Worldwide, central banks adopt various measures to increase money flow in the economy to stimulate economic growth. One of such measures is Quantitative Easing - QE in short, where the central bank buys financial instruments, primarily long-term securities from the banks, to infuse money into the economy. Here we are to inform you about QE and its effects on the economy, benefits, and concerns.

What is Quantitative Easing?

Quantitative easing is a form of monetary policy in which the central bank makes large-scale purchases of financial assets like G-secs and bonds from the open market to infuse money into the economy. By buying long-term securities, central banks aim to lower the long-term interest rates and pump money into the market.

How does Quantitative Easing work?

As said, QE entails the large-scale purchase of longer maturity securities by Central banks from the banks and other financial institutions. These purchases are made possible by creating new bank reserves, i.e., printing money. The simple act of buying leads to the following:

- New money enters the economy as financial institutions now have more cash which they will lend to customers and businesses.

- Increased liquidity in the banking system makes borrowing more accessible and timely, encouraging economic activities.

- Lowering long-term interest rates as the large-scale purchase of long-term securities tends to put upward pressure on their prices.

- Change in asset allocation as investors are more likely to invest in high-return assets like equities with a lower return on fixed assets.

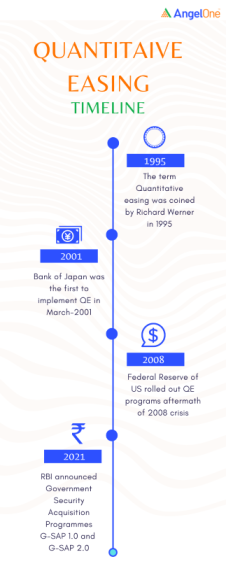

Quantitative Easing so far

Benefits of Quantitative Easing

- Increases money supply and thus boosts economic activities, instilling confidence in the economy

- Restores stability to financial markets

- Attracts foreign investment and increases exports as the increase in the money supply through quantitative easing keeps the value of a country’s currency low.

- Keeps bond-yield low, thus making debt rates affordable for businesses and corporates

Downsides of Quantitative Easing

-

- May lead to inflation: Increased money inflow increases people's buying power. If the availability of goods and services does not correlate with the increased buying power, the price increase may lead to inflation.

- May cause asset bubbles: Infusion of money in the economy may give way to buying more assets due to increased buying power, which may lead to a potential asset bubble.

- May lead to income inequality: Increased asset prices tend to benefit only those who can afford them when the prices go up, exposing the danger of rising inequality.

- May not stimulate the economy as expected: If the banks do not opt to lend the new money and instead choose to invest in emerging markets, thereby creating a capital flight, it defeats the purpose of QE.

- Unfavorable to imports: Depreciation of local currency is not beneficial to the import industry as it creates a higher cost burden.

QE is one of the tools at the disposal of central banks to stimulate the economy. QE tends to affect long-term interest rates. Other often used methods are,

→ lowering the overnight interest rates charged on banks when they borrow money from the central banks

→ reducing the reserve requirements for banks so that they can lend more

The above methods directly impact the short-term interest rates. It is a general convention that central banks opt for QE when the above techniques are no longer effective in stimulating the economy.

Explore the Share Market Prices Today

| Tata Steel share price | Adani Power share price |

| PNB share price | Zomato share price |

| BEL share price | BHEL share price |

| Infosys share price | ITC share price |

| Jio Finance share price | LIC share price |

Disclaimer: This article is exclusively for educational purposes.