looking to employ fixed-income arbitrage is required to execute it within a short window of time. Failure to do so might result in the opportunity being missed, and it can even lead to a loss. Such kinds of situations actually increase the risk involved with fixed income arbitrage strategies and therefore warrants a significant amount of caution when dealing with them.

How does fixed-income arbitrage work?

For fixed-income arbitrage strategies to work accurately, there are two primary conditions that should be satisfied.

- The fixed-income securities need to be liquid so as to enable you to buy and sell them in the market with relative ease.

- The securities that are to be used for the arbitrage strategy should ideally be quite similar to each other with very minimal differences.

Once these conditions are satisfied, all that you need to do next is take a long position on the security that’s overpriced and simultaneously take up a short position on the security that’s underpriced. Executing both the trades at the same time would lock-in the price difference. Once the prices of the two securities undergo a correction, both the trades can then be settled to realize the profit.

Now that you know how this strategy works, let’s take a look at a fixed income arbitrage example to understand this concept better.

Fixed-income arbitrage - an example

Assume that there’s fixed income security like the convertible bond of a company. You can exploit the price difference between the market price of the convertible bond and that of the underlying stock. To do that, you’re required to take a long position on the convertible bond and a simultaneous short position on the stock of the company. When the price of the stock falls, the short position would generate significant gains, while the long position would only witness minor price correction. The difference between the prices of the short position and the long position would then be your profit.

Alternatively, if you feel that the convertible bond is overpriced with respect to its underlying stock, you could short the convertible bond and simultaneously assume a long position on the underlying stock as well.

While convertible bond arbitrage is a great fixed-income arbitrage example, it is far from the only one. Swap-spread and yield curve are two other popular fixed-income arbitrage examples.

Conclusion

While fixed-income arbitrage strategies might seem lucrative, they also carry significant amounts of risk. On top of that, to properly execute a fixed income arbitrage, it is highly essential for an investor to possess large amounts of investment capital. These are two of the primary reasons why only large institutional investors like hedge funds, private equity players, and investment banks employ such investment strategies.

Learn Free Stock Market Course Online at Smart Money with Angel One.