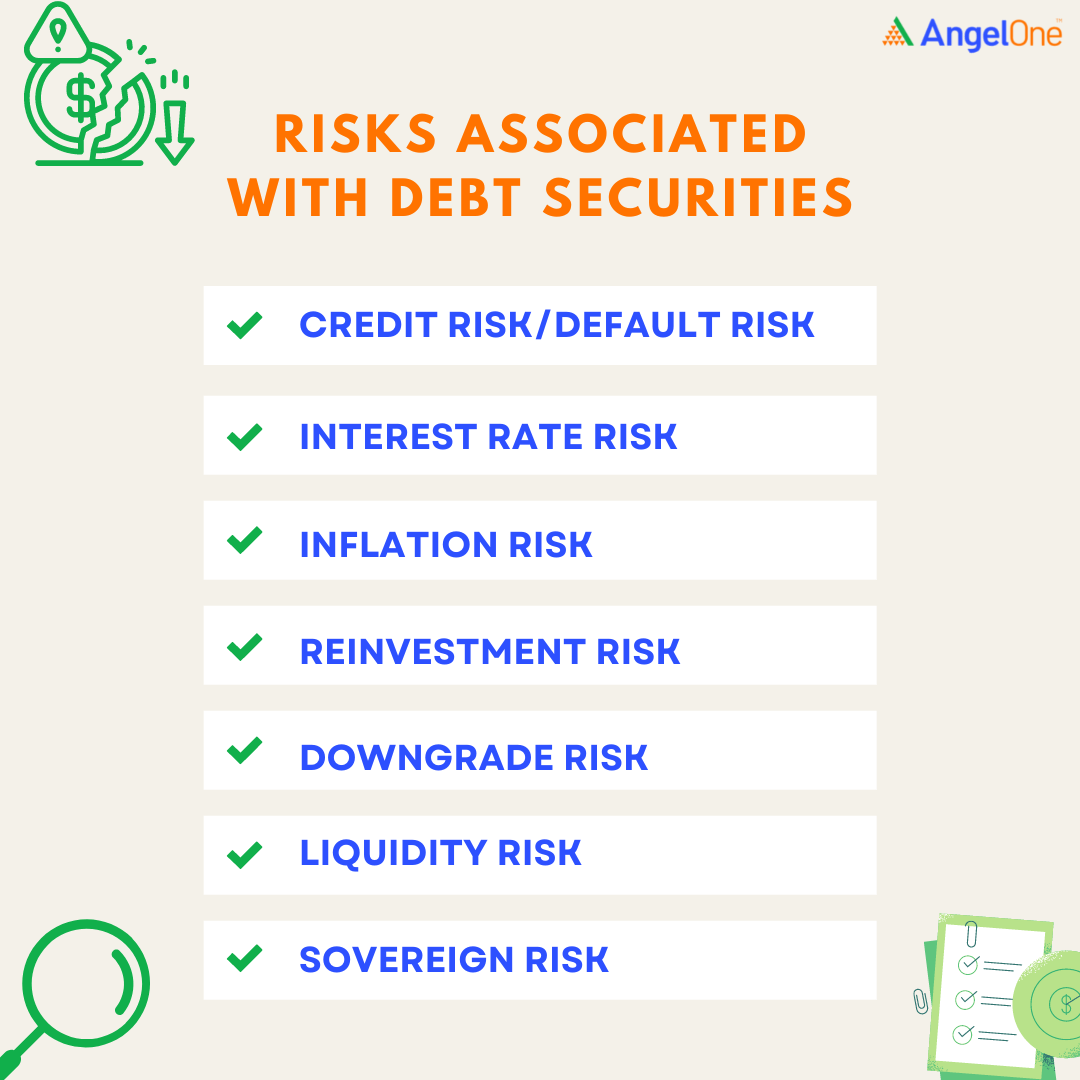

Debt instruments like G-secs, corporate bonds, etc., are considered best for investors with a low-risk appetite and looking for stability. However, debt funds are not risk-free. Here are some of the risks that debt instruments carry:

When you buy debt security like bonds, you buy a certificate of debt. The government or company should repay the amount borrowed over a period with interest. The probability that the issuer of a bond or any other debt security may be unable to make timely payments of interest or repay the principal is referred to as credit risk/default risk. Credit rating agencies rate the bond issuer's ability to repay. Learn more about credit risk here.

