Stagflation vs Inflation

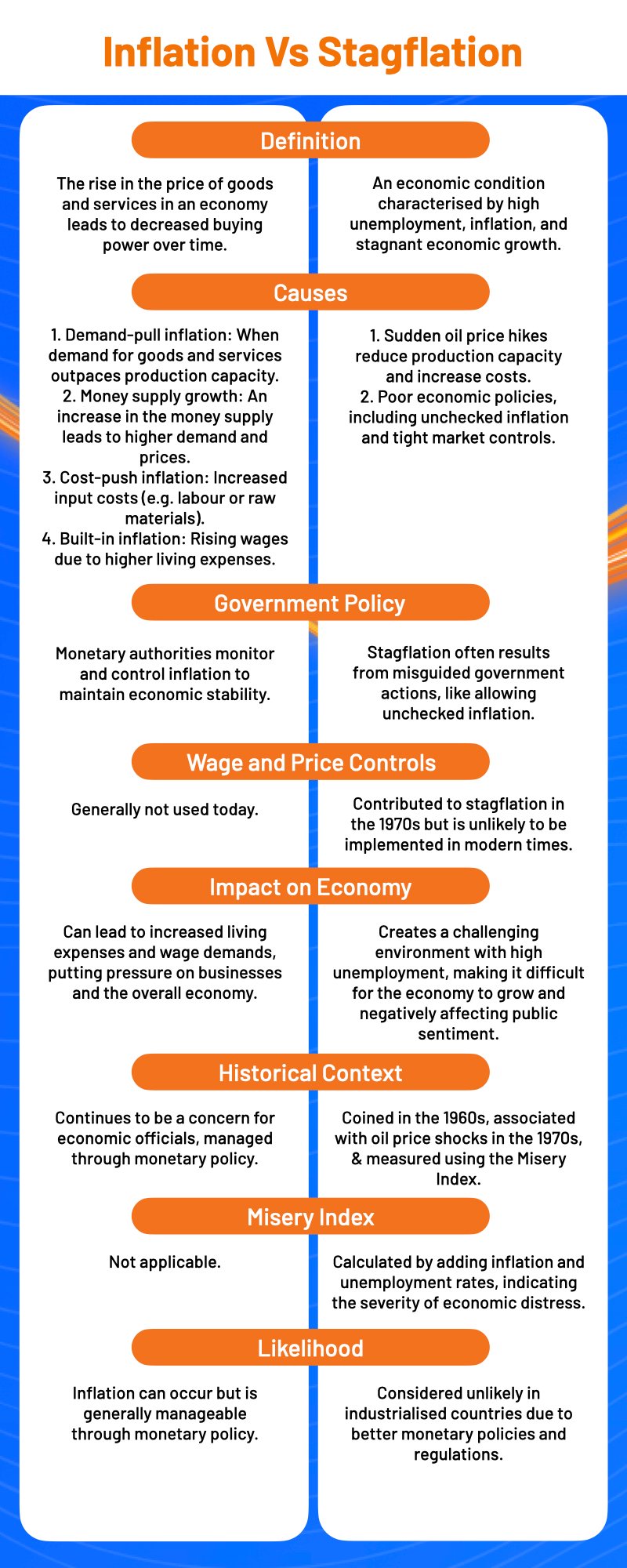

Economists use the word "inflation" to describe large price rises. Inflation is defined as the rise in the price of goods and services in a given economy. Inflation is also described as a decrease in buying power over time.

Stagflation is a word used by economists to describe an economy with high unemployment, inflation, and a sluggish or stagnant pace of economic growth. Stagflation is something that authorities all over the world aim to avoid at all costs. The population of a nation is impacted by high rates of inflation and unemployment amid stagflation. High unemployment rates exacerbate a country's economic downturn, leading the economic growth rate to swing just a single percentage point above or below zero.

Inflation

Economic officials, such as the Federal Reserve, are always on the lookout for signals of inflation. Consumers' perceptions of inflation should not be ingrained in policymakers' thoughts. To put it another way, authorities do not want people to believe that prices will continue to rise indefinitely. Such views lead to things like workers demanding for greater pay to offset rising living expenses, putting companies and, as a result, the whole economy under duress.

There are three sorts of inflation causes: demand-pull inflation, cost-push inflation, and built-in inflation. When an economy's total demand for goods and services grows faster than its production capability, inflation occurs. It causes a demand-supply gap, resulting in higher prices due to more demand and lower supply. In addition, a rise in an economy's money supply leads to inflation. Positive consumer mood leads to increased expenditure when people have more money. As a result, demand rises and prices rise.

The monetary authorities may raise the money supply by printing and handing out more money to people, or by depreciating (lowering the value of) the currency. Money loses its buying value in all such circumstances of increased demand.

Increases in the pricing of manufacturing process inputs cause cost-push inflation. A rise in labour expenses to make a product or provide a service, or an increase in the cost of raw materials, are two examples. These changes raise the price of the completed product or service, contributing to inflation.

The third factor that influences adaptive expectations is built-in inflation. Labor expects and demands more salaries when the price of goods and services increases, in order to maintain their standard of life. Their greater incomes lead to higher prices for products and services, and this wage-price spiral continues as one component causes the other.

Stagflation

Iain Macleod, a politician in the United Kingdom, coined the word "stagflation" in the 1960s. During the 1970s, when international oil prices soared rapidly, several nations suffered stagflation, resulting in the creation of the Misery Index.

The Misery Index, which is calculated by adding the inflation and unemployment rates together, is a rough indicator of how awful people are feeling during stagflation. During the 1980 presidential election in the United States, the word was often used.

Stagflation is thought to be caused by one of two ideas. According to one explanation, this economic phenomenon occurs when the price of oil rises suddenly, reducing an economy's production capability. Producing things and delivering them to stores becomes more costly as transportation costs increase, and prices rise even as people lose their jobs.

Another hypothesis contends that inflation is merely the product of bad economic policy. Allowing inflation to run amok and then slamming the brakes is one example of bad policy that some have said contributes to stagflation. Others point to the tight controls on markets, products, and labour, as well as the ability of central banks to produce infinite sums of money.

Particular Points to Consider

Stagflation is said to be an unnatural phenomenon in a poor economy because sluggish growth causes people to spend less, which stops prices from growing. As a consequence, stagflation is solely the outcome of misguided government action.

Stagflation is unlikely to occur in industrialized countries again, according to experts who have a better knowledge of monetary policy. Governments do conduct expansive monetary policies with the danger of inflation during times of economic crisis, however, the Fed no longer uses stop-go monetary policies, such as raising and lowering the Fed funds rate. It follows a defined monetary policy and guarantees that inflation does not exceed 2%.

Wage and price regulations were another source of stagflation in the 1970s. This contributed to the rise in unemployment since businesses were unable to raise product pricing or lower employee salaries, leaving them with little choice except to lay off people. Today, such a programme would not even be contemplated, reinforcing the idea that stagflation is unlikely to recur.

Learn Free Stock Market Course Online at Smart Money with Angel One.