A Good Till Trigger (GTT) order permits investors to purchase or sell a security only when a certain trigger price is met in the market. When the order is activated, it is automatically placed at a predetermined limit price during market hours. GTT orders are often used for scheduled entry, exits, and stop-loss strategies, particularly when investors do not want to constantly monitor market fluctuations.

Key Takeaways

-

GTT orders help investors plan buy or sell trades in advance without watching the market.

-

They activate only when a chosen trigger price is reached during market hours.

-

Different GTT types support both entry and exit strategies.

-

GTT orders suit delivery and long-term positions, not intraday trades.

What is Good Till Trigger

GTT order stands for Good till trigger order. GTT order allows you to place buy or sell orders at a predetermined limit price. These orders are executed if the market price of the stock reaches your specified price, also called as “Trigger Price”, before the GTT order expires.

A GTT order is a limit order where the product type can be delivered or margin. You cannot place GTT orders in the intraday product type. You can also place GTT orders in the derivatives segment. In this case, the GTT order will be executed as a carry-forward type order, and order expiry will be as per the contract expiry date.

Now, let's see what the use cases are for this feature.

How to Use GTT Order in the Stock Market?

Using a GTT order in the stock market is fairly simple and works well if you don’t want to track price movements all day. You start by selecting the stock you want to buy or sell, and then decide the trigger price at which the order should activate. Once the market price reaches this trigger level, the order is automatically placed at the preset limit price.

A GTT order is useful for planned entries or exits, especially when you already know your target or stop level. After placing it, the order stays active for an extended period, allowing you to focus on other things while the system handles execution when conditions are met.

Types of GTT Orders

Here are four common types of GTT (Good Till Triggered) order options you might come across. Some brokers may offer additional choices:

Limit Buy Order

A limit buy order lets you buy a stock at or below a certain price. For example, if you want to buy shares of XYZ Ltd, currently priced at ₹1000, you can set a GTT limit buy order at ₹950. The order will go through only if the stock price drops to ₹950 or lower.

Stop-Loss Buy Order

A stop-loss buy order is used to buy a stock once it reaches a specific higher price. This is typically used when you expect a stock to continue rising after breaking through a resistance level. For instance, if you think XYZ Ltd will climb further after hitting ₹1500, you can set a GTT stop-loss buy order at ₹1500. The order will execute once the price reaches ₹1500.

Limit Sell Order

A limit sell order allows you to sell a stock at or above a set price. If you own shares of XYZ Ltd bought at ₹900 and want to sell them at ₹1100, you can place a GTT limit sell order at ₹1100. The order will execute if the stock price reaches ₹1100 or higher.

Stop-Loss Sell Order

A stop-loss sell order is designed to sell a stock if its price falls to a specific lower level, helping to limit potential losses. To protect your investment in XYZ Ltd, you can set a GTT stop-loss sell order at ₹800. The order will trigger and sell the stock if the price drops to ₹800.

Also Read More Stop-loss Order

Some Facts About GTT Order in Stock Market

-

Authorisation for selling: Selling shares through a GTT order may require prior authorisation from the depository, unless a valid delivery instruction or power of attorney is already in place.

-

Execution timing: Although a GTT order can be placed at any time, it is triggered and executed only during normal market hours.

-

Limit on active orders: Investors can maintain a limited number of active GTT orders in a single account at the same time, which varies across brokers.

-

Effect of corporate actions: GTT orders linked to stocks undergoing major corporate actions may be cancelled on the record or ex-date.

-

Product type restriction: GTT orders are generally available for delivery and carry-forward positions and are not applicable to intraday trades.

-

Category changes: If a stock’s trading category changes while a GTT order is pending, the order may be automatically cancelled.

Benefits of Using the GTT Order Feature

Understanding the GTT feature highlights several benefits that might appeal to you:

Saves Time:

With GTT orders, you don’t have to keep an eye on the market constantly. Once you set your desired entry or exit price, the order automatically triggers when those conditions are met, allowing you to focus on other tasks or strategies.

Reduces Slippage:

GTT orders can help reduce slippage, which is when your trade is executed at a price different from what you wanted. By setting your price in advance, you lower the risk of this happening.

Encourages Disciplined Trading:

GTT orders help you stick to your trading plan by removing emotions from the decision-making process. Since you set your conditions beforehand, you’re less likely to make impulsive moves based on market fluctuations.

Long-Term Order Validity:

Unlike regular orders that expire at the end of the trading day, GTT orders remain active for a longer period, often up to a year, or until the trigger condition is met. This feature is particularly handy for those with long-term trading strategies.

Use Cases of GTT Order

The GTT order feature helps you save your time and energy.

Suppose that you want to invest in a stock and you also have an entry position in mind. Or suppose that you want to exit your position at a certain price point. In both these cases, you can create a GTT order with your desired price points and then stop tracking the movement of prices.

Stock market prices are quite volatile, and they go up and down. Whether you are a full-time trader who’s into trading day in and day out, or you trade or invest in stocks on a part-time basis, and have a full-time job or business on the side, thus cannot track the price movement all day long, every day, GTT is the tool to be used; it’s for everyone.

The GTT order allows you to execute trades at your desired price point automatically so you can do other things with your time.

Is the GTT Order Applicable on All Stocks?

A GTT order is available for most actively traded stocks, but it may not apply to every security in the market. Availability usually depends on factors such as the stock’s trading category, liquidity, and eligibility for delivery or carry-forward positions.

While placing a GTT order, it is important to check whether the selected stock supports this feature, as certain securities or special trading categories may not allow GTT-based execution.

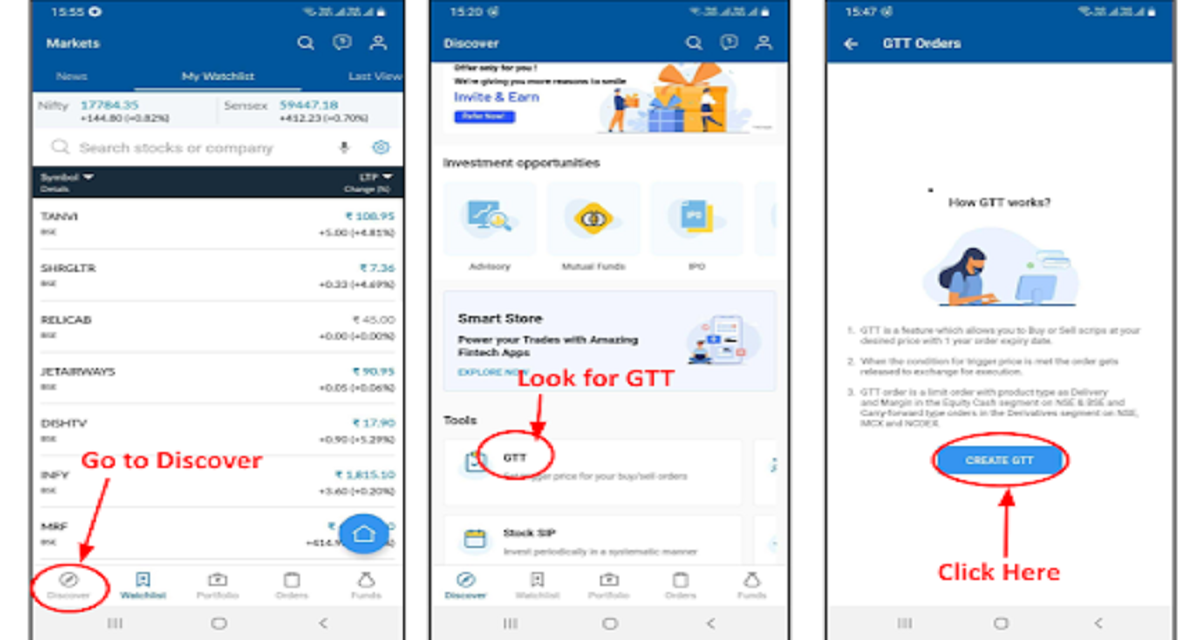

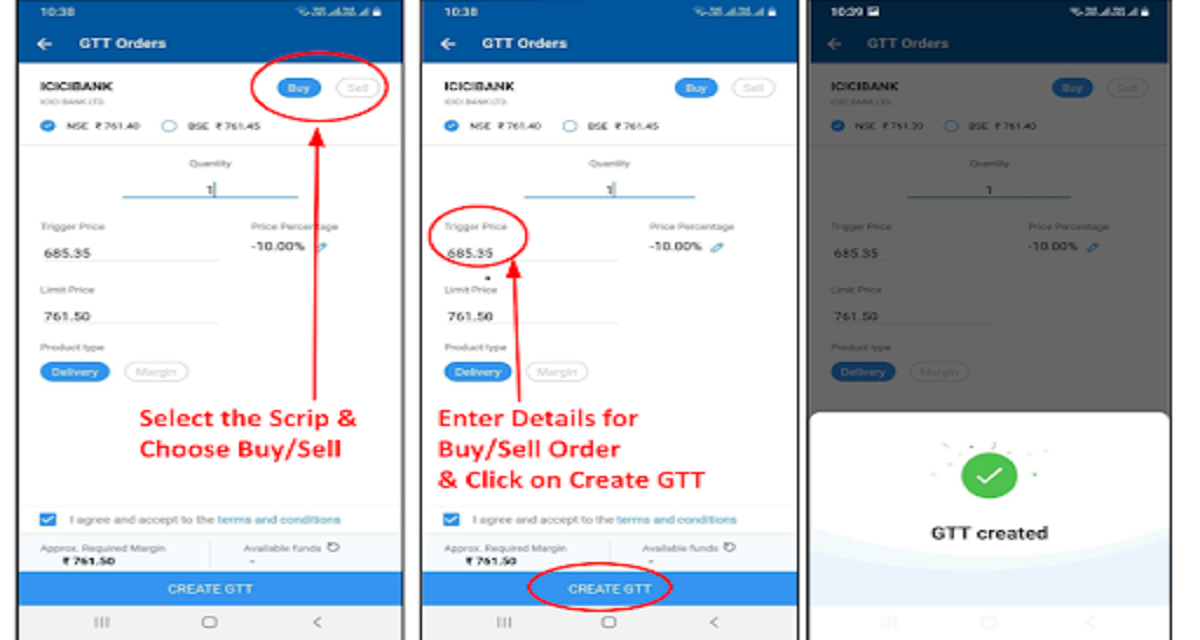

How To Place a GTT Order on the Angel One App?

Let's look at how easy it is to place the GTT order in the Angel One mobile app. Step 1: Log in on the app and head to Discover. Step 2: Tap on GTT under the Tools section. Step 3: Tap on create GTT and search for the scrip for which you want to place the GTT order. Step 4: Enter the quantity, the limit price, the trigger price or the price percentage and select the product type. Step 5: Tap on create GTT. That's it - your GTT order is created. You can track the updates in the GTT section.

Conclusion

Are you interested in investing but the notion of extensive time commitment puts you off? Delay no longer. The Good Till Trigger feature of the Angel One mobile app and web platform, allows you to trade and invest at your own pace. Pick your entry and exit positions, place GTT orders, and let our smooth and automated processes take care of the rest.