- Interest rate Risk

Interest rate risk can be defined as the risk emerging from the change in the interest rates due to prevailing market conditions affecting the yield on the existing debt instruments. Bond prices hold an inverse relationship with interest rates. Simply put, when interest rates rise, bond prices fall and vice versa.

Let’s suppose that a bond with a duration of 5 years with a face value of ₹100000 and a coupon rate of 6% is available in the market. If there is an increase in interest rate in the market, there will be new debt instruments with a coupon rate of more than 6%, say 7% or 8%. The demand for the bond goes down as investors will be keen to purchase the latter instruments with higher interest rates. As the demand for the bond goes down, the price value of the bond drops. The risk of devaluation of a bond due to increasing interest rates is called the Interest Rate Risk. Refer here to know more about interest rate risk.

- Inflation Risk

When you buy a bond, you commit to receiving a rate of interest for the bond's period. What if inflation increases at a faster rate than the rate of return?

Suppose you buy a bond with a rate of return of 3% (assuming the inflation rate is 1% during the purchase), and the inflation grows to 4% after the bond purchase. Then, the real rate of return will fall to -1% eroding the purchasing power. The longer the bond tenure, the higher the chance that inflation may affect the real rate of return. The annual inflation rate of India has touched 7.79% (as of May 22), while the yield on the 10-year government bond edged at 7.49%.

- Reinvestment Risk

Reinvestment risk is when an investor is at risk of reinvesting the proceeds from principal or interest payments at a lower rate than the original investment. For example, let’s suppose an investor buys a bond when the interest rate is 5% and the interest rate falls to 4% later. Now the investor will have to reinvest the coupon cashflows he receives at a lower rate of 4% than the original 5% reducing the yield to maturity(YTM).

The early redemption of a bond or any debt fund may leave the investor unable to reinvest cash flows at a rate comparable to their current rate of return. Therefore, the likelihood of a new investment earning less than the previous investment creating an opportunity cost is the Reinvestment Risk.

- Downgrade Risk

Downgrade Risk results when credit rating agencies lower their rating on a bond. A downgrade in a bond may lead to liquidity risk and default risk. Let’s see how.

When the credit rating degrades, the demand for the bond falls in the market. As a result, an investor in the bond might find it challenging to sell the bond due to the lower rating, exposing him to liquidity risk.

If the rating of an issuer enters below the investment grade, it indicates the deteriorating fundamentals of the issuer. The lower rating may not permit the issuer to avail of any new debt hitting the flow of funds. Investors are at risk of loss as the bond issuer may not be able to repay the investors. When investors rush to sell the bond, they may not find the interested buyers due to the rating downgrade, impacting the secondary market. Know more about the reasons and effects of upgrades and downgrades here.

- Liquidity Risk

We know liquidity is the ease of converting an asset into cash. Liquidity Risk arises when you can’t sell your investment quickly in time and value. The market for debt instruments is narrow, with few buyers and sellers with a high bid-ask spread. An investor is at liquidity risk when he/she cannot sell the debt security held when needed due to low or no potential buyers.

- Sovereign Risk

Government is the primary issuer of debt instruments to raise funds for public infrastructures like power and energy systems, transportation lines, etc. Any risk that arises when a government fails to repay debts or clear the loans is termed sovereign risk or country risk. Such risk may occur when a nation is in economic or political turmoil. For example, Greece defaulted on its debt payments in 2015. Venezuela defaulted on its loans between 2017 and 2018. The economic crisis of Sri Lanka is the latest example of sovereign risk.

The corporate bond defaults of IL&FS, DHFL, Reliance Capital, Suzlon Energy, and Jet Airways are some examples of the last decade. In the wake of the pandemic, firms defaulted at least ₹ 5700 crores in domestic bonds. Though debt instruments are considered safe investment choices, they are not 100% risk-free. Knowledge of the debt market is essential to analyze the impact of risks on your investment and make informed investment decisions. One should consider all the associated risks with debt securities before investing the hard-earned money; prioritizing safety and liquidity as much as the rate of return is essential when choosing to invest in debt securities